Answered step by step

Verified Expert Solution

Question

1 Approved Answer

26. Which of the following statements is true of the budgeting process? (Points: 2) If a company carefully plans for its future, there will

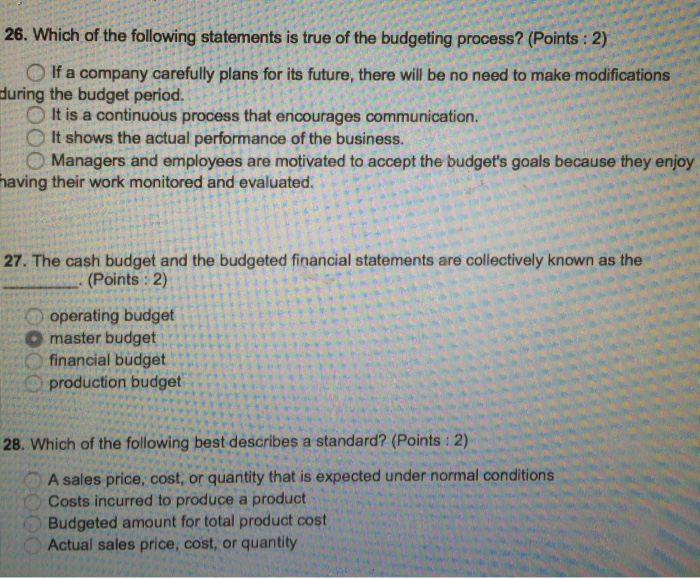

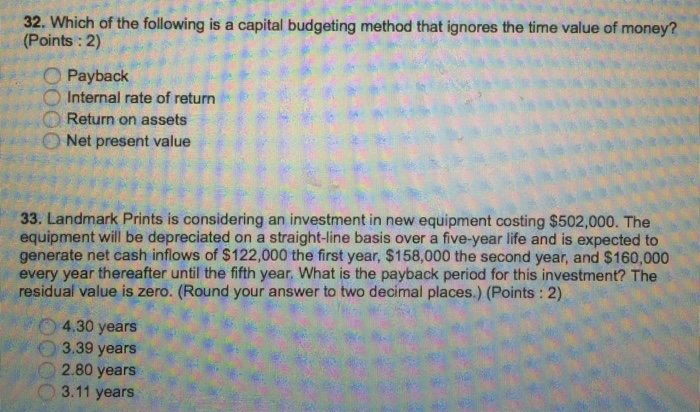

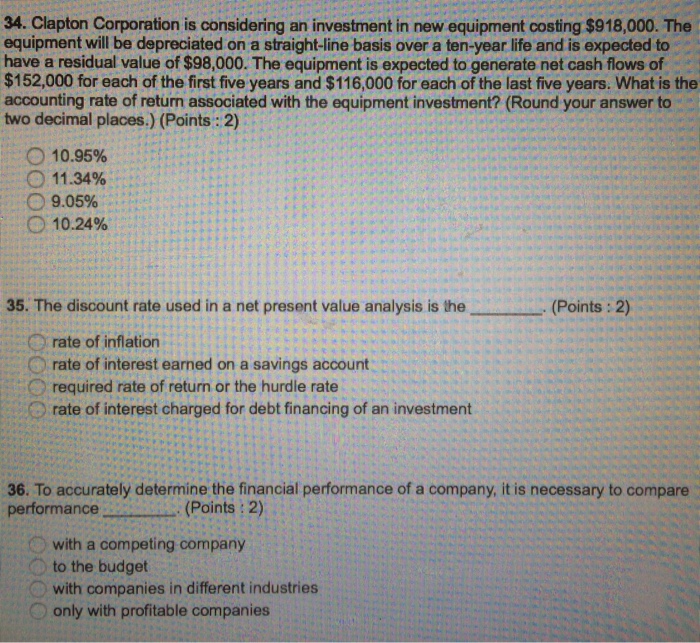

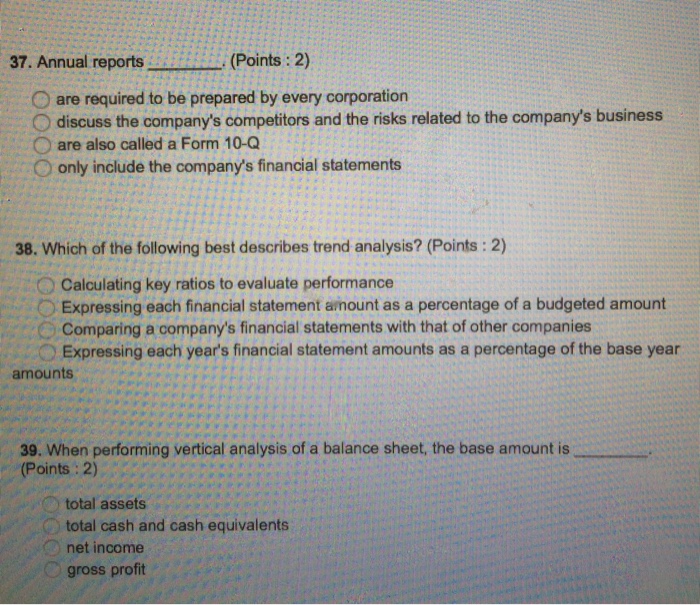

26. Which of the following statements is true of the budgeting process? (Points: 2) If a company carefully plans for its future, there will be no need to make modifications during the budget period. It is a continuous process that encourages communication. It shows the actual performance of the business. Managers and employees are motivated to accept the budget's goals because they enjoy having their work monitored and evaluated. 00 27. The cash budget and the budgeted financial statements are collectively known as the (Points: 2) 000 operating budget master budget financial budget production budget 28. Which of the following best describes a standard? (Points: 2) A sales price, cost, or quantity that is expected under normal conditions Costs incurred to produce a product Budgeted amount for total product cost Actual sales price, cost, or quantity 32. Which of the following is a capital budgeting method that ignores the time value of money? (Points: 2) 0000 Payback Internal rate of return Return on assets Net present value 33. Landmark Prints is considering an investment in new equipment costing $502,000. The equipment will be depreciated on a straight-line basis over a five-year life and is expected to generate net cash inflows of $122,000 the first year, $158,000 the second year, and $160,000 every year thereafter until the fifth year. What is the payback period for this investment? The residual value is zero. (Round your answer to two decimal places.) (Points: 2) 4.30 years 3.39 years 2.80 years 3.11 years 34. Clapton Corporation is considering an investment in