Answered step by step

Verified Expert Solution

Question

1 Approved Answer

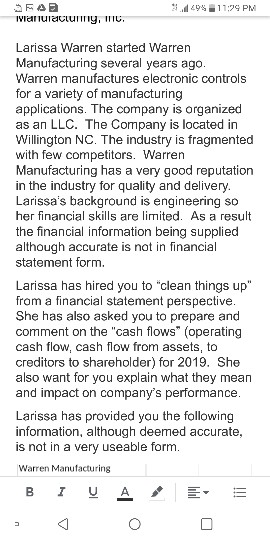

294 11:29 PM valuacluny, Larissa Warren started Warren Manufacturing several years ago. Warren manufactures electronic controls for a variety of manufacturing applications. The company is

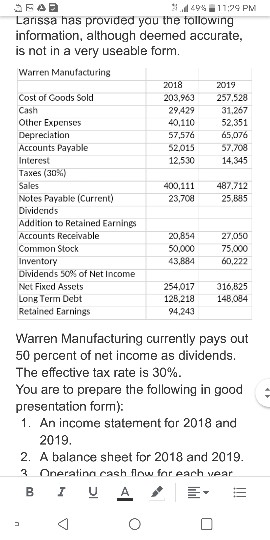

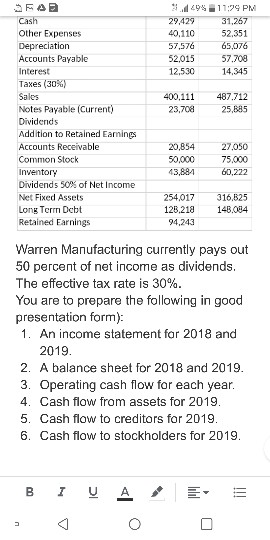

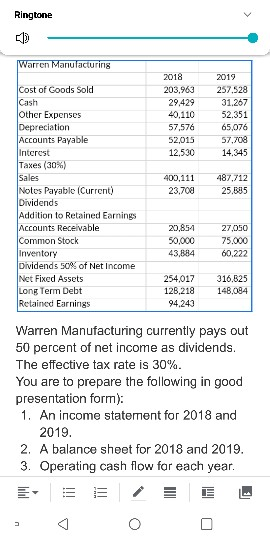

294 11:29 PM valuacluny, Larissa Warren started Warren Manufacturing several years ago. Warren manufactures electronic controls for a variety of manufacturing applications. The company is organized as an LLC. The Company is located in Willington NC. The industry is fragmented with few competitors. Warren Manufacturing has a very good reputation in the industry for quality and delivery. Larissa's background is engineering so her financial skills are limited. As a result the financial information being supplied although accurate is not in financial statement form. Larissa has hired you to clean things up" from a financial statement perspective. She has also asked you to prepare and comment on the "cash flows" (operating cash flow, cash flow from assets, to creditors to shareholder) for 2019. She also want for you explain what they mean and impact on company's performance. Larissa has provided you the following information, although deemed accurate, is not in a very useable form. Warren Manufacturing RA 3494 11:29 PM Larissa has provided you the following information, although deemed accurate, is not in a very useable form. Warren Manufacturing 2018 2019 Cost of Goods Sold 203,963 257.528 Cash 29.429 31.267 Other Expenses 40.110 52.351 Depreciation 57,576 65,076 Accounts Payable 52,015 57.708 Interest 12,530 14,345 Taxes (30%) Sales 400,111 487.712 Noles Payable (Current) 23.700 25,585 Dividends Addition to Retained Earnings Accounts Receivable 20,854 27.050 Common Stock 50,000 75.000 Inventory 43,884 60,222 Dividends 50% of Net Income Net Fixed Assets 254,017 316.525 Long Term Debt 128.218 148.084 Retained Earnings 94.243 Warren Manufacturing currently pays out 50 percent of net income as dividends. The effective tax rate is 30%. You are to prepare the following in good presentation form): 1. An income statement for 2018 and 2019 2. A balance sheet for 2018 and 2019. 3 Onerating cash flow for each year B = 29811:29 PM 29.429 31,267 40.110 52,351 57,57 65.076 52015 57.708 12,530 14,345 400,111 23,700 487.712 25,685 Cash Other Expenses Depreciation Accounts Payable Interest Taxes (30%) Sales Notes Payable (Current) Dividends Addition to Retained Eaming Accounts Receivable Common Stock Inventory Dividends 50% of Net Income Net Fixed Assets Long Term Debt Retained Earnings 20,854 50,000 43,884 27.050 75.000 60,222 254,017 125.218 94,243 316,625 143.084 Warren Manufacturing currently pays out 50 percent of net income as dividends. The effective tax rate is 30%. You are to prepare the following in good presentation form): 1. An income statement for 2018 and 2019. 2. A balance sheet for 2018 and 2019. 3. Operating cash flow for each year. 4. Cash flow from assets for 2019. 5. Cash flow to creditors for 2019. 6. Cash flow to stockholders for 2019. B 7 A U Ringtone Ringtone > Warren Manufacturing 2018 203,963 29.429 40.110 57,576 52,015 12,530 2019 257.528 31.267 52.351 65,076 57,708 14,345 400,111 23,700 487,712 25,885 Cost of Goods Sold Cash Other Expenses Depreciation Accounts Payable Interest Taxes (30%) Sales Notes Payable (Current) Dividends Addition to Retained Earnings Accounts Receivable Common Stock Inventory Dividends 50% of Net Income Net Fixed Assets Long Term Debt Retained Earnings 20,851 50,000 43,884 27,050 75.000 60.222 254,017 128,218 94,243 316.525 148,084 Warren Manufacturing currently pays out 50 percent of net income as dividends. The effective tax rate is 30%. You are to prepare the following in good presentation form): 1. An income statement for 2018 and 2019. 2. A balance sheet for 2018 and 2019. 3. Operating cash flow far each year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started