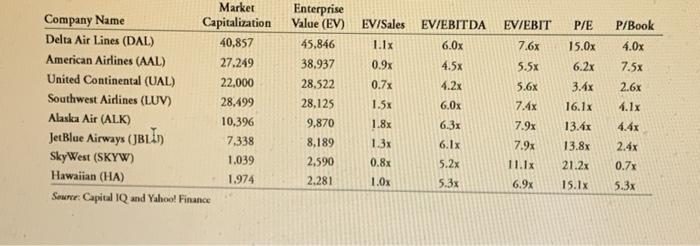

27. In addition to footwear, Kenneth Cole Productions designs and sells handbags, apparel, and other accessories. You decide, therefore, to consider comparables for KCP outside the footwear industry a. Suppose that Fossil, Inc., has an enterprise value to EBITDA multiple of 11.08 and a P/E multiple of 17.09. What share price would you estimate for KCP using each of these mul- tiples, based on the data for KCP in Problems 25 and 262 b. Suppose that Tommy Hilfiger Corporation has an enterprise value to EBITDA multiple of 7,07 and a P/E multiple of 17.36. What share price would you estimate for KCP using each of these multiples, based on the data for KCP in Problems 25 and 262 28. Consider the following data for the titi EV/Sales EV/EBIT EV/EBITDA 6.0x P/E 15.0x 1.1x 7.6x P/Book 4.0x 7.5x 4.5x 5.5x 6.2x 0.9x 0.7% 4.2% 3.1x 2.6x Market Company Name Capitalization Delta Air Lines (DAL) 40,857 American Airlines (AAL) 27.249 United Continental (UAL) 22.000 Southwest Aidines (LUV) 28.499 Alaska Air (ALK) 10,396 JetBlue Airways (JBLL) 7.338 SkyWest (SKYW) 1.039 Hawaiian (HA) 1.974 Sewer: Capital IQ and Yahoo! Finance Enterprise Value (EV) 45,846 38.937 28.522 28.125 9,870 8,189 2,590 2.281 6.Ox 16.1x 4.1x 1.5x 1.8% 1.33 5.6% 7.4x 7.9x 7.9% 11.1x 6.9x 6.32 6.1x 5.2x 5.3x 13.1x 13.8x 21.2x 4.4% 2.4x 0.8x 0.7% 1.0x 15.1x 5.3x 27. In addition to footwear, Kenneth Cole Productions designs and sells handbags, apparel, and other accessories. You decide, therefore, to consider comparables for KCP outside the footwear industry a. Suppose that Fossil, Inc., has an enterprise value to EBITDA multiple of 11.08 and a P/E multiple of 17.09. What share price would you estimate for KCP using each of these mul- tiples, based on the data for KCP in Problems 25 and 262 b. Suppose that Tommy Hilfiger Corporation has an enterprise value to EBITDA multiple of 7,07 and a P/E multiple of 17.36. What share price would you estimate for KCP using each of these multiples, based on the data for KCP in Problems 25 and 262 28. Consider the following data for the titi EV/Sales EV/EBIT EV/EBITDA 6.0x P/E 15.0x 1.1x 7.6x P/Book 4.0x 7.5x 4.5x 5.5x 6.2x 0.9x 0.7% 4.2% 3.1x 2.6x Market Company Name Capitalization Delta Air Lines (DAL) 40,857 American Airlines (AAL) 27.249 United Continental (UAL) 22.000 Southwest Aidines (LUV) 28.499 Alaska Air (ALK) 10,396 JetBlue Airways (JBLL) 7.338 SkyWest (SKYW) 1.039 Hawaiian (HA) 1.974 Sewer: Capital IQ and Yahoo! Finance Enterprise Value (EV) 45,846 38.937 28.522 28.125 9,870 8,189 2,590 2.281 6.Ox 16.1x 4.1x 1.5x 1.8% 1.33 5.6% 7.4x 7.9x 7.9% 11.1x 6.9x 6.32 6.1x 5.2x 5.3x 13.1x 13.8x 21.2x 4.4% 2.4x 0.8x 0.7% 1.0x 15.1x 5.3x