new equipment costing $918,000. The equipment will be depreciated on a straight-line basis over a ten-year life and is expected to have a residual value of $98,000. The equipment is expected to generate net cash flows of $152,000 for each of the first five years and $116,000 for each of the last five years. What is the accounting rate of return associated with the equipment investment? (Round your answer to two decimal places.) (Points: 2) 10.95% 11.34% 9.05% 10.24% 35. The discount rate used in a net present value analysis is the 0000 rate of inflation rate of interest earned on a savings account required rate of return or the hurdle rate rate of interest charged for debt financing of an investment . (Points: 2) 36. To accurately determine the financial performance of a company, it is necessary to compare performance (Points: 2) with a competing company to the budget with companies in different industries only with profitable companies 37. Annual reports 0000 (Points : 2) are required to be prepared by every corporation discuss the company's competitors and the risks related to the company's business are also called a Form 10-Q only include the company's financial statements 38. Which of the following best describes trend analysis? (Points: 2) Calculating key ratios to evaluate performance Expressing each financial statement amount as a percentage of a budgeted amount Comparing a company's financial statements with that of other companies Expressing each year's financial statement amounts as a percentage of the base year 00.00 amounts 39. When performing vertical analysis of a balance sheet, the base amount is (Points: 2) total assets total cash and cash equivalents net income gross profit 40. Which of the following items is a measure of a company's ability to collect receivables? (Points: 2) Inventory turnover ratio Current ratio Days' sales in receivables. Account receivable balance

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started