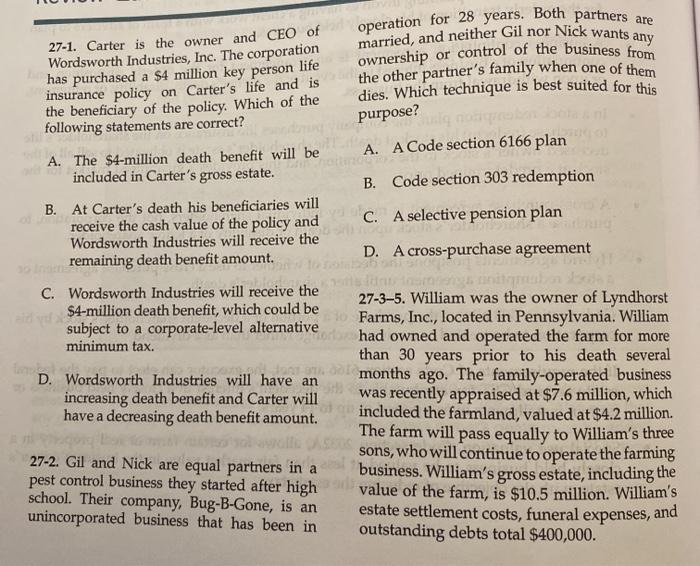

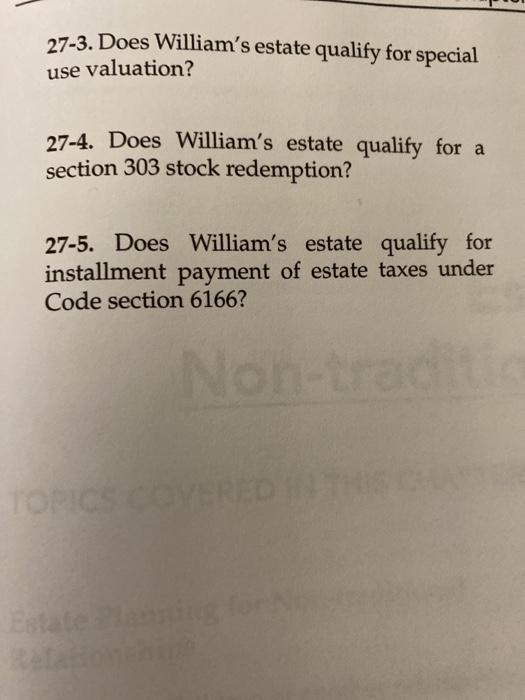

27-1. Carter is the owner and CEO of Wordsworth Industries, Inc. The corporation has purchased a $4 million key person life insurance policy on Carter's life and is the beneficiary of the policy. Which of the following statements are correct? operation for 28 years. Both partners are married, and neither Gil nor Nick wants any ownership or control of the business from the other partner's family when one of them dies. Which technique is best suited for this purpose? A. A Code section 6166 plan B. Code section 303 redemption A. The $4-million death benefit will be included in Carter's gross estate. B. At Carter's death his beneficiaries will receive the cash value of the policy and Wordsworth Industries will receive the remaining death benefit amount. C. Wordsworth Industries will receive the $4-million death benefit, which could be subject to a corporate-level alternative minimum tax. C. A selective pension plan D. A cross-purchase agreement D. Wordsworth Industries will have an increasing death benefit and Carter will have a decreasing death benefit amount. 27-3-5. William was the owner of Lyndhorst Farms, Inc., located in Pennsylvania. William had owned and operated the farm for more than 30 years prior to his death several months ago. The family-operated business was recently appraised at $7.6 million, which included the farmland, valued at $4.2 million. The farm will pass equally to William's three sons, who will continue to operate the farming business. William's gross estate, including the value of the farm, is $10.5 million. William's estate settlement costs, funeral expenses, and outstanding debts total $400,000. 27-2. Gil and Nick are equal partners in a pest control business they started after high school. Their company, Bug-B-Gone, is an unincorporated business that has been in 27-1. Carter is the owner and CEO of Wordsworth Industries, Inc. The corporation has purchased a $4 million key person life insurance policy on Carter's life and is the beneficiary of the policy. Which of the following statements are correct? operation for 28 years. Both partners are married, and neither Gil nor Nick wants any ownership or control of the business from the other partner's family when one of them dies. Which technique is best suited for this purpose? A. A Code section 6166 plan B. Code section 303 redemption A. The $4-million death benefit will be included in Carter's gross estate. B. At Carter's death his beneficiaries will receive the cash value of the policy and Wordsworth Industries will receive the remaining death benefit amount. C. Wordsworth Industries will receive the $4-million death benefit, which could be subject to a corporate-level alternative minimum tax. C. A selective pension plan D. A cross-purchase agreement D. Wordsworth Industries will have an increasing death benefit and Carter will have a decreasing death benefit amount. 27-3-5. William was the owner of Lyndhorst Farms, Inc., located in Pennsylvania. William had owned and operated the farm for more than 30 years prior to his death several months ago. The family-operated business was recently appraised at $7.6 million, which included the farmland, valued at $4.2 million. The farm will pass equally to William's three sons, who will continue to operate the farming business. William's gross estate, including the value of the farm, is $10.5 million. William's estate settlement costs, funeral expenses, and outstanding debts total $400,000. 27-2. Gil and Nick are equal partners in a pest control business they started after high school. Their company, Bug-B-Gone, is an unincorporated business that has been in