2a. In the salary-based compensation scheme, what is the company's break-even point in unit sales? 30,000 units 13,044 units 25,000 units 35,000 units 2b.

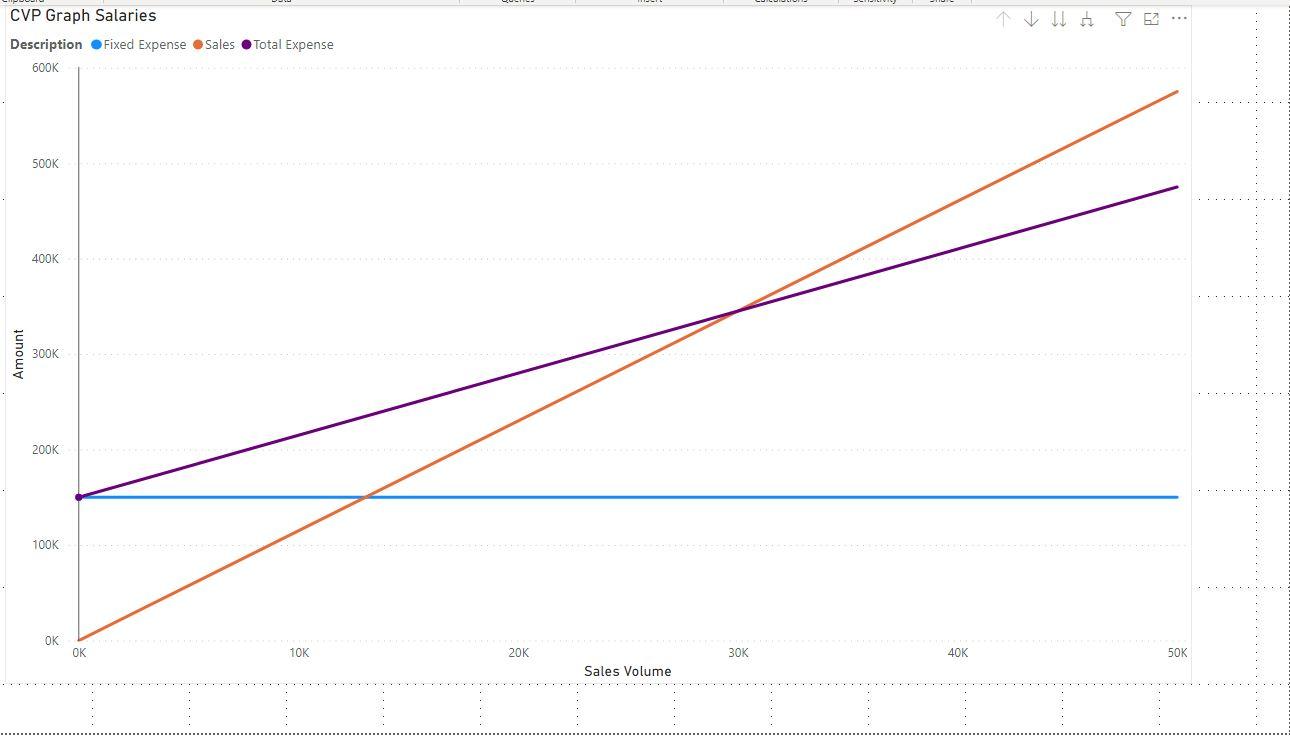

2a. In the salary-based compensation scheme, what is the company's break-even point in unit sales? 30,000 units 13,044 units 25,000 units 35,000 units 2b. When the orange line is above the purple line and the gap between these two lines widens its suggests which of the following is true? The total profit decreases by the contribution margin per unit multiplied by each additional unit sold. The total profit increases by the contribution margin per unit multiplied by each additional unit sold. The total profit increases by the selling price per unit multiplied by each additional unit sold. The total profit decreases by the selling price per unit multiplied by each additional unit sold. 2c. When the orange line is below the purple line and the gap between these two lines widens its suggests which of the following is true? The total loss decreases by the selling price per unit multiplied by the decline in unit sales. The total loss increases by the selling price per unit multiplied by the decline in unit sales. The total loss decreases by the contribution margin per unit multiplied by the decline in unit sales. The total loss increases by the contribution margin per unit multiplied by the decline in unit sales. Amount CVP Graph Salaries Description 600K 500K 400K 300K 200K 100K THAYE Fixed Expense Sales Total Expense OK OK 10K 20K 30K 40K 50K Sales Volume

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the questions well consider basic principles of CostVolumeProfit CVP analysis 2a Breakeven ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started