Answered step by step

Verified Expert Solution

Question

1 Approved Answer

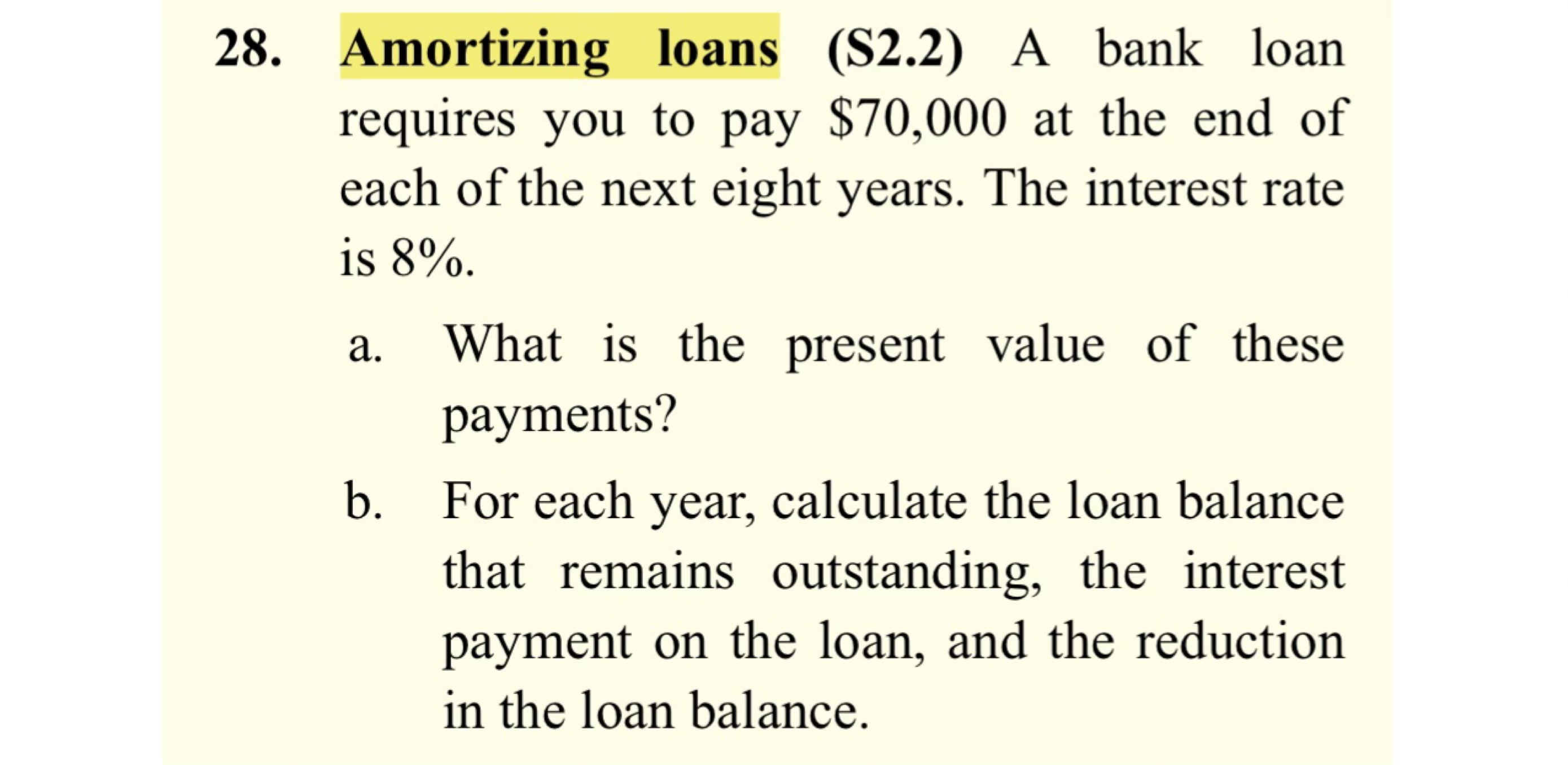

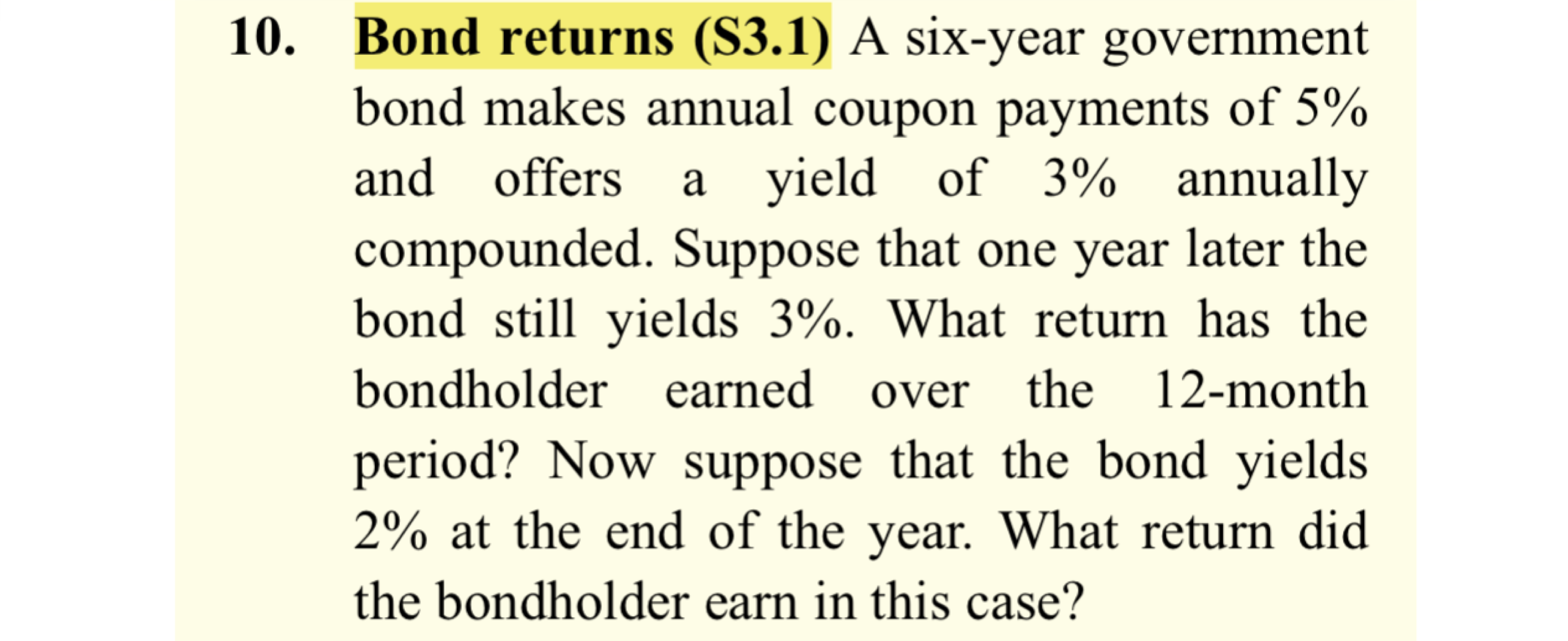

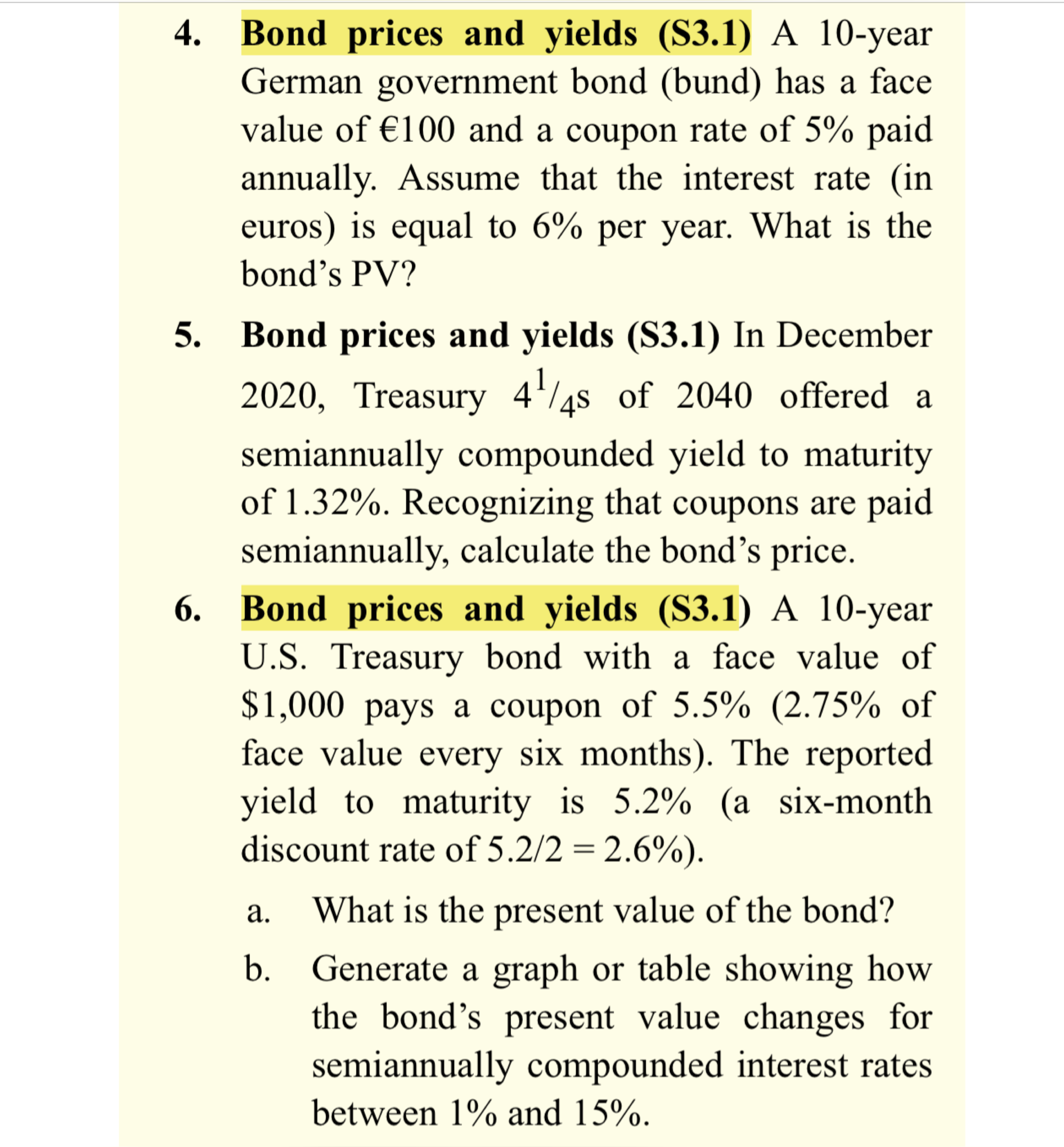

28. Amortizing loans (S2.2) A bank loan requires you to pay $70,000 at the end of each of the next eight years. The interest

28. Amortizing loans (S2.2) A bank loan requires you to pay $70,000 at the end of each of the next eight years. The interest rate is 8%. a. What is the present value of these payments? b. For each year, calculate the loan balance that remains outstanding, the interest payment on the loan, and the reduction in the loan balance. 10. Bond returns (S3.1) A six-year government bond makes annual coupon payments of 5% and offers offers a yield of 3% annually compounded. Suppose that one year later the bond still yields 3%. What return has the bondholder earned over the 12-month period? Now suppose that the bond yields 2% at the end of the year. What return did the bondholder earn in this case? 4. Bond prices and yields (S3.1) A 10-year German government bond (bund) has a face value of 100 and a coupon rate of 5% paid annually. Assume that the interest rate (in euros) is equal to 6% per year. What is the bond's PV? 5. Bond prices and yields (S3.1) In December 2020, Treasury 4/4s of 2040 offered a semiannually compounded yield to maturity of 1.32%. Recognizing that coupons are paid semiannually, calculate the bond's price. 6. Bond prices and yields (S3.1) A 10-year U.S. Treasury bond with a face value of $1,000 pays a coupon of 5.5% (2.75% of face value every six months). The reported yield to maturity is 5.2% (a six-month discount rate of 5.2/2 = 2.6%). a. What is the present value of the bond? b. Generate a graph or table showing how the bond's present value changes for semiannually compounded interest rates between 1% and 15%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started