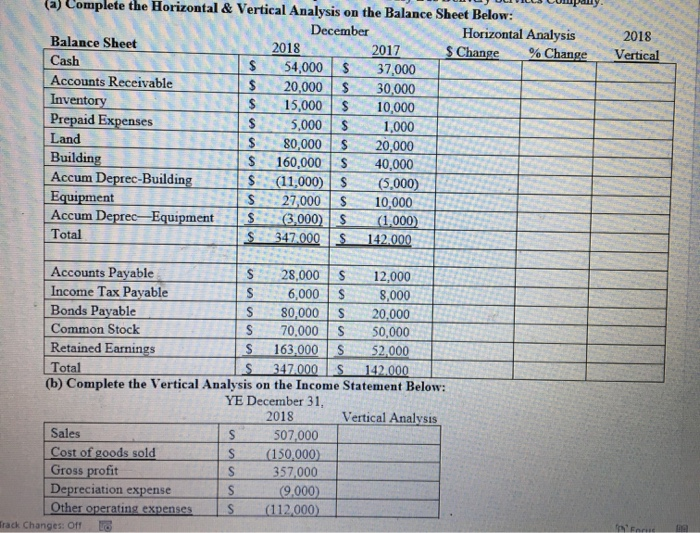

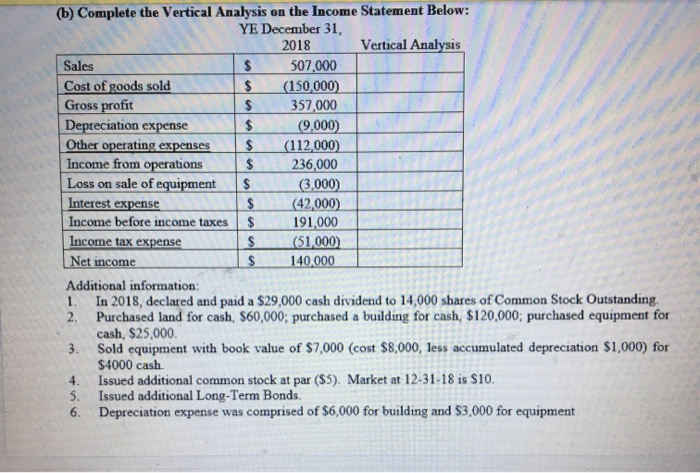

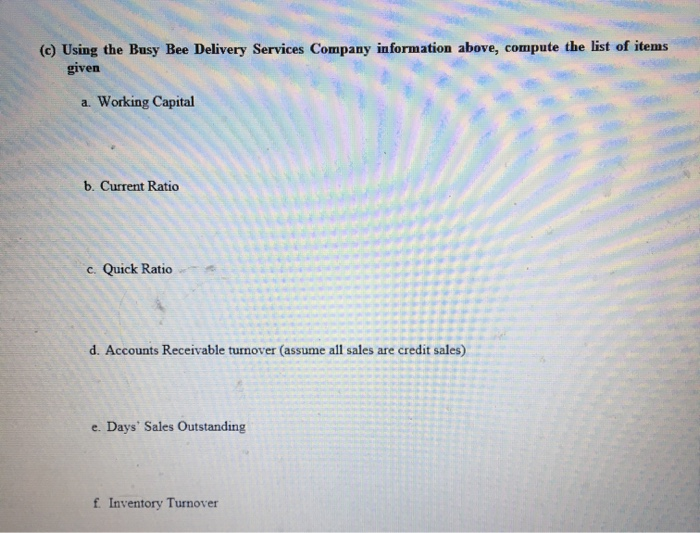

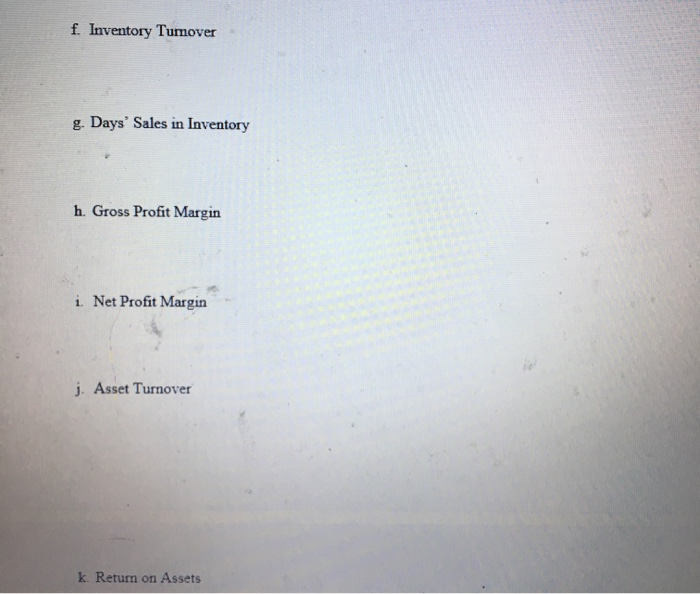

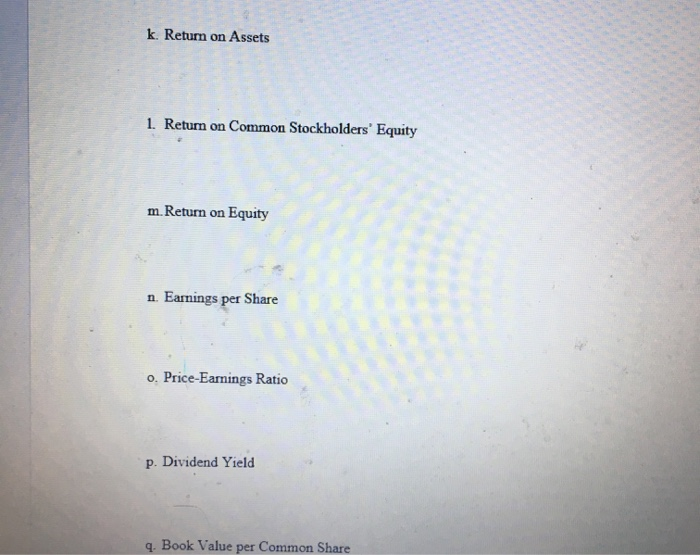

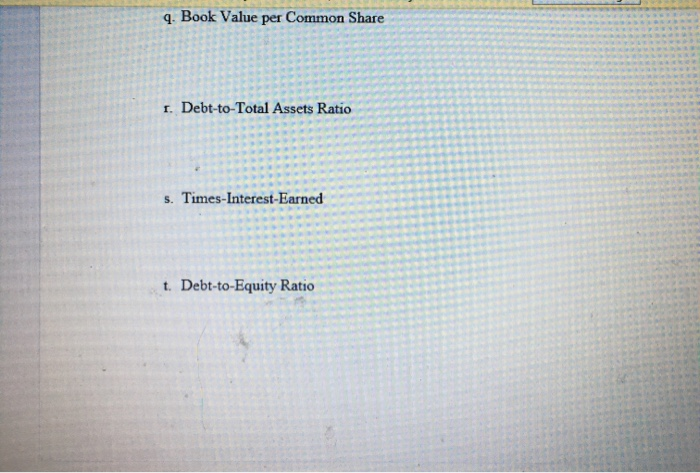

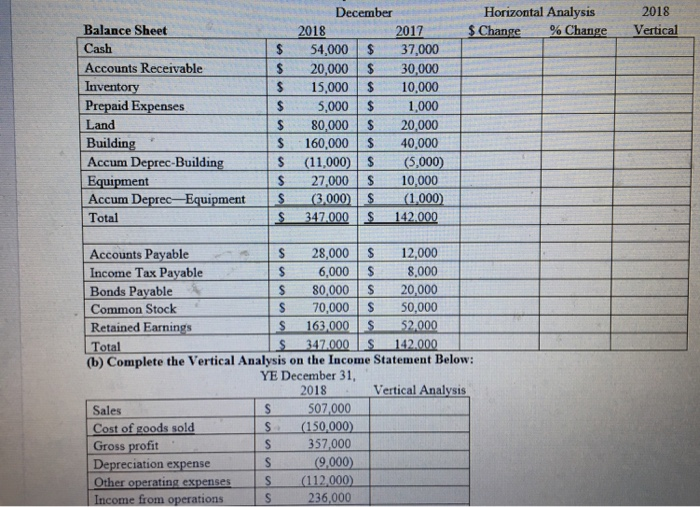

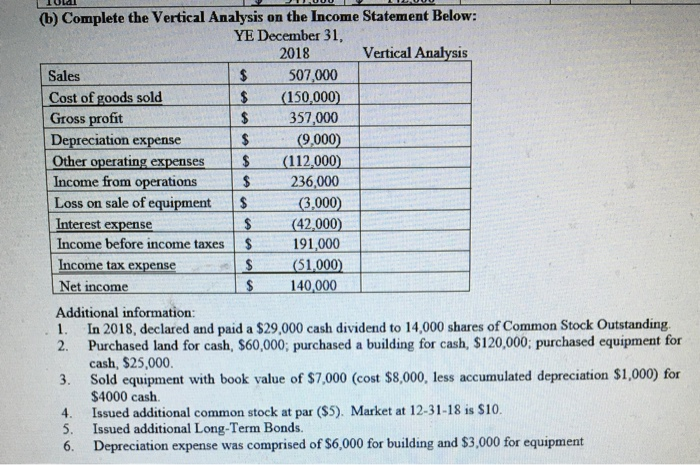

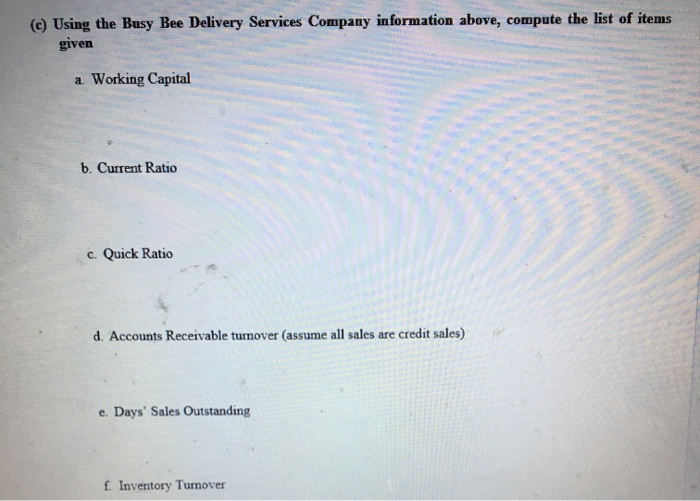

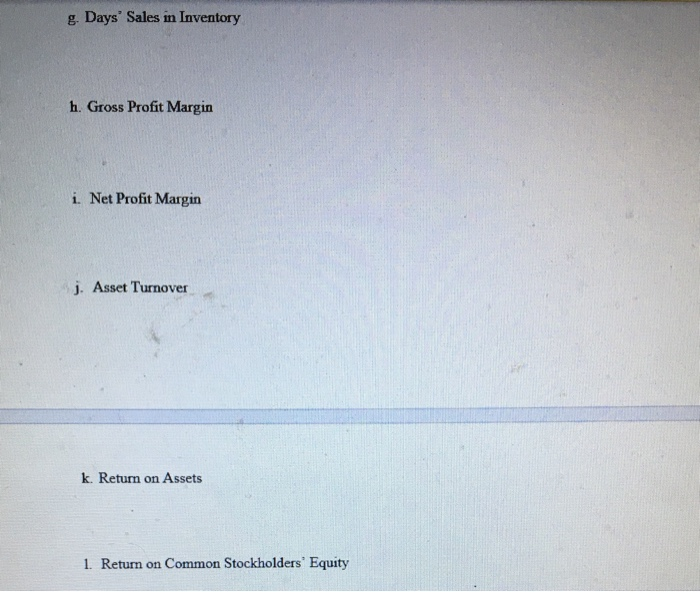

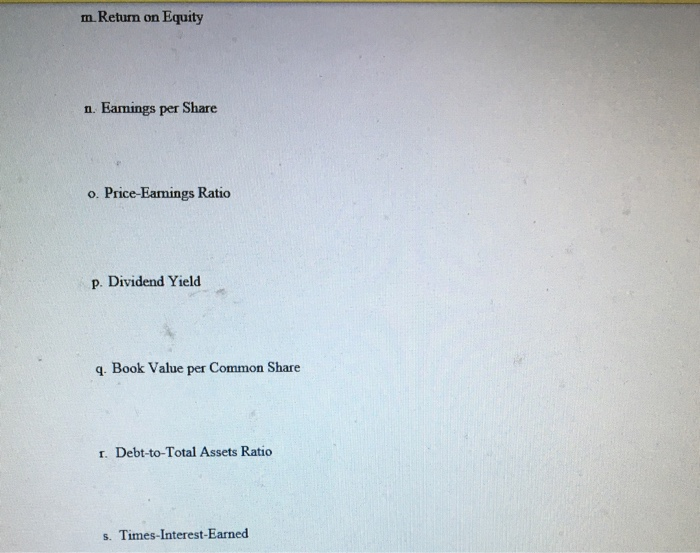

29 2018 Vertical (a) Complete the Horizontal & Vertical Analysis on the Balance Sheet Below: December Horizontal Analysis Balance Sheet 2018 2017 Change % Change Cash $ 54,000 $ 37.000 Accounts Receivable $ 20,000 $ 30,000 Inventory $ 15,000 $ 10,000 Prepaid Expenses $ 5,000S 1,000 Land $ 80,000 $ 20,000 Building $ 160,000 S 40,000 Accum Deprec-Building s (11,000) S (5,000) Equipment $ 27,000 S 10,000 Accum Deprec-Equipments (3,00 Total e s 347.000 S 142.000 Accounts Payable $ 28,000S 12,000 Income Tax Payable S 6,000 $ 8,000 Bonds Payable $ 80,000 S 20,000 Common Stock IS 70.000 S 50,000 Retained Earnings S 163.000 $ 52,000 Total $ 347.000 S 142.000 (b) Complete the Vertical Analysis on the Income Statement Below: YE December 31, 2018 Vertical Analysis Sales DES 507,000 Cost of goods sold S (150.000) Gross profit S 357,000 Depreciation expense S 9,000 Other operating expenses