Question

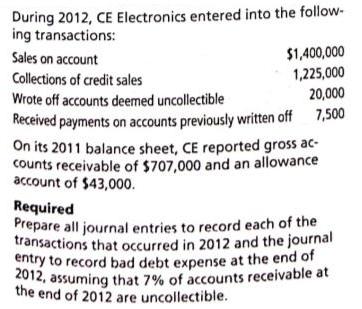

During 2012, CE Electronics entered into the follow- ing transactions: $1,400,000 1,225,000 20,000 Sales on account Collections of credit sales Wrote off accounts deemed

During 2012, CE Electronics entered into the follow- ing transactions: $1,400,000 1,225,000 20,000 Sales on account Collections of credit sales Wrote off accounts deemed uncollectible Received payments on accounts previously written off 7,500 On its 2011 balance sheet, CE reported gross ac- counts receivable of $707,000 and an allowance account of $43,000. Required Prepare all journal entries to record each of the transactions that occurred in 2012 and the journal entry to record bad debt expense at the end of 2012, assuming that 7% of accounts receivable at the end of 2012 are uncollectible.

Step by Step Solution

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial ACCT2

Authors: Norman H. Godwin, C. Wayne Alderman

2nd edition

9781285632544, 1111530769, 1285632540, 978-1111530761

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App