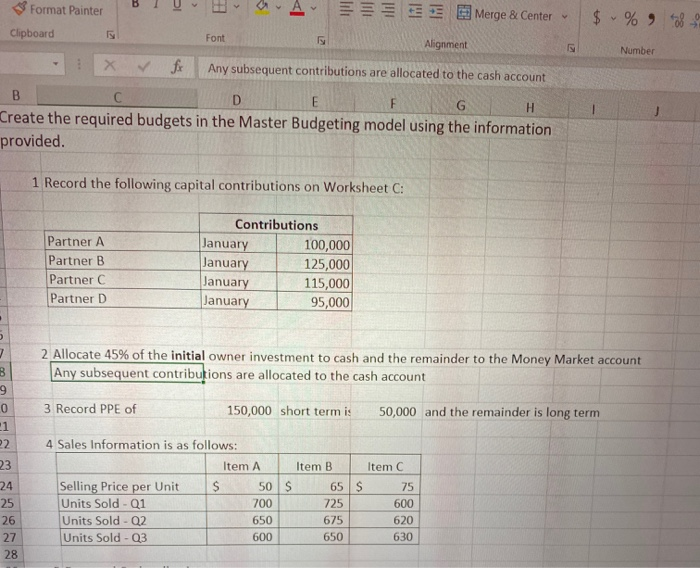

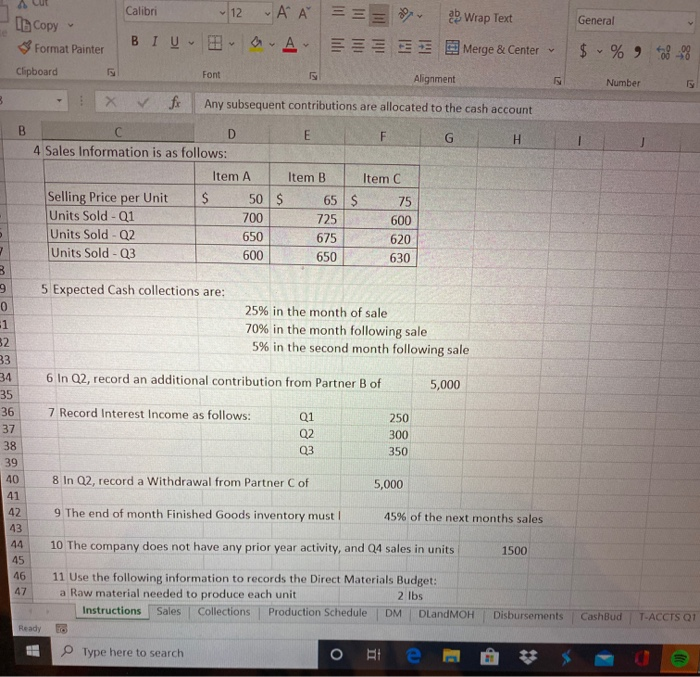

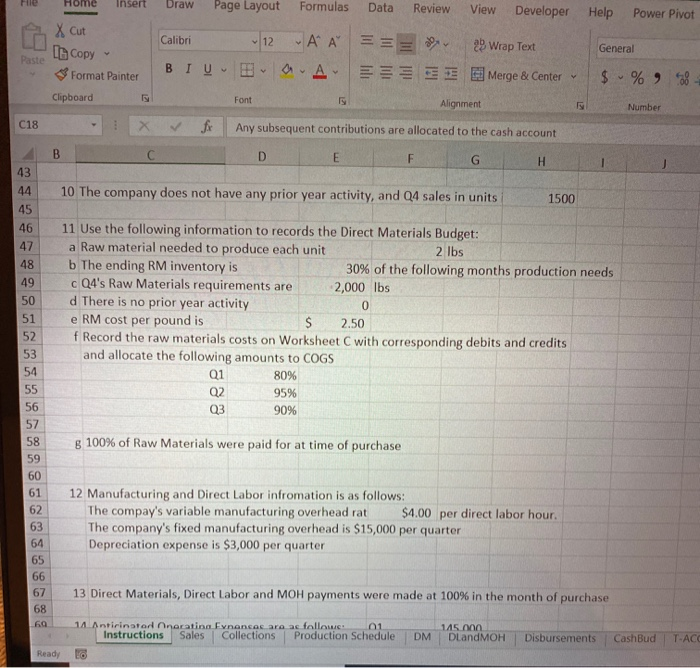

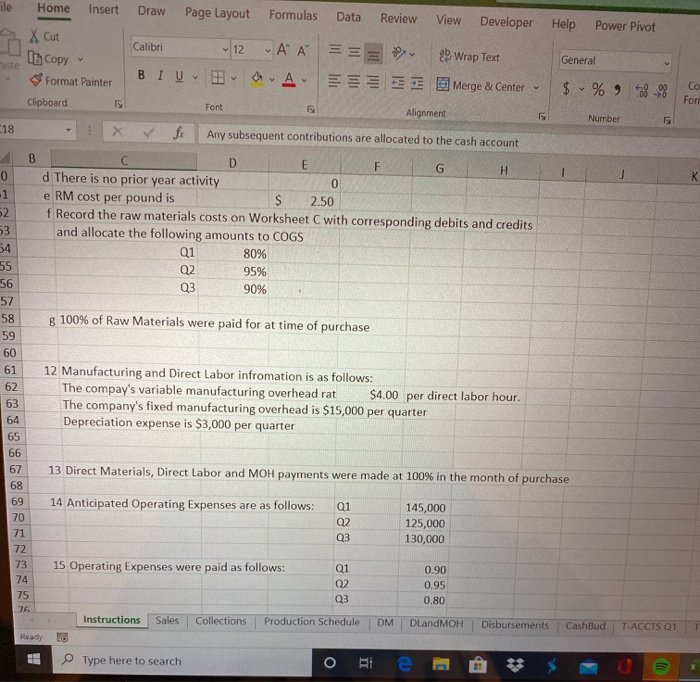

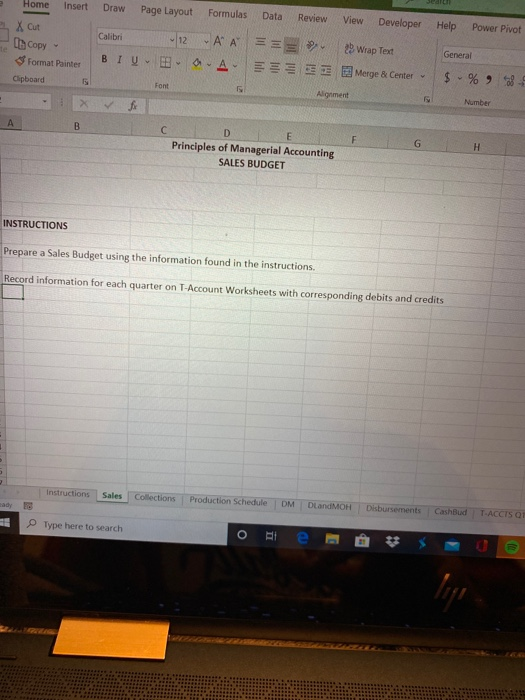

$ -% -28- Number B 1 Format Painter Merge & Center - Clipboard IS Font Alignment T X Fr Any subsequent contributions are allocated to the cash account B FUNGH Create the required budgets in the Master Budgeting model using the information provided. 1 Record the following capital contributions on Worksheet C: Partner A Partner B Partner C Partner D Contributions January 100,000 January 125,000 January 115,000 January 95,000 2 Allocate 45% of the initial owner investment to cash and the remainder to the Money Market account Any subsequent contributions are allocated to the cash account 3 Record PPE of 150,000 short term is 50,000 and the remainder is long term Item C 4 Sales Information is as follows: Item A Item B Selling Price per Unit $ 50 S 65 Units Sold - Q1 700 725 Units Sold - Q2 650 675 Units Sold - Q3 600 650 600 620 630 12 A A == General - b copy - 3 Format Painter Calibri BIUB Wrap Text Merge & Center A $ % 9 7899 Clipboard Font Alignment Number 6 B X V ft Any subsequent contributions are allocated to the cash account DET FIGHT 4 Sales Information is as follows: Item Item B Item C Selling Price per Unit S 50 S 65 S Units Sold - Q1 700 725 600 Units Sold - Q2 650 675 620 Units Sold - Q3 600 650 75 630 5 Expected Cash collections are: 25% in the month of sale 70% in the month following sale 5% in the second month following sale 6 In Q2, record an additional contribution from Partner B of tion from Partner B of 5,000 7 Record Interest Income as follows: 250 300 350 8 In Q2, record a Withdrawal from Partner Cof 5,000 9 The end of month Finished Goods inventory must! 45% of the next months sales 10 The company does not have any prior year activity, and Q4 sales in units 1500 47 11 Use the following information to records the Direct Materials Budget: a Raw material needed to produce each unit 2 lbs Instructions Sales Collections Production Schedule DM DLandMOH to Type here to search Disbursements Cashbud T-ACCTSOL Ready o te m $50 DrawPage Layout Formulas Data Review View Developer Help Power Pivot Home Insert 2 x Cut In Copy Paste Format Painter Clipboard AA General Calibri BTU 12 A == E 2 Wrap Text Merge & Center $ % 938 Font Alignment Number C18 X fx Any subsequent contributions are allocated to the cash account C D E F G H I J 44 10 The company does not have any prior year activity, and 04 sales in units 1500 11 Use the following information