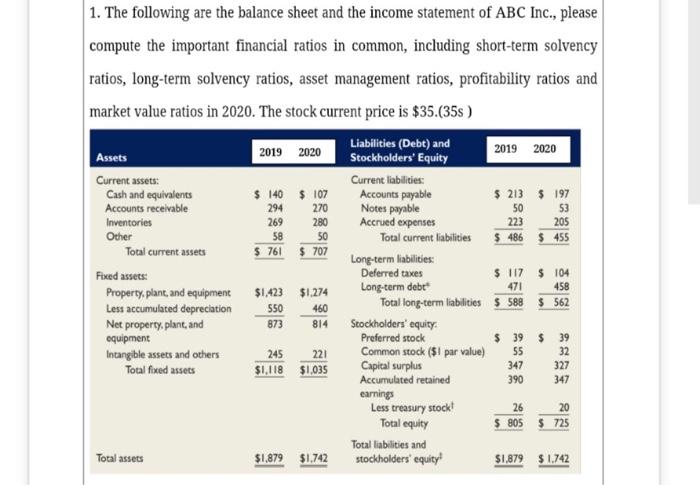

294 269 205 1. The following are the balance sheet and the income statement of ABC Inc., please compute the important financial ratios in common, including short-term solvency ratios, long-term solvency ratios, asset management ratios, profitability ratios and market value ratios in 2020. The stock current price is $35.(35) Liabilities (Debt) and Assets 2019 2020 2019 2020 Stockholders' Equity Current assets: Current liabilities: Cash and equivalents $ 140 $ 107 Accounts payable $ 213 $ 197 Accounts receivable 270 Notes payable 50 53 Inventories 280 Accrued expenses 223 Other 58 Total current liabilities $ 486 $ 455 Total current assets $ 761 $ 707 Long-term liabilities: Fixed assets: Deferred taxes $ 117 $ 104 Property, plant, and equipment $1,423 $1.274 Long-term debe 458 Lest accumulated depreciation 550 460 Total long-term liabilities $ 588 $ 562 Net property, plant, and 873 814 Stockholders' equity equipment Preferred stock $ 39 $ 39 Intangible assets and others 245 221 Common stock ($1 par value) 55 32 347 Total fixed assets Capital surplus $1,118 $1,035 327 Accumulated retained 390 earnings Less treasury stock! 26 20 Total equity $ 805 $ 725 Total liabilities and Total assets $1.879 $1.742 stockholders' equity! $1,879 $ 1.742 50 471 347 294 269 205 1. The following are the balance sheet and the income statement of ABC Inc., please compute the important financial ratios in common, including short-term solvency ratios, long-term solvency ratios, asset management ratios, profitability ratios and market value ratios in 2020. The stock current price is $35.(35) Liabilities (Debt) and Assets 2019 2020 2019 2020 Stockholders' Equity Current assets: Current liabilities: Cash and equivalents $ 140 $ 107 Accounts payable $ 213 $ 197 Accounts receivable 270 Notes payable 50 53 Inventories 280 Accrued expenses 223 Other 58 Total current liabilities $ 486 $ 455 Total current assets $ 761 $ 707 Long-term liabilities: Fixed assets: Deferred taxes $ 117 $ 104 Property, plant, and equipment $1,423 $1.274 Long-term debe 458 Lest accumulated depreciation 550 460 Total long-term liabilities $ 588 $ 562 Net property, plant, and 873 814 Stockholders' equity equipment Preferred stock $ 39 $ 39 Intangible assets and others 245 221 Common stock ($1 par value) 55 32 347 Total fixed assets Capital surplus $1,118 $1,035 327 Accumulated retained 390 earnings Less treasury stock! 26 20 Total equity $ 805 $ 725 Total liabilities and Total assets $1.879 $1.742 stockholders' equity! $1,879 $ 1.742 50 471 347