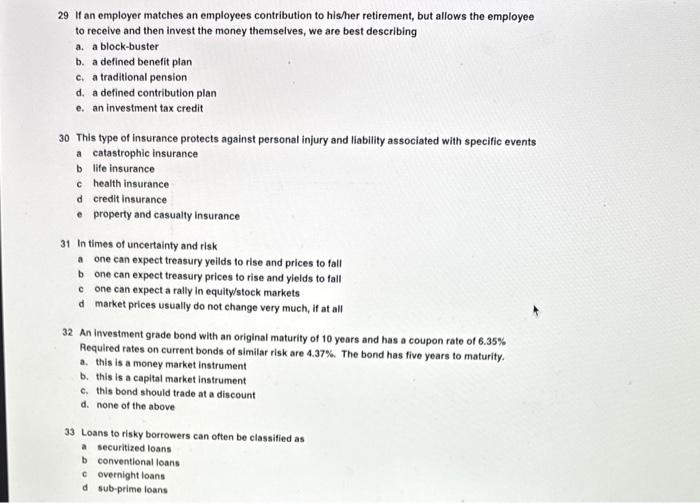

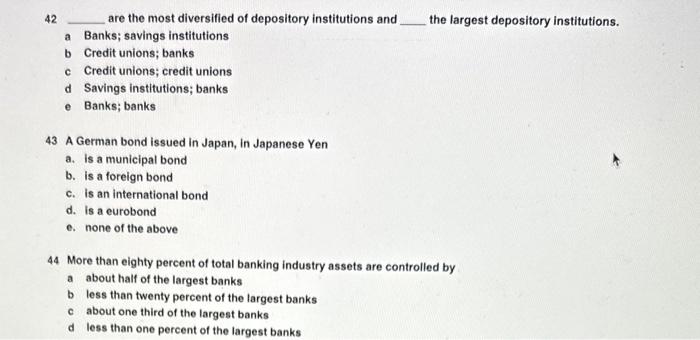

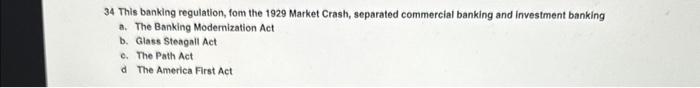

29 If an employer matches an employees contribution to his/her retirement, but allows the employee to receive and then invest the money themselves, we are best describing a. a block-buster b. a defined benefit plan c. a traditional pension d. a defined contribution plan e. an investment tax credit 30 This type of insurance protects against personal injury and liability associated with specific events a catastrophic insurance b life insurance c health insurance d credit insurance - property and casualty insurance 31 In times of uncertainty and risk a one can expect treasury yeilds to rise and prices to fall b one can expect treasury prices to rise and yields to fall c one can expect a rally in equity/stock markets d market prices usually do not change very much, if at all 32 An investment grade bond with an original maturity of 10 years and has a coupon rate of 6.35% Required rates on current bonds of similar risk are 4.37%. The bond has five years to maturity. a. this is a money market instrument b. this is a capital market instrument c. this bond should trade at a discount d. none of the above 33 Loans to risky borrowers can often be classified as a securitized loans b conventional loans c overnight loans d sub-prime loans 42 are the most diversified of depository institutions and the largest depository institutions. a Banks; savings institutions b Credit unions; banks c Credit unions; credit unions d Savings institutions; banks e Banks; banks 43 A German bond issued in Japan, in Japanese Yen a. is a municipal bond b. is a foreign bond c. is an international bond d. is a eurobond e. none of the above 44 More than eighty percent of total banking industry assets are controlled by a about half of the largest banks b less than twenty percent of the largest banks c about one third of the largest banks d less than one percent of the largest banks 34 This banking regulation, fom the 1929 Market Crash, separated commercial banking and investment banking a. The Banking Modernization Act b. Glass Steagall Act e. The Path Act d The America First Act