Answered step by step

Verified Expert Solution

Question

1 Approved Answer

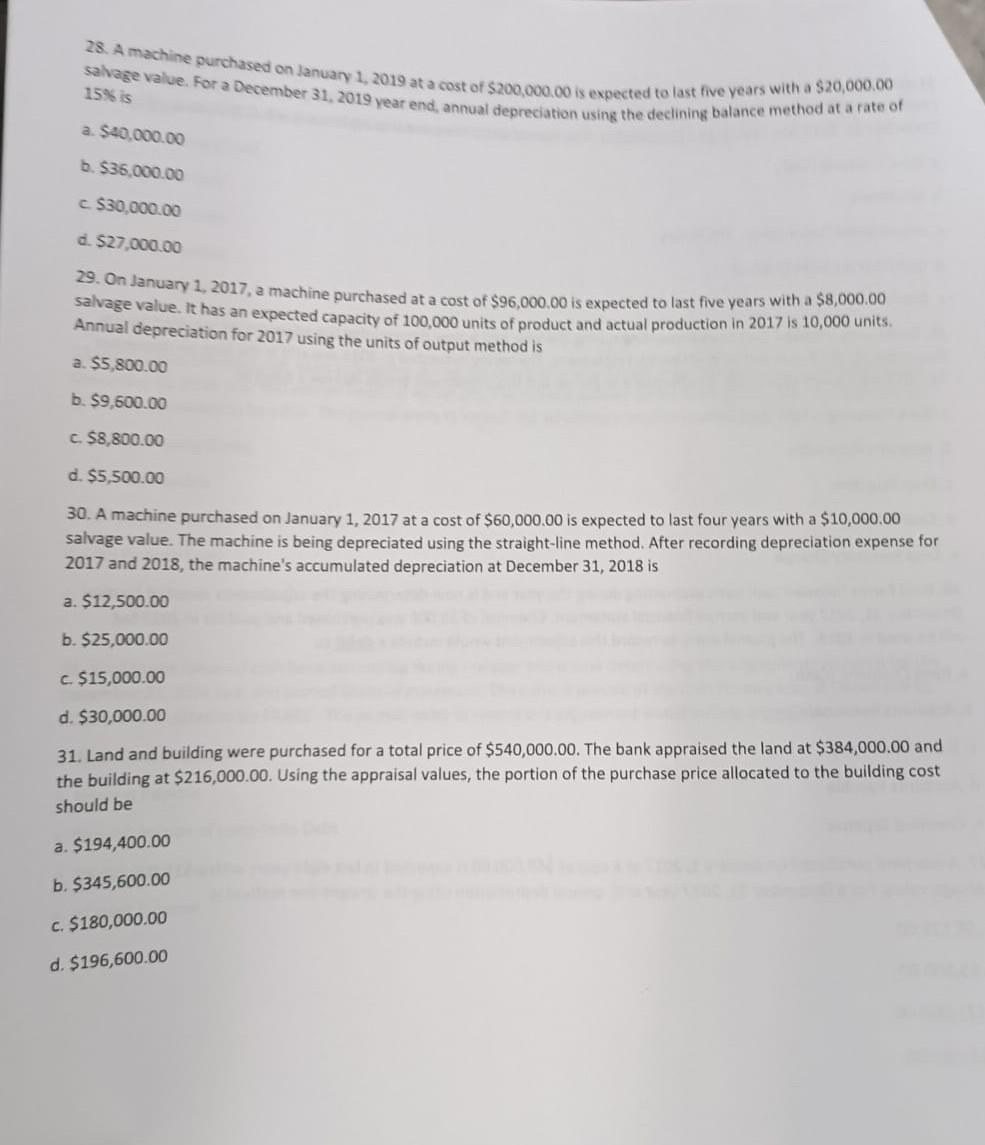

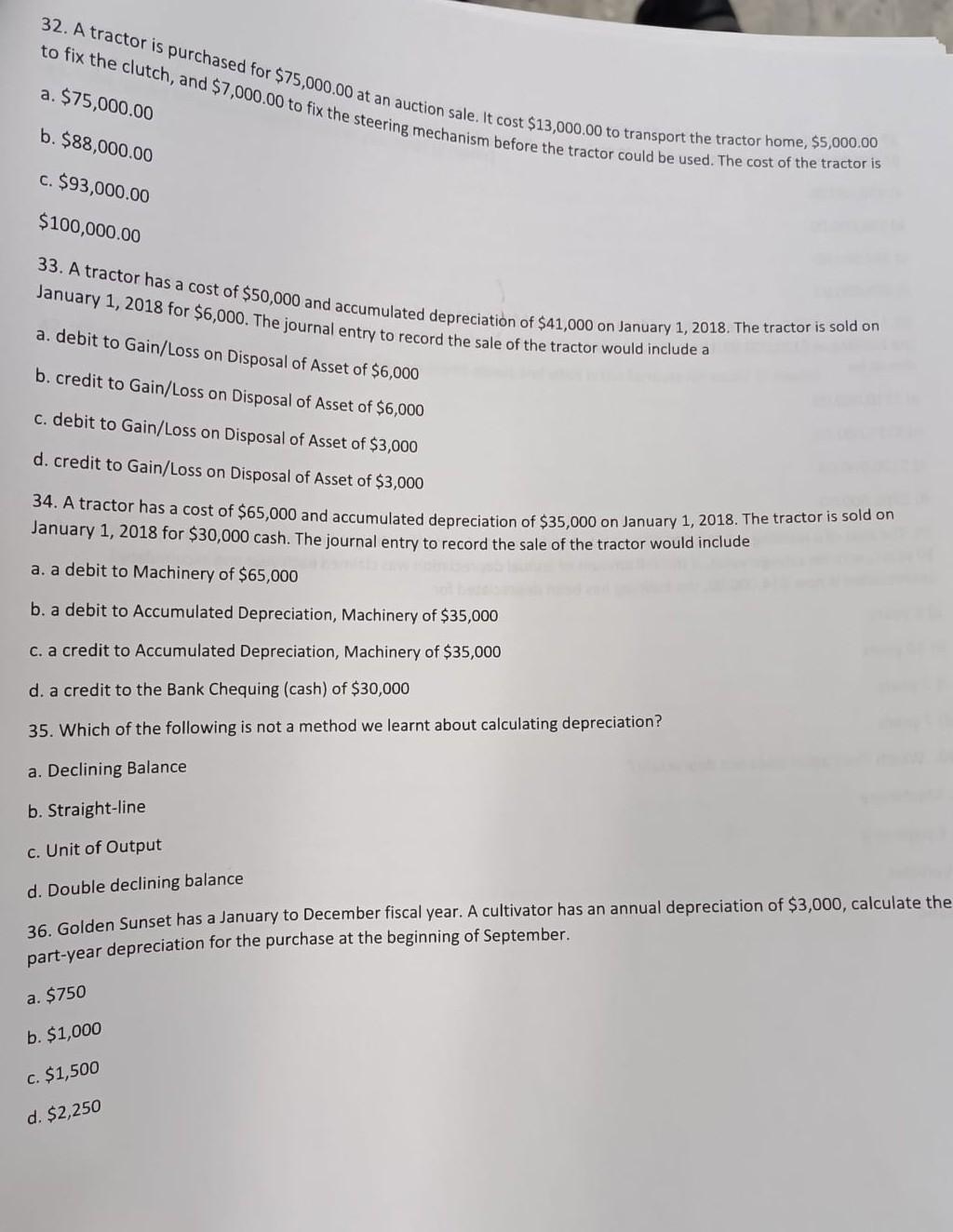

28. A machine purchased on lanuary 1, 2019 at a cost of $200,000.00 is expected to last five years with a $20,000.00 Sahage value. For

