Question

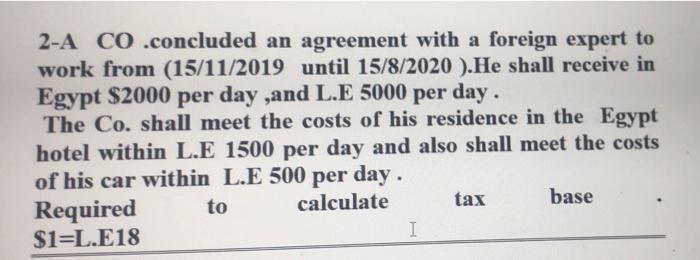

2-A CO .concluded an agreement with a foreign expert to work from (15/11/2019 until 15/8/2020 ).He shall receive in Egypt $2000 per day ,and

2-A CO .concluded an agreement with a foreign expert to work from (15/11/2019 until 15/8/2020 ).He shall receive in Egypt $2000 per day ,and L.E 5000 per day. The Co. shall meet the costs of his residence in the Egypt hotel within L.E 1500 per day and also shall meet the costs of his car within L.E 500 per day. Required $1=L.E18 calculate tax base to I

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Since the question is silent about the relation ship between company and Foreign Expert it is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing and Assurance services an integrated approach

Authors: Alvin a. arens, Randal j. elder, Mark s. Beasley

14th Edition

133081605, 132575957, 9780133081602, 978-0132575959

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App