to records the Direct Materials Budget: a Raw material needed to produce each unit 2 lbs b The ending RM inventory is 30% of the following months production needs cQ4's Raw Materials requirements are 2,000 lbs d There is no prior year activity e RM cost per pound is $ 2.50 f Record the raw materials costs on Worksheet C with corresponding debits and credits and allocate the following amounts to COGS 80% Q2 95% 90% Qi 03 g 100% of Raw Materials were paid for at time of purchase 12 Manufacturing and Direct Labor infromation is as follows: The compay's variable manufacturing overhead rat $4.00 per direct labor hour. The company's fixed manufacturing overhead is $15,000 per quarter Depreciation expense is $3,000 per quarter 13 Direct Materials, Direct Labor and MOH payments were made at 100% in the month of purchase 60 1 4 Antirinator narating Eynences are as follows: 1 Instructions Sales Collections Production Schedule DM 145.000 DLandMOH Disbursements CashBud TAC Ready Home Insert ile a Draw Page Layout Formulas Data Review View Developer Help Power Pivot X Cut 12 Ib Copy Calibri BIU 2 Wrap Text AA SEE O A General Merge & Center $ % 9 8 % Clipboard Font Alignment Number C18 Any subsequent contributions are allocated to the cash account B G 0 d There is no prior year activity e RM cost per pound is $ 2.50 f Record the raw materials costs on Worksheet C with corresponding debits and credits and allocate the following amounts to COGS Q1 80% Q2 95% 90% Q3 g 100% of Raw Materials were paid for at time of purchase 12 Manufacturing and Direct Labor infromation is as follows: The compay's variable manufacturing overhead rat $4.00 per direct labor hour. The company's fixed manufacturing overhead is $15,000 per quarter Depreciation expense is $3,000 per quarter 13 Direct Materials, Direct Labor and MOH payments were made at 100% in the month of purchase 14 Anticipated Operating Expenses are as follows: 145,000 125,000 130,000 15 Operating Expenses were paid as follows: 0.90 0.95 0.80 76 Instructions Sales Collections Production Schedule DM DLandMOH Disbursements CashBud T-ACCTS 01 T Ready Type here to search Data Review View a Developer Home Insert Draw Page Layout Formulas & Cut 12 - AA In Copy Format Painter BTU - OA Help Power Pivot Calibri == E Wrap Text Merge General Clipboard 5 Algiment E - V Number X B for A C DE Principles of Managerial Accounting G H SALES BUDGET INSTRUCTIONS Prepare a Sales Budget using the information found in the instructions. Record information for each quarter on T-Account Worksheets with corresponding debits and credits Instructions Sales Collections Production Schedule DM DLandMOH Disbursements Cashbud TACCISO Type here to search $ -% -28- Number B 1 Format Painter Merge & Center - Clipboard IS Font Alignment T X Fr Any subsequent contributions are allocated to the cash account B FUNGH Create the required budgets in the Master Budgeting model using the information provided. 