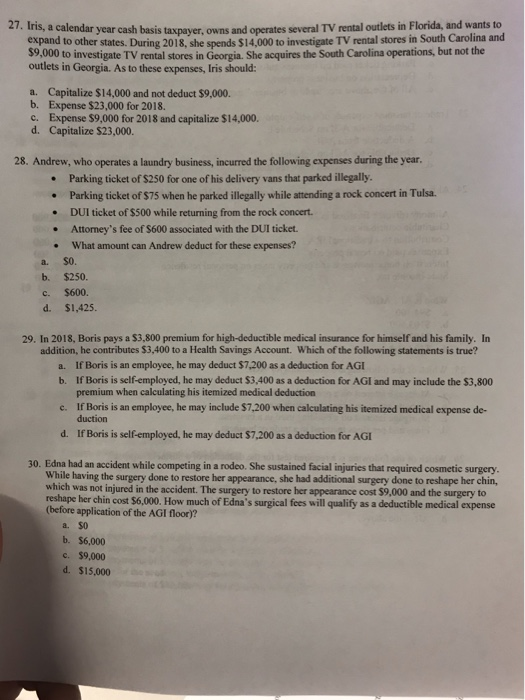

27. Iris, a calendar year cash basi is taxpayer, owns and operates several TV rental outlets in Florida, and wants to in South Carolina and expand to other states. During 2018, she spends $9,000 to investigate TV rental stores in Georgia. She acquires the South Carolina operations, but not the outlets in Georgia. As to these expenses, Iris should $14,000 to investigate TV rental stores a. Capitalize $14,000 and not deduct $9,000 b. Expense $23,000 for 2018. c. Expense $9,000 for 2018 and capitalize $14,000. d. Capitalize $23,000. 28. Andrew, who operates a laundry business, incurred the following expenses during the year Parking ticket of $250 for one of his delivery vans that parked illegally Parking ticket of $75 when he parked illegally while attending a rock concert in Tulsa. DUl ticket of $500 while returning from the rock concert. Attorney's fee of $600 associated with the DUI ticket. What amount can Andrew deduct for these expenses? . a, $0. b. $250 c. $600. d. $1,425. 29. In 2018, Boris pays a $3,800 premium for high-deductible medical insurance for himself and his family. In addition, he contributes $3,400 to a Health Savings Account. Which of the following statements is true? a. If Boris is an employee, he may deduct $7,200 as a deduction for AGI b. If Boris is self-employed, he may deduct $3,400 as a deduction for AGI and may include the $3,800 premium when calculating his itemized medical deduction duction If Boris is self-employed, he may deduct $7,200 as a deduction for AGI c. If Boris is an employee, he may include $7,200 when calculating his itemized medical expense de- d. 30. Edna had an accident while competing in a rodeo. She sustained facial injuries that required cosmetic surgery While having the surgery done to restore her appearance, she had additional surgery done to reshape her chin, which was not injured in the accident. The surgery to restore her appearance cost $9,000 and the surgery to reshape her chin cost $6,000. How much of Edna's surgical fees will qualify as a deductible medical expense (before application of the AGI floor)? a. $0 b. $6,000 c. $9,000 d. $15,000