Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2A Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as

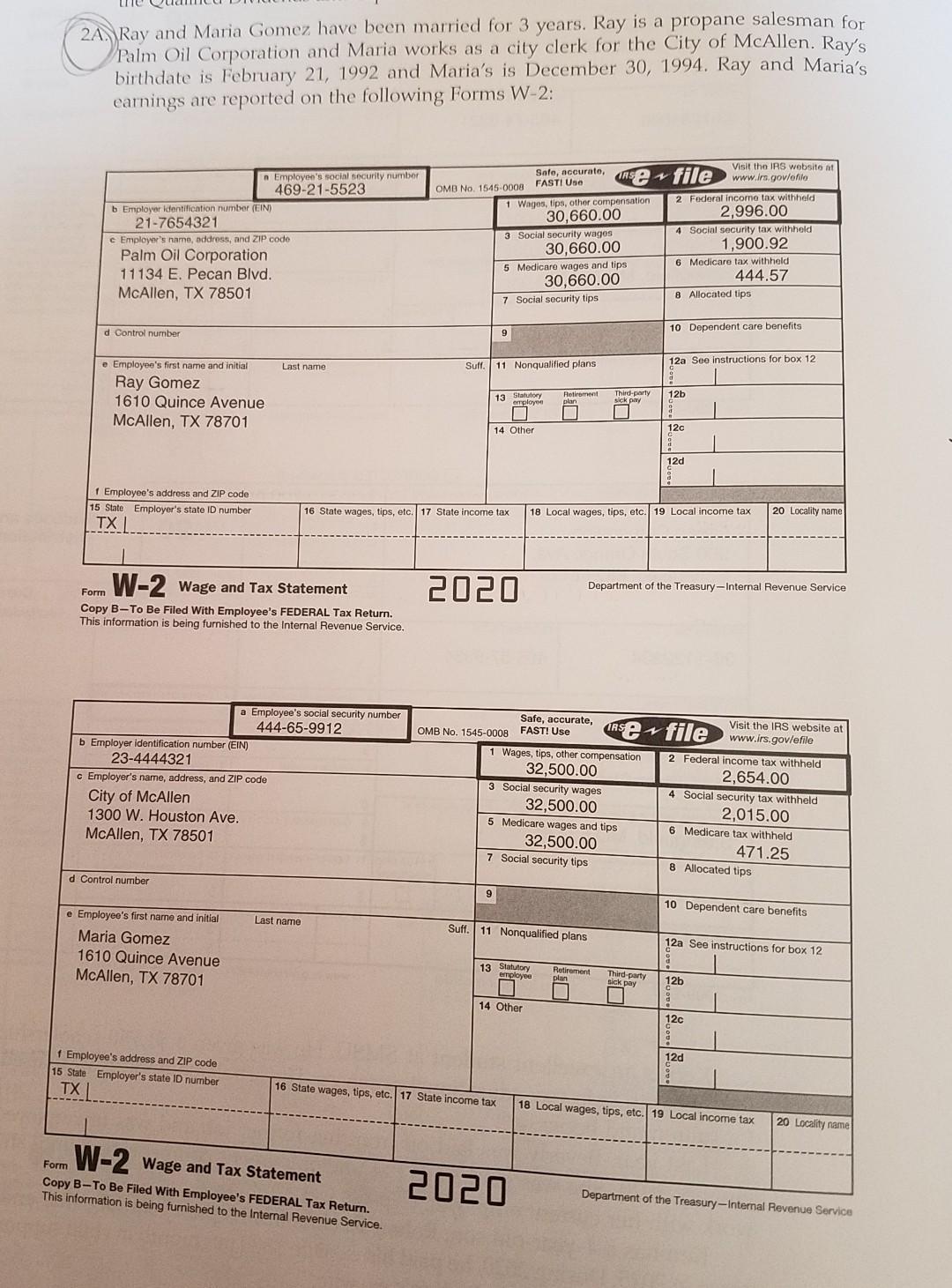

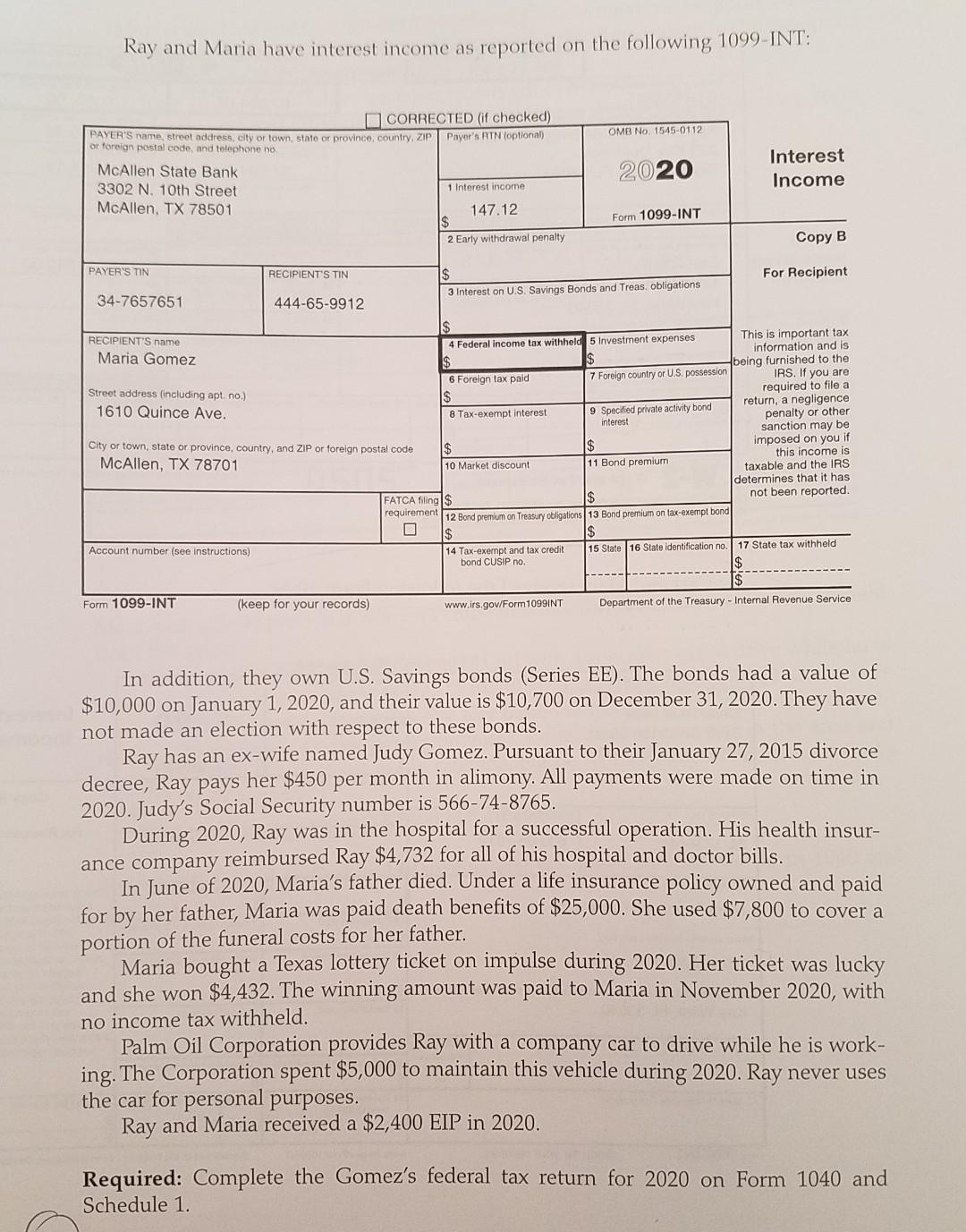

2A Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as a city clerk for the City of McAllen. Ray's birthdate is February 21, 1992 and Maria's is December 30, 1994. Ray and Maria's earnings are reported on the following Forms W-2: b Employer identification number (EIN) 21-7654321 e Employer's name, address, and ZIP code Palm Oil Corporation 11134 E. Pecan Blvd. McAllen, TX 78501 d Control number e Employee's first name and initial Ray Gomez 1610 Quince Avenue McAllen, TX 78701 f Employee's address and ZIP code 15 State Employer's state number TX | In Employee's social security number 469-21-5523 d Control number Form W-2 Wage and Tax Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. b Employer identification number (EIN) 23-4444321 c Employer's name, address, and ZIP code City of McAllen 1300 W. Houston Ave. McAllen, TX 78501 e Employee's first name and initial Maria Gomez 1610 Quince Avenue McAllen, TX 78701 f Employee's address and ZIP code 15 State Employer's state ID number TX | Last name a Employee's social security number 444-65-9912 Last name OMB No. 1545-0008 Suff. W-2 Wage and Tax Statement Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. 16 State wages, tips, etc. 17 State income tax Suff. 1 Wages, tips, other compensation. 30,660.00 3 Social security wages. 30,660.00 5 Medicare wages and tips 30,660.00 7 Social security tips 9 11 Nonqualified plans 9 13 Statutory 14 Other 2020 OMB No. 1545-0008 Safe, accurate, FAST! Use 16 State wages, tips, etc. 17 State income tax Retirement 13 Statutory employee 14 Other Safe, accurate, FAST! Use 11 Nonqualified plans 2020 1 Wages, tips, other compensation 32,500.00 3 Social security wages 32,500.00 5 Medicare wages and tips 32,