282930....

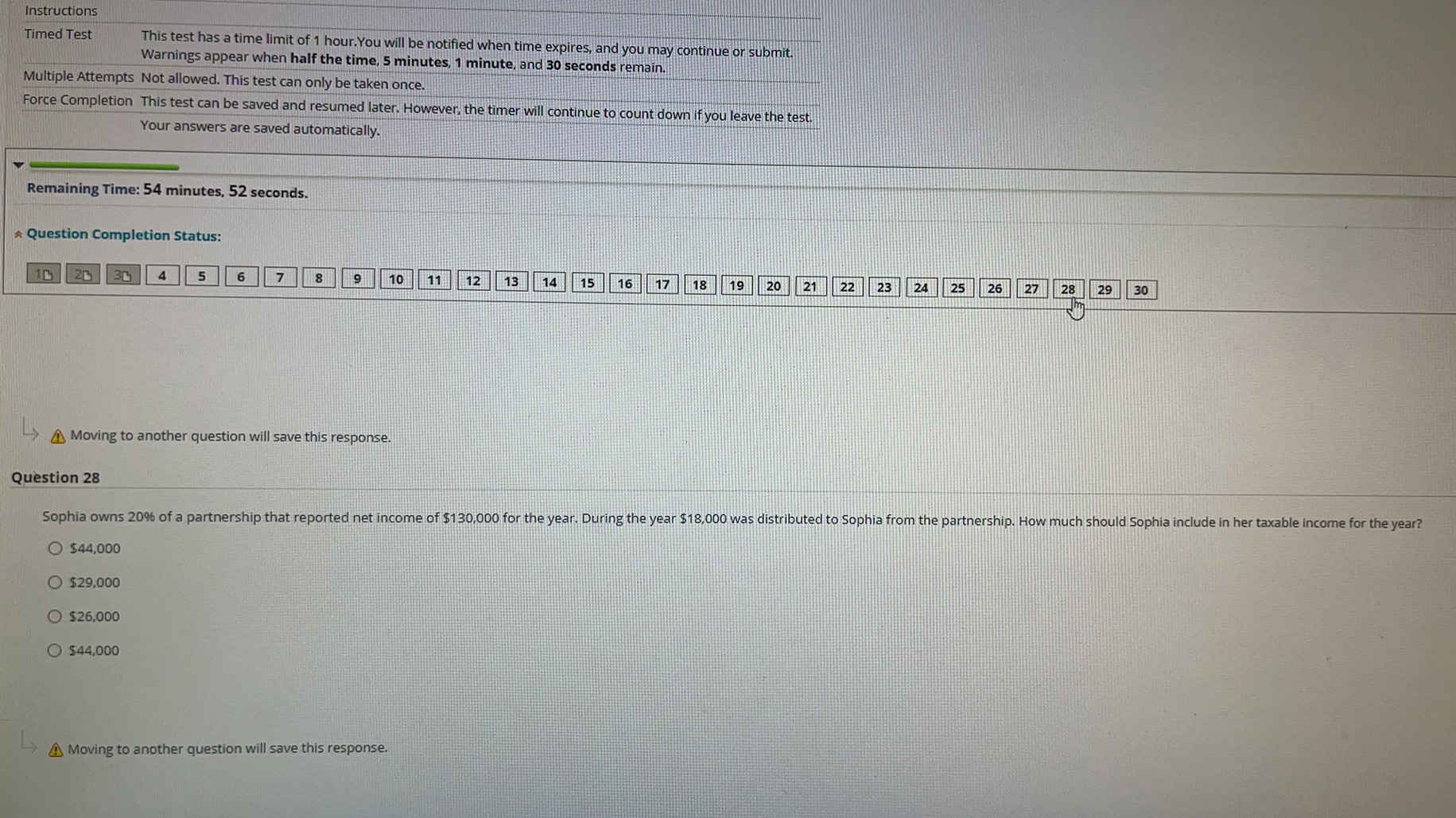

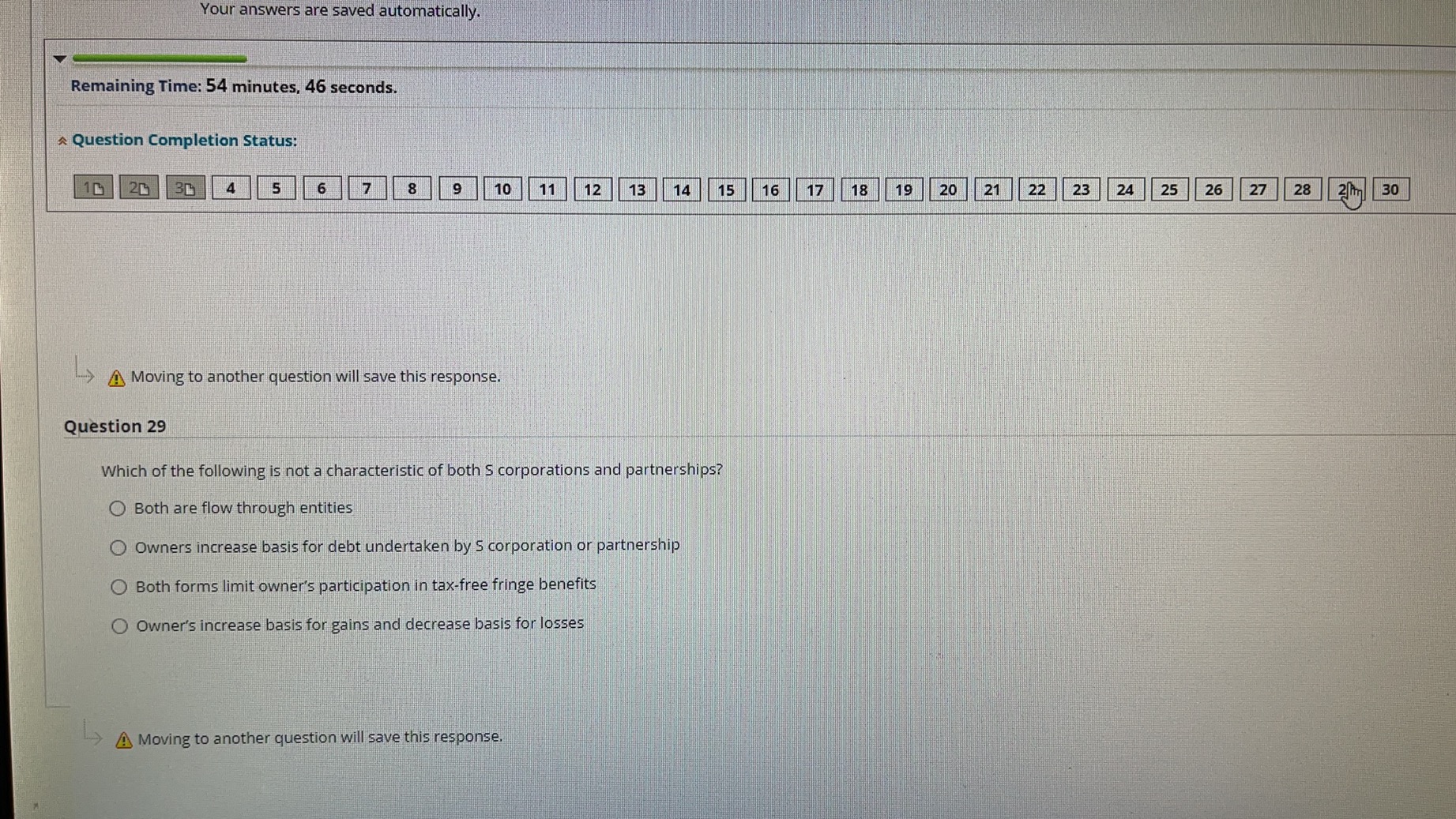

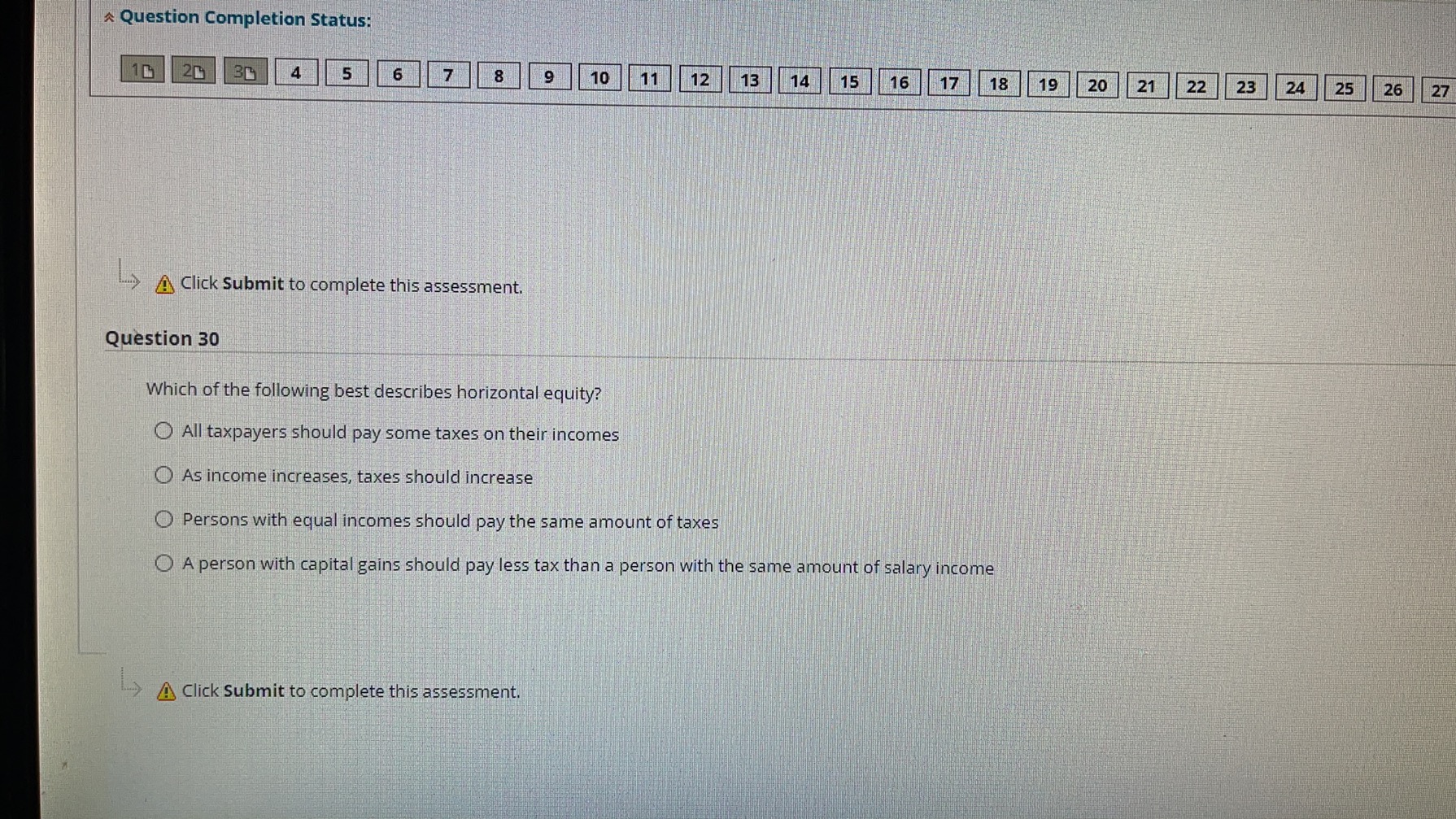

Instructions Timed Test This test has a time limit of 1 hour. You will be notified when time expires, and you may continue or submit. Warnings appear when half the time, 5 minutes, 1 minute, and 30 seconds remain. Multiple Attempts Not allowed. This test can only be taken once. Force Completion This test can be saved and resumed later. However, the timer will continue to count down if you leave the test. Your answers are saved automatically. Remaining Time: 54 minutes, 52 seconds. Question Completion Status: 10 20 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 -> Moving to another question will save this response. Question 28 Sophia owns 20% of a partnership that reported net income of $130,000 for the year. During the year $18,000 was distributed to Sophia from the partnership. How much should Sophia include in her taxable income for the year? $44,000 $29,000 $26,000 $44,000 > A Moving to another question will save this response.Your answers are saved automatically. Remaining Time: 54 minutes, 46 seconds. Question Completion Status: 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 2 Mm 30 -> Moving to another question will save this response. Question 29 Which of the following is not a characteristic of both S corporations and partnerships? Both are flow through entities O Owners increase basis for debt undertaken by S corporation or partnership Both forms limit owner's participation in tax-free fringe benefits O Owner's increase basis for gains and decrease basis for losses A Moving to another question will save this response.* Question Completion Status: BR 5 6 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 .> Click Submit to complete this assessment. Question 30 Which of the following best describes horizontal equity? O All taxpayers should pay some taxes on their incomes As income increases, taxes should increase O Persons with equal incomes should pay the same amount of taxes O A person with capital gains should pay less tax than a person with the same amount of salary income > A Click Submit to complete this assessment