Answered step by step

Verified Expert Solution

Question

1 Approved Answer

29. (9 points) At the end of its first year of operations (2019). Ace reported the following: Pretax (GAAP-based) $2,100,000 financial income 2019 Book

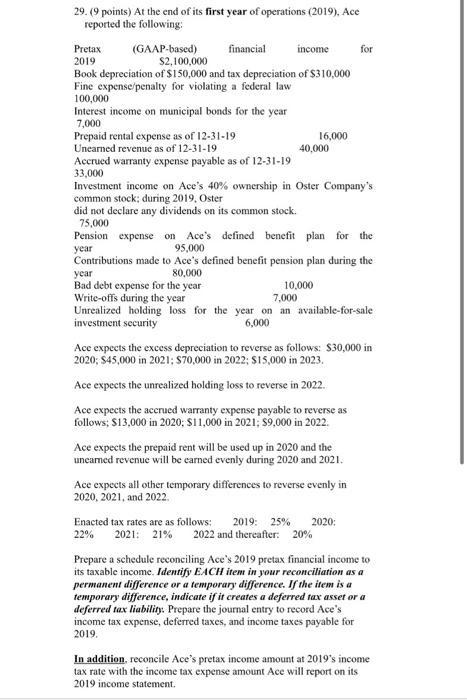

29. (9 points) At the end of its first year of operations (2019). Ace reported the following: Pretax (GAAP-based) $2,100,000 financial income 2019 Book depreciation of $150,000 and tax depreciation of $310,000 Fine expense/penalty for violating a federal law 100,000 Interest income on municipal bonds for the year 7,000 Prepaid rental expense as of 12-31-19 Unearned revenue as of 12-31-19 Accrued warranty expense payable as of 12-31-19 33,000 16,000 40,000 Investment income on Ace's 40% ownership in Oster Company's common stock; during 2019, Oster 10,000 did not declare any dividends on its common stock. 75,000 Pension expense on Ace's defined benefit plan for the year 95,000 Contributions made to Ace's defined benefit pension plan during the year 80,000 Bad debt expense for the year Write-offs during the year 7,000 Unrealized holding loss for the year on an available-for-sale investment security 6,000 for Ace expects the excess depreciation to reverse as follows: $30,000 in 2020; $45,000 in 2021; $70,000 in 2022; $15,000 in 2023. Ace expects the unrealized holding loss to reverse in 2022. Ace expects the accrued warranty expense payable to reverse as follows: $13,000 in 2020; $11,000 in 2021; $9,000 in 2022. Ace expects the prepaid rent will be used up in 2020 and the unearned revenue will be earned evenly during 2020 and 2021. Ace expects all other temporary differences to reverse evenly in 2020, 2021, and 2022. Enacted tax rates are as follows: 2019: 25% 2020: 22% 2021: 21% 2022 and thereafter: 20% Prepare a schedule reconciling Ace's 2019 pretax financial income to its taxable income. Identify EACH item in your reconciliation as a permanent difference or a temporary difference. If the item is a temporary difference, indicate if it creates a deferred tax asset or a deferred tax liability. Prepare the journal entry to record Ace's income tax expense, deferred taxes, and income taxes payable for 2019. In addition, reconcile Ace's pretax income amount at 2019's income tax rate with the income tax expense amount Ace will report on its 2019 income statement.

Step by Step Solution

★★★★★

3.58 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Reconciliation of 2019 Pretax Financial Income to Taxable Income Permanent Differences Interest income on municipal bonds Permanent Difference This item is not taxable and will not affect taxable inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started