Answered step by step

Verified Expert Solution

Question

1 Approved Answer

29 30 Suppose you begin saving for your retirement by depositing $5,000 per year in an IRA. The interest rate earned is 3%. If

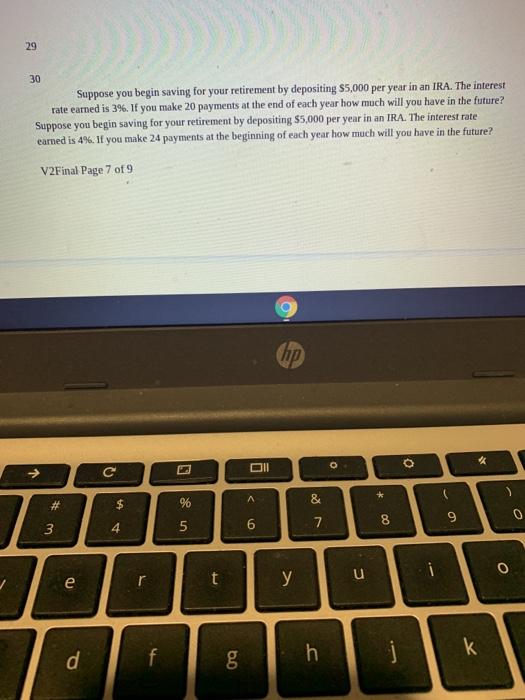

29 30 Suppose you begin saving for your retirement by depositing $5,000 per year in an IRA. The interest rate earned is 3%. If you make 20 payments at the end of each year how much will you have in the future? Suppose you begin saving for your retirement by depositing $5,000 per year in an IRA. The interest rate earned is 4%. If you make 24 payments at the beginning of each year how much will you have in the future? V2Final Page # 3 e d 7 of 9 C $ 4 f 0 % 5 t B.O g Oll A 6 hp y 87 & h O C * 8 j O a % k O 0 29 30 Suppose you begin saving for your retirement by depositing $5,000 per year in an IRA. The interest rate earned is 3%. If you make 20 payments at the end of each year how much will you have in the future? Suppose you begin saving for your retirement by depositing $5,000 per year in an IRA. The interest rate earned is 4%. If you make 24 payments at the beginning of each year how much will you have in the future? V2Final Page 7 of 9 # 3 e d C $ 4 f 25 6.0 g Oll < 6 hp y & 18 7 h O u * 8 00 O 9 11 10 j k %

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer i IRA or Individual Retirement Account is a form of retirement plan in the United States which is provided by many financial institutions Its a form of investment that accumulates small investm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started