28. A machine purchased on lanuary 1, 2019 at a cost of $200,000.00 is expected to last five years with a $20,000.00 Sahage value. For a December 31,2019 15% year end, annual depreciation using the declining balance method at a rate of 3. $40,000.00 b. $36,000.00 c. $30,000.00 d. $27,000.00 29. On January 1, 2017, a machine purchased at a cost of $96,000.00 is expected to last five years with a $8,000.00 salvage value. It has an expected capacity of 100,000 units of product and actual production in 2017 is 10,000 units. Annual depreciation for 2017 using the units of output method is a. $5,800.00 b. $9,600.00 c. $8,800.00 d. $5,500.00 30. A machine purchased on January 1,2017 at a cost of $60,000.00 is expected to last four years with a $10,000.00 salvage value. The machine is being depreciated using the straight-line method. After recording depreciation expense for 2017 and 2018, the machine's accumulated depreciation at December 31,2018 is a. $12,500.00 b. $25,000.00 c. $15,000.00 d. $30,000.00 31. Land and building were purchased for a total price of $540,000.00. The bank appraised the land at $384,000.00 and the building at $216,000.00. Using the appraisal values, the portion of the purchase price allocated to the building cost should be a. $194,400.00 b. $345,600.00 c. $180,000.00 d. $196,600.00 32. A tractor is purchased for $75,000.00 at an auction sale. It cost $13,000.00 to transport the tractor home, $5,000.00 to fix the clutch, and $7,000.00 to fix the steering mechanism before the tractor could be used. The cost of the tractor is c. $93,000.00 $100,000.00 January 1,2018 for $6,000. The journal entry to record the sale of the tractor would include a a. debit to Gain/Loss on Disposal of Asset of $6,000 b. credit to Gain/Loss on Disposal of Asset of $6,000 c. debit to Gain/Loss on Disposal of Asset of $3,000 d. credit to Gain/Loss on Disposal of Asset of $3,000 34. A tractor has a cost of $65,000 and accumulated depreciation of $35,000 on January 1,2018 . The tractor is sold on January 1,2018 for $30,000 cash. The journal entry to record the sale of the tractor would include a. a debit to Machinery of $65,000 b. a debit to Accumulated Depreciation, Machinery of $35,000 c. a credit to Accumulated Depreciation, Machinery of $35,000 d. a credit to the Bank Chequing (cash) of $30,000 35. Which of the following is not a method we learnt about calculating depreciation? a. Declining Balance b. Straight-line c. Unit of Output d. Double declining balance 36. Golden Sunset has a January to December fiscal year. A cultivator has an annual depreciation of $3,000, calculate the part-year depreciation for the purchase at the beginning of September. a. $750 b. $1,000 c. $1,500 d. $2,250 28. A machine purchased on lanuary 1, 2019 at a cost of $200,000.00 is expected to last five years with a $20,000.00 Sahage value. For a December 31,2019 15% year end, annual depreciation using the declining balance method at a rate of 3. $40,000.00 b. $36,000.00 c. $30,000.00 d. $27,000.00 29. On January 1, 2017, a machine purchased at a cost of $96,000.00 is expected to last five years with a $8,000.00 salvage value. It has an expected capacity of 100,000 units of product and actual production in 2017 is 10,000 units. Annual depreciation for 2017 using the units of output method is a. $5,800.00 b. $9,600.00 c. $8,800.00 d. $5,500.00 30. A machine purchased on January 1,2017 at a cost of $60,000.00 is expected to last four years with a $10,000.00 salvage value. The machine is being depreciated using the straight-line method. After recording depreciation expense for 2017 and 2018, the machine's accumulated depreciation at December 31,2018 is a. $12,500.00 b. $25,000.00 c. $15,000.00 d. $30,000.00 31. Land and building were purchased for a total price of $540,000.00. The bank appraised the land at $384,000.00 and the building at $216,000.00. Using the appraisal values, the portion of the purchase price allocated to the building cost should be a. $194,400.00 b. $345,600.00 c. $180,000.00 d. $196,600.00 32. A tractor is purchased for $75,000.00 at an auction sale. It cost $13,000.00 to transport the tractor home, $5,000.00 to fix the clutch, and $7,000.00 to fix the steering mechanism before the tractor could be used. The cost of the tractor is c. $93,000.00 $100,000.00 January 1,2018 for $6,000. The journal entry to record the sale of the tractor would include a a. debit to Gain/Loss on Disposal of Asset of $6,000 b. credit to Gain/Loss on Disposal of Asset of $6,000 c. debit to Gain/Loss on Disposal of Asset of $3,000 d. credit to Gain/Loss on Disposal of Asset of $3,000 34. A tractor has a cost of $65,000 and accumulated depreciation of $35,000 on January 1,2018 . The tractor is sold on January 1,2018 for $30,000 cash. The journal entry to record the sale of the tractor would include a. a debit to Machinery of $65,000 b. a debit to Accumulated Depreciation, Machinery of $35,000 c. a credit to Accumulated Depreciation, Machinery of $35,000 d. a credit to the Bank Chequing (cash) of $30,000 35. Which of the following is not a method we learnt about calculating depreciation? a. Declining Balance b. Straight-line c. Unit of Output d. Double declining balance 36. Golden Sunset has a January to December fiscal year. A cultivator has an annual depreciation of $3,000, calculate the part-year depreciation for the purchase at the beginning of September. a. $750 b. $1,000 c. $1,500 d. $2,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started