Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2a. Amina plans to invest 54% of her savings in a commodity based mutual fund and 46% in an emerging market based mutual fund. The

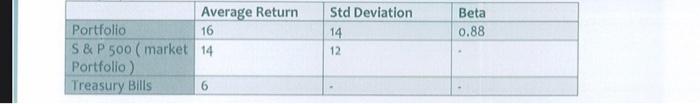

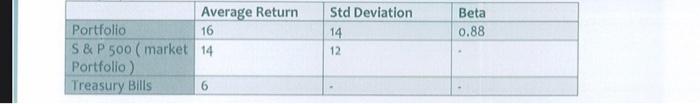

2a. Amina plans to invest 54% of her savings in a commodity based mutual fund and 46% in an emerging market based mutual fund. The expected return on the two funds are 16% and 14%, respectively. The standard deviations are 22% and 18%, respectively. The correlation between the two funds is 0.75. What would be the expected return and standard deviation for Amina's portfolio? 2b. A fund manager with a leading savings & loan company wants to evaluate a Portfolio consisting of a mix of blue-chip, defensive and cyclical shares. He has compiled the following useful information for this purpose.  Assist the fund manager in evaluating the performance of the Portfolio and the S&P 500 using Sharpe and Treynor measures. Based on your calculation, comment on the performance of the Portfolio and the S&P 500 using Sharpe and Treynor measures. Std Deviation 14 12 Beta 0.88 Average Return Portfolio 16 S&P 500 (market 14 Portfolio ) Treasury Bills 6

Assist the fund manager in evaluating the performance of the Portfolio and the S&P 500 using Sharpe and Treynor measures. Based on your calculation, comment on the performance of the Portfolio and the S&P 500 using Sharpe and Treynor measures. Std Deviation 14 12 Beta 0.88 Average Return Portfolio 16 S&P 500 (market 14 Portfolio ) Treasury Bills 6

2a. Amina plans to invest 54% of her savings in a commodity based mutual fund and 46% in an emerging

market based mutual fund. The expected return on the two funds are 16% and 14%, respectively. The

standard deviations are 22% and 18%, respectively. The correlation between the two funds is 0.75. What

would be the expected return and standard deviation for Amina's portfolio?

2b. A fund manager with a leading savings & loan company wants to evaluate a Portfolio consisting of a

mix of blue-chip, defensive and cyclical shares. He has compiled the following useful information for

this purpose.

Assist the fund manager in evaluating the performance of the Portfolio and the S&P 500 using Sharpe

and Treynor measures. Based on your calculation, comment on the performance of the Portfolio and

the S&P 500 using Sharpe and Treynor measures.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started