1 Record the following capital contributions on Worksheet C: Partner A Partner B Partner C Partner D Contributions January 100,000 January 125,000 January 115,000 January 95,000 2 Allocate 45% of the initial owner investment to cash and the remainder to the Money Market account Any subsequent contributions are allocated to the cash account 3 Record PPE of 150,000 short term is 50,000 and the remainder is long term Item C 4 Sales Information is as follows: Item A Item B Selling Price per Unit $ 50 S 65 Units Sold - Q1 700 725 Units Sold - Q2 650 675 Units Sold - Q3 600 650 600 620 630 12 A A == General - b copy - 3 Format Painter Calibri BIUB Wrap Text Merge & Center A $ % 9 7899 Clipboard Font Alignment Number 6 B X V ft Any subsequent contributions are allocated to the cash account DET FIGHT 4 Sales Information is as follows: Item Item B Item C Selling Price per Unit S 50 S 65 S Units Sold - Q1 700 725 600 Units Sold - Q2 650 675 620 Units Sold - Q3 600 650 75 630 5 Expected Cash collections are: 25% in the month of sale 70% in the month following sale 5% in the second month following sale 6 In Q2, record an additional contribution from Partner B of tion from Partner B of 5,000 7 Record Interest Income as follows: 250 300 350 8 In Q2, record a Withdrawal from Partner Cof 5,000 9 The end of month Finished Goods inventory must! 45% of the next months sales 10 The company does not have any prior year activity, and Q4 sales in units 1500 47 11 Use the following information to records the Direct Materials Budget: a Raw material needed to produce each unit 2 lbs Instructions Sales Collections Production Schedule DM DLandMOH to Type here to search Disbursements Cashbud T-ACCTSOL Ready o te m $50 DrawPage Layout Formulas Data Review View Developer Help Power Pivot Home Insert 2 x Cut In Copy Paste Format Painter Clipboard AA General Calibri BTU 12 A == E 2 Wrap Text Merge & Center $ % 938 Font Alignment Number C18 X fx Any subsequent contributions are allocated to the cash account C D E F G H I J 44 10 The company does not have any prior year activity, and 04 sales in units 1500 11 Use the following information to records the Direct Materials Budget: a Raw material needed to produce each unit 2 lbs b The ending RM inventory is 30% of the following months production needs cQ4's Raw Materials requirements are 2,000 lbs d There is no prior year activity e RM cost per pound is $ 2.50 f Record the raw materials costs on Worksheet C with corresponding debits and credits and allocate the following amounts to COGS 80% Q2 95% 90% Qi 03 g 100% of Raw Materials were paid for at time of purchase 12 Manufacturing and Direct Labor infromation is as follows: The compay's variable manufacturing overhead rat $4.00 per direct labor hour. The company's fixed manufacturing overhead is $15,000 per quarter Depreciation expense is $3,000 per quarter 13 Direct Materials, Direct Labor and MOH payments were made at 100% in the month of purchase 60 1 4 Antirinator narating Eynences are as follows: 1 Instructions Sales Collections Production Schedule DM 145.000 DLandMOH Disbursements CashBud TAC Ready Home Insert ile a Draw Page Layout Formulas Data Review View Developer Help Power Pivot X Cut 12 Ib Copy Calibri BIU 2 Wrap Text AA SEE O A General Merge & Center $ % 9 8 % Clipboard Font Alignment Number C18 Any subsequent contributions are allocated to the cash account B G 0 d There is no prior year activity e RM cost per pound is $ 2.50 f Record the raw materials costs on Worksheet C with corresponding debits and credits and allocate the following amounts to COGS Q1 80% Q2 95% 90% Q3 g 100% of Raw Materials were paid for at time of purchase 12 Manufacturing and Direct Labor infromation is as follows: The compay's variable manufacturing overhead rat $4.00 per direct labor hour. The company's fixed manufacturing overhead is $15,000 per quarter Depreciation expense is $3,000 per quarter 13 Direct Materials, Direct Labor and MOH payments were made at 100% in the month of purchase 14 Anticipated Operating Expenses are as follows: 145,000 125,000 130,000 15 Operating Expenses were paid as follows: 0.90 0.95 0.80 76 Instructions Sales Collections Production Schedule DM DLandMOH Disbursements CashBud T-ACCTS 01 T Ready Type here to search Data Review View a Developer Home Insert Draw Page Layout Formulas & Cut 12 - AA In Copy Format Painter BTU - OA Help Power Pivot Calibri == E Wrap Text Merge General Clipboard 5 Algiment E - V Number X B for A C DE Principles of Managerial Accounting G H SALES BUDGET INSTRUCTIONS Prepare a Sales Budget using the information found in the instructions. Record information for each quarter on T-Account Worksheets with corresponding debits and credits Instructions Sales Collections Production Schedule DM DLandMOH Disbursements Cashbud TACCISO Type here to search