Answered step by step

Verified Expert Solution

Question

1 Approved Answer

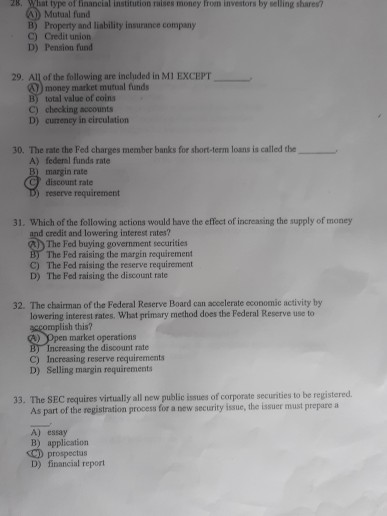

28, What type of financial institution raises money Irom investors by selling shares? Mutual fund Property and liability insurince company Credit union Pension fund B)

28, What type of financial institution raises money Irom investors by selling shares? Mutual fund Property and liability insurince company Credit union Pension fund B) C) D) 29, Alof the following are included in M1 EXCEPT Q) money market mutual funds B) total value of coins C) checking accounts D) curency in circulation 30. The rate the Fed charges member banks for short-term loans is called the A) federal funds rate B) margin rate Cf discount rate ) reserve requirement 31. Which of the following actions would have the effect of increasing the supply of money and credit and lowering interest rates? The Fed buying government securities The Fed raising the margin requirement C) The Fed raising the reserve requirement D) The Fed raising the discount rate 32. The chairman of the Federal Reserve Board can accelerate economic activity by lowering interest rates. What primary method does the Federal Reserve use to omplish this? Open market operations Increasing the discount rate Increasing reserve requirements D) C) Selling margin requirements 33. The SEC requires virtually all new public issues of corporate securities to be registered. As part of the registration process for a new security issue, the issuer must prepare:a A) essay B) application prospectus D) financial report

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started