Answered step by step

Verified Expert Solution

Question

1 Approved Answer

28. Suppose that a portfolio company, Bigco, is currently valued at $100 million. VCs plan to exit in one year. On exit date, Bigco

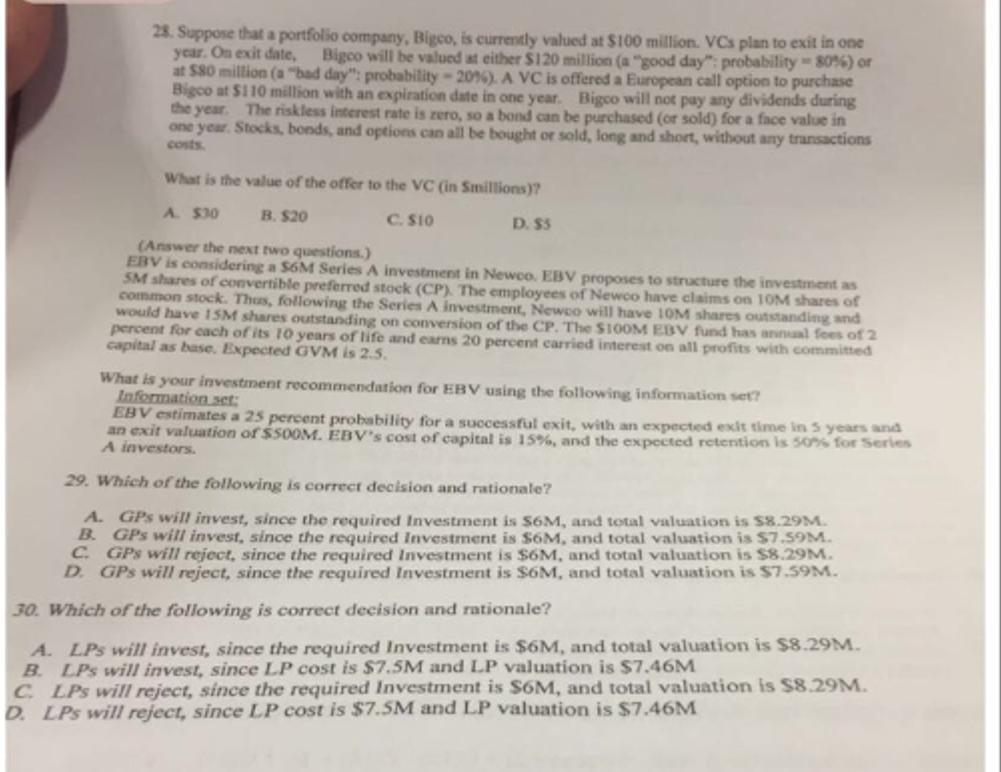

28. Suppose that a portfolio company, Bigco, is currently valued at $100 million. VCs plan to exit in one year. On exit date, Bigco will be valued at either $120 million (a "good day": probability 80%) or at $80 million (a "bad day": probability -20%). A VC is offered a European call option to purchase Bigco at $110 million with an expiration date in one year. Bigco will not pay any dividends during the year. The riskless interest rate is zero, so a bond can be purchased (or sold) for a face value in one year. Stocks, bonds, and options can all be bought or sold, long and short, without any transactions costs. What is the value of the offer to the VC (in Smillions)? A. $30 B. $20 C. $10 (Answer the next two questions.) EBV is considering a S6M Series A investment in Newco. EBV proposes to structure the investment as SM shares of convertible preferred stock (CP). The employees of Newco have claims on 10M shares of common stock. Thus, following the Series A investment, Newco will have 10M shares outstanding and would have 15M shares outstanding on conversion of the CP. The $100M EBV fund has annual fees of 2 percent for each of its 10 years of life and earns 20 percent carried interest on all profits with committed capital as base. Expected GVM is 2.5. D. $5 What is your investment recommendation for EBV using the following information set? Information set: EBV estimates a 25 percent probability for a successful exit, with an expected exit time in 5 years and an exit valuation of $500M. EBV's cost of capital is 15%, and the expected retention is 50% for Series A investors. 29. Which of the following is correct decision and rationale? A. GPs will invest, since the required Investment is $6M, and total valuation is $8.29M. B. GPs will invest, since the required Investment is $6M, and total valuation is $7.59M. C. GPs will reject, since the required Investment is $6M, and total valuation is $8.29M. D. GPs will reject, since the required Investment is $6M, and total valuation is $7.59M. 30. Which of the following is correct decision and rationale? A. LPs will invest, since the required Investment is $6M, and total valuation is $8.29M. B. LPs will invest, since LP cost is $7.5M and LP valuation is $7.46M C. LPs will reject, since the required Investment is S6M, and total valuation is $8.29M. D. LPs will reject, since LP cost is $7.5M and LP valuation is $7.46M

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

28 ANS WER C 10 WORK ING The value of the offer to the VC is the present value of the expected payof...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started