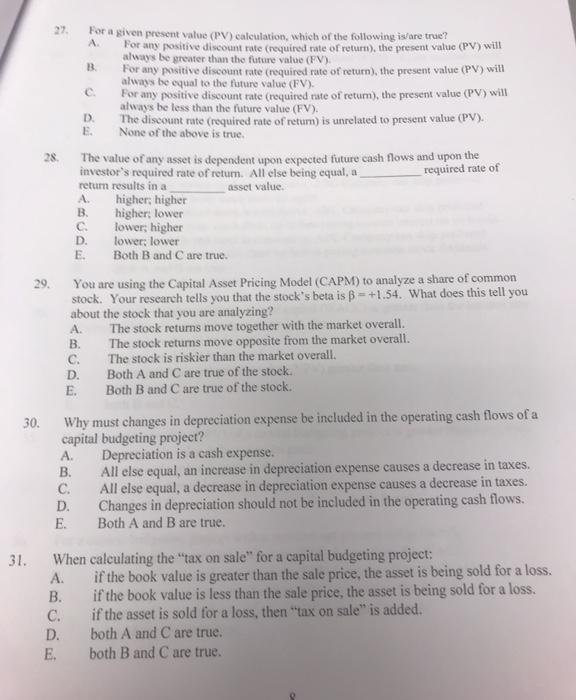

28 27. For a given present value (PV) calculation, which of the following is/are true? A For any positive discount rate (required rate of return), the present value (PV) will always be greater than the future value (FV). B For any positive discount rate (required rate of return), the present value (PV) will always be equal to the future value (FV). C For any positive discount rate (required rate of return), the present value (PV) will always be less than the future value (FV). D. The disepunt rate (required rate of return) is unrelated to present value (PV). E. None of the above is true. The value of any asset is dependent upon expected future cash flows and upon the investor's required rate of return. All else being equal, a required rate of retum results in a asset value A higher; higher B. higher lower . lower; higher D. lowers lower E Both B and C are true 29. You are using the Capital Asset Pricing Model (CAPM) to analyze a share of common stock. Your research tells you that the stock's beta is B = +1.54. What does this tell you about the stock that you are analyzing? A The stock returns move together with the market overall. B. The stock returns move opposite from the market overall. C. The stock is riskier than the market overall. D. Both A and Care true of the stock. E. Both B and C are true of the stock. 30. Why must changes in depreciation expense be included in the operating cash flows of a capital budgeting project? A Depreciation is a cash expense. B. All else equal, an increase in depreciation expense causes a decrease in taxes. C. All else equal, a decrease in depreciation expense causes a decrease in taxes. D. Changes in depreciation should not be included in the operating cash flows. E. Both A and B are true. 31. When calculating the "tax on sale for a capital budgeting project: A if the book value is greater than the sale price, the asset is being sold for a loss. B. if the book value is less than the sale price, the asset is being sold for a loss. C. if the asset is sold for a loss, then "tax on sale" is added. D. both A and C are true. E. both B and C are true