Answered step by step

Verified Expert Solution

Question

1 Approved Answer

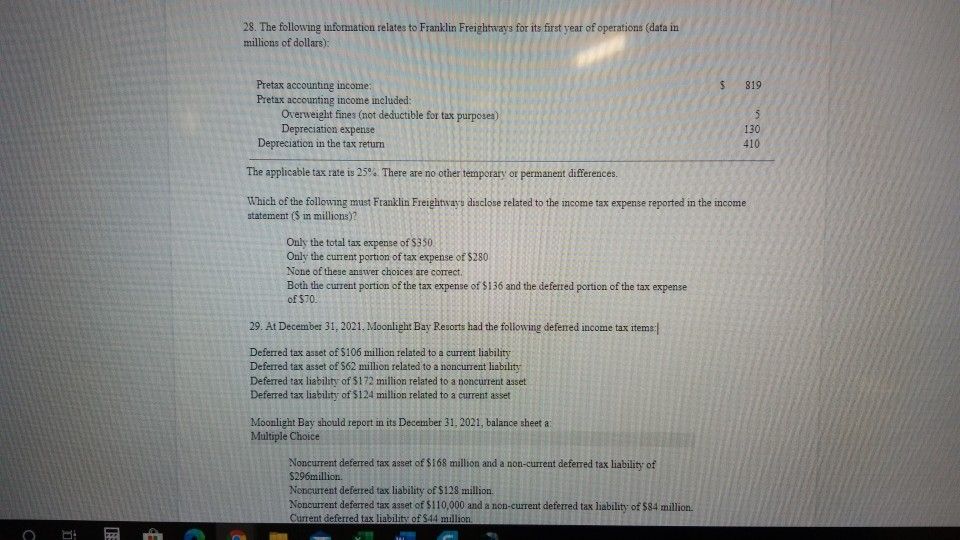

28. The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars): $ 819 Pretax accounting income: Pretax

28. The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars): $ 819 Pretax accounting income: Pretax accounting income included: Overweight fines (not deductible for tax purposes) Depreciation expense Depreciation in the tax retum 130 410 The applicable tax rate is 25%. There are no other temporary or permanent differences. Which of the following must Franklin Freight was duuclose related to the income tax expense reported in the income statement (Sin millions)? Only the total tax expense of $350. Only the current portion of tax expense of $280 None of these answer choices are correct. Both the current portion of the tax expense of $136 and the deferred portion of the tax expense of $70. 29. At December 31, 2021, Moonlight Bay Resorts had the following deferred income tax items: Deferred tax asset of $106 million related to a current liability Deferred tax asset of S62 million related to a noncurrent liability Deferred tax liability of $172 million related to a noncurrent asset Deferred tax liability of $124 million related to a current asset Moonlight Bay should report in its December 31, 2021, balance sheet a Multiple Choice Noncurrent deferred tax asset of $168 million and a non-current deferred tax liability of $296million. Noncurrent deferred tax liability of $128 million Noncurrent deferred tax asset of $110,000 and a non-current deferred tax liability of $84 million. Current deferred tax liability of S44 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started