S (112,000) (b) Complete the Vertical Analysis on the Income Statement Below: YE December 31, 2018 Vertical Analysis Sales $ 507,000 Cost of goods sold $ (150.000) Gross profit $ 357,000 Depreciation expense $ 9,000) Other operating expenses $ (112,000) Income from operations Loss on sale of equipment S (3.000) $ (42,000) Income before income taxes $ 191,000 Income tax expense $ (51.000) Net income $ 140,000 Additional information: 1. In 2018, declared and paid a $29,000 cash dividend to 14,000 shares of Common Stock Outstanding 2. Purchased land for cash, $60,000; purchased a building for cash, $120,000; purchased equipment for cash, $25,000. Sold equipment with book value of $7,000 (cost $8,000, less accumulated depreciation $1,000) for $4000 cash. Issued additional common stock at par ($5). Market at 12-31-18 is $10. 5. Issued additional Long-Term Bonds. 6. Depreciation expense was comprised of $6,000 for building and $3,000 for equipment (c) Using the Busy Bee Delivery Services Company information above, compute the list of items given a. Working Capital b. Current Ratio c. Quick Ratio d. Accounts Receivable turnover (assume all sales are credit sales) e. Days' Sales Outstanding f. Inventory Turnover f. Inventory Tumover g. Days' Sales in Inventory h. Gross Profit Margin i. Net Profit Margin j. Asset Turnover k. Return on Assets k. Return on Assets 1. Return on Common Stockholders' Equity m. Return on Equity n. Earnings per Share o. Price-Earnings Ratio p. Dividend Yield q. Book Value per Common Share q. Book Value per Common Share 1. Debt-to-Total Assets Ratio s. Times-Interest-Earned t. Debt-to-Equity Ratio Horizontal Analysis $ Change % Change 2018 Vertical Balance Sheet Cash Accounts Receivable Inventory Prepaid Expenses Land Building Accum Deprec-Building Equipment Accum Deprec-Equipment Total $ $ $ $ S $ S $ $ $ December 2018 2017 54,000 $ 37,000 20,000 $ 30,000 15,000 $ 10,000 5,000 $ 1,000 80.000 $ 20,000 160,000 $ 40,000 (11,000) $ (5,000) 27,000 S 10,000 (3,000) $ (1.000) 347.000 $ 142.000 Accounts Payable S 28,000 $ 12,000 Income Tax Payable IS 6,000 $ 8,000 Bonds Payable I $ 80,000 $ 20,000 Common Stock $ 70,000 S 50,000 Retained Earnings S 163.000 $ 52.000 Total IS 347.000 S 142.000 (b) Complete the Vertical Analysis on the Income Statement Below: YE December 31, 2018 Vertical Analysis Sales S 507.000 Cost of goods sold (150,000) Gross profit s 357,000 Depreciation expense s (9,000) Other operating expenses S (112,000) Income from operations S 236,000 b) Complete the Vertical Analysis on the Income Statement Below: YE December 31, 2018 Vertical Analysis Sales $ 507,000 Cost of goods sold (150,000) Gross profit 357.000 Depreciation expense (9,000) Other operating expenses (112,000) Income from operations 236,000 Loss on sale of equipment (3.000) Interest expense (42,000) Income before income taxes $ 191,000 Income tax expense (51000) Net income 140,000 Additional information: 1. In 2018, declared and paid a $29,000 cash dividend to 14,000 shares of Common Stock Outstanding 2. Purchased land for cash, $60,000; purchased a building for cash, $120,000; purchased equipment for cash, $25,000 3. Sold equipment with book value of $7,000 (cost $8,000, less accumulated depreciation $1,000) for $4000 cash. 4. Issued additional common stock at par ($5). Market at 12-31-18 is $10. 5. Issued additional Long-Term Bonds. 6. Depreciation expense was comprised of $6,000 for building and $3,000 for equipment (c) Using the Busy Bee Delivery Services Company information above, compute the list of items given a Working Capital b. Current Ratio c. Quick Ratio d. Accounts Receivable turnover (assume all sales are credit sales) e. Days' Sales Outstanding f. Inventory Tumover g. Days' Sales in Inventory h. Gross Profit Margin i. Net Profit Margin j. Asset Turnover k. Return on Assets 1. Return on Common Stockholders' Equity m Return on Equity n. Eamings per Share o. Price-Eamings Ratio p. Dividend Yield 4. Book Value per Common Share 1. Debt-to-Total Assets Ratio s. Times Interest-Earned