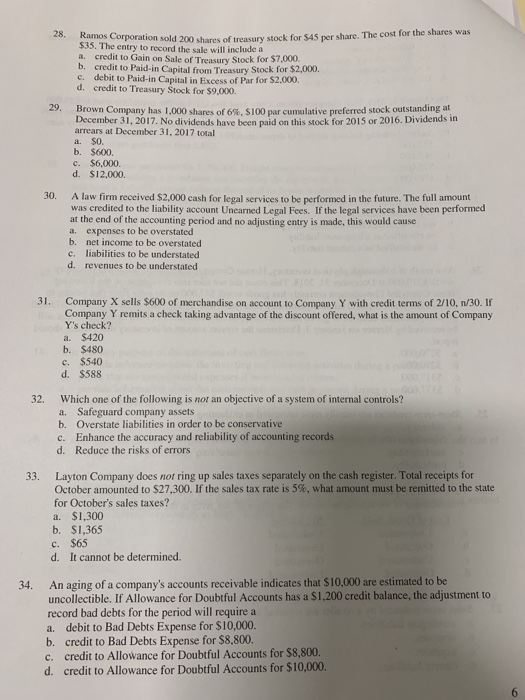

28. Ramos Corporation sold $35. The entry to record the sale will include a a. 200 shares of treasury stock for $45 per share. The cost for the shares was credit to Gain on Sale of Treasury Stock for $7,000. n Treasury Stock for $2,000. debit to Paid-in Capital in Excess of Par for $2,000. credit to Treasury Stock for $9,000 c. d. 29, Brown Company has 1,000 shares of 6%, S100 par cumulative preferred stock outstanding at December 31, 2017. No dividends have been paid on this stock for 2015 or 2016. Dividends in arrears at December 31, 2017 total a. $0. b. $600. c. $6,000. d. $12,000. 30. A law firm received $2,000 cash for legal services to be performed in the future. The full amount was credited to the liability account Unearned Legal Fees. If the legal services have been performed at the end of the accounting period and no adjusting entry is made, this would cause a. expenses to be overstated b. net income to be overstated c. liabilities to be understated d. revenues to be understated 31. Company X sells $600 of merchandise on account to Company Y with credit terms of 2/10, n/30. If Company Y remits a check taking advantage of the discount offered, what is the amount of Company Y's check? a. $420 b. $480 c. $540 d. $588 32. Which one of the following is not an objective of a system of internal controls? a. Safeguard company assets Overstate liabilities in order to be conservative b. Enhance the accuracy and reliability of accounting records c. d. Reduce the risks of errors Layton Company does not ring up sales taxes separately on the cash register. Total receipts for October amounted to $27.300. If the sales tax rte is 5%, what amount Imust be remitted to the state for October's sales taxes? a. $1,300 b. $1,365 . $65 d. It cannot be determined. 33. An aging of a company's accounts receivable indicates that $10,000 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a $1,200 credit balance, the adjustment to record bad debts for the period will require a a. 34. debit to Bad Debts Expense for $10,000. credit to Bad Debts Expense for $8,800. credit to Allowance for Doubtful Accounts for $8,800. credit to Allowance for Doubtful Accounts for $10,000. b. c. d