Answered step by step

Verified Expert Solution

Question

1 Approved Answer

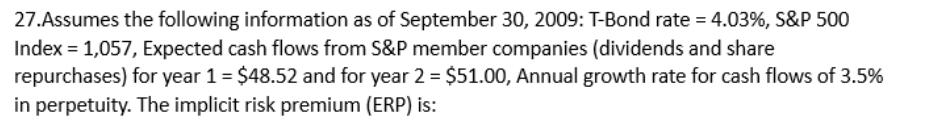

27.Assumes the following information as of September 30, 2009: T-Bond rate = 4.03%, S&P 500 Index = 1,057, Expected cash flows from S&P member

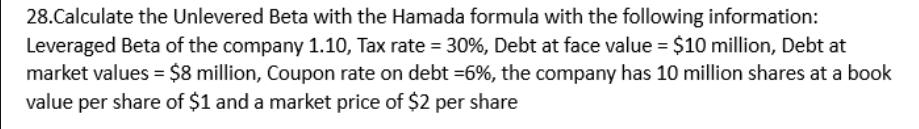

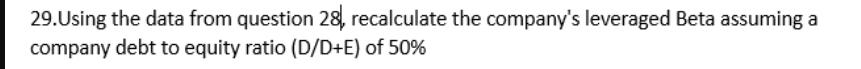

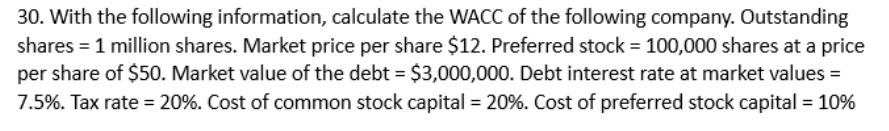

27.Assumes the following information as of September 30, 2009: T-Bond rate = 4.03%, S&P 500 Index = 1,057, Expected cash flows from S&P member companies (dividends and share repurchases) for year 1 = $48.52 and for year 2 = $51.00, Annual growth rate for cash flows of 3.5% in perpetuity. The implicit risk premium (ERP) is: 28.Calculate the Unlevered Beta with the Hamada formula with the following information: Leveraged Beta of the company 1.10, Tax rate = 30%, Debt at face value = $10 million, Debt at market values = $8 million, Coupon rate on debt = 6%, the company has 10 million shares at a book value per share of $1 and a market price of $2 per share 29.Using the data from question 28, recalculate the company's leveraged Beta assuming a company debt to equity ratio (D/D+E) of 50% 30. With the following information, calculate the WACC of the following company. Outstanding shares = 1 million shares. Market price per share $12. Preferred stock = 100,000 shares at a price per share of $50. Market value of the debt = $3,000,000. Debt interest rate at market values= 7.5%. Tax rate = 20%. Cost of common stock capital = 20%. Cost of preferred stock capital = 10%

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

27 The implicit risk premium ERP is calculated as follows ERP TBond rate Expected return on the SP 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started