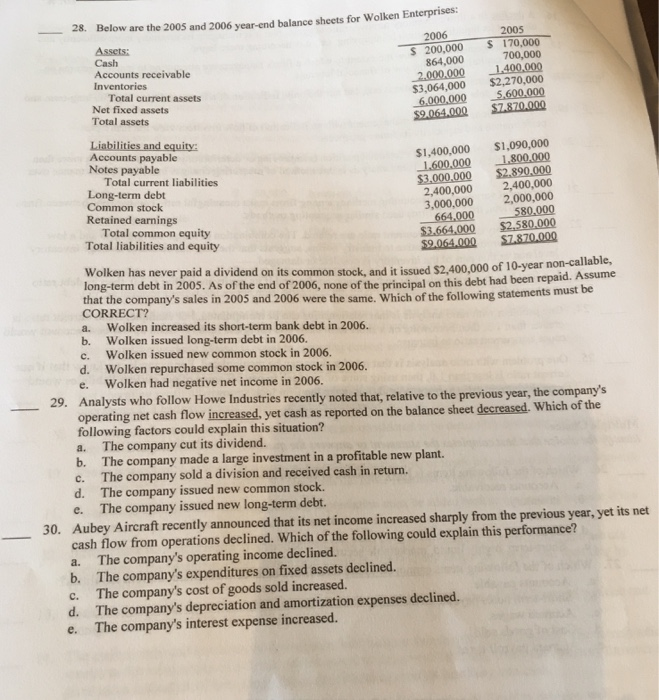

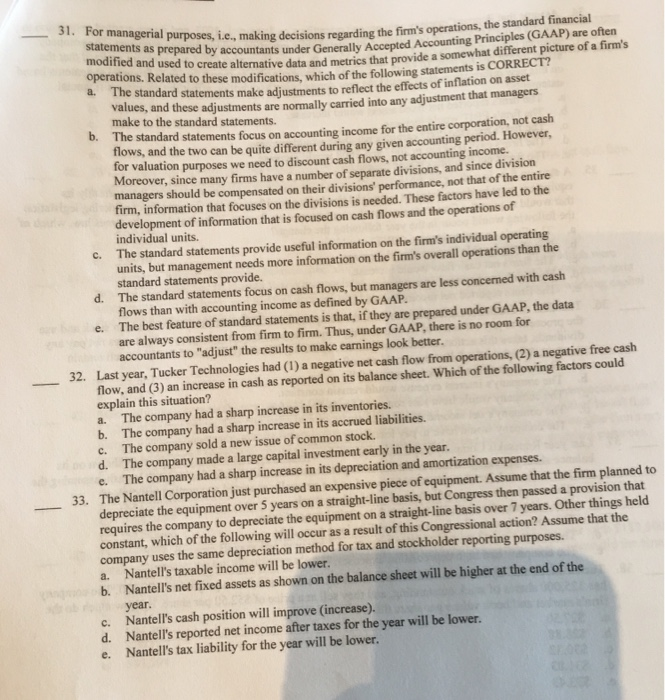

28. Below are the 200S and 2006 year-end balance sheets for Wolken Enterprises: 2006 2005 Assets: Cash Accounts receivable Inventories S 200,000 S170,000 700,000 864,000 $3,064,000 $2,270,000 Total current assets Net fixed assets Total assets S1,400,000 $1,090,000 1.600.000 800.000 $3,000,000 $2,890,000 2,400,000 2,400,000 3,000,000 2,000,000 664,000 580.,000 Accounts payable Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total common equity Total liabilities and equity $2064.000 $7.870.000 stock, and it issued $2,400,000 of 10-year non-callable, this debt had been repaid. Assume Wolken has never paid a dividend on its common long-term debt in 2005. As of the end of 2006, none of the principal on that the company's sales in 2005 and 2006 were the same. Which CORRECT? a. b. Wolken issued long-term debt in 2006 c. d. of the following statements must be Wolken increased its short-term bank debt in 2006. Wolken issued new common stock in 2006. Wolken repurchased some common stock in 2006. Wolken had negative net income in 2006. e. 29. Analysts who follow Howe Industries recently noted that, relative to the previous year, the company's balance sheet decreased. Which of the operating net cash flow increased, yet cash as reported on the following factors could explain this situation? a. The company cut its dividend. b. The company made a large investment in a profitable new plant. c. The company sold a division and received cash in return. d. The company issued new common stock e. The company issued new long-term debt. Aubey Aircraft recently announced that its net income increased sharply from the previous year, yet its net cash flow from operations declined. Which of the following could explain this performance? a. b. 30. c d. e. The company's operating income declined. The company's expenditures on fixed assets declined. The company's cost of goods sold increased. The company's depreciation and amortization expenses declined. The company's interest expense increased. 31. For managerial purposes, i.e., makin as prepared by accountants under Generally Accepted Accounting Principles (GAAP) are often g decisions regarding the firm's operations, the standard financial modified and used to create alternative data and metrics that provide a somewhat different picture of a firm's perations. Related to these modifications, which of the following statements is CORRECT? d.The standard statements make adjustments to reflect the effects of inflation on asset Values, and these adjustments are normally carried into any adjustment that managers make to the standard statements. b. The standard statements focus on accounting income for the entire corporation, not cash flows, and the two can be quite different during any given accounting period. However for valuation purposes we need to discount cash flows, not accounting income. Moreover, since many firms have a number of separate divisions, and since division managers should be compensated on their divisions' performance, not that of the entire firm, information that focuses on the divisions is needed. These factors have led to the development of information that is focused on cash flows and the operations of individual units. c. The standard statements provide useful information on the firm's individual operating units, but management needs more information on the firm's overall operations than the standard statements provide. d. The standard statements focus on cash flows, but managers are less concerned with cash flows than with accounting income as defined by GAAP. The best feature of standard statements is that, if they are prepared under GAAP, the data e. are always consistent from firm to firm. Thus, under GAAP, there is no room for accountants to "adjust" the results to make earnings look better. Last year, Tucker Technologies had (1) a negative net cash flow from operations, (2) a negative free cash flow, and (3) an increase in cash as reported on its balance sheet. Which of the following factors could explain this situation? a. The company had a sharp increase in its inventories. b. The company had a sharp increase in its accrued liabilities. c. The company sold a new issue of common stock. d. The company made a large capital investment early in the year. e. The company had a sharp increase in its depreciation and amortization expenses. The Nantell Corporation just purchased an expensive piece of equipment. Assume that the firm planned to depreciate the equipment over 5 years on a straight-line basis, but Congress then passed a provision that requires the company to depreciate the equipment on a straight-line basis over 7 years. Other things held constant, which of the following will occur as a result of this Congressional action? Assume that the company uses the same depreciation method for tax and stockholder reporting purposes 32. 33. a. Nantell's taxable income will be lower. b. Nantell's net fixed assets as shown on the balance sheet will be higher at the end of the year. c. Nantell's cash position will improve (increase). d. Nantell's reported net income after taxes for the year will be lower e. Nantell's tax liability for the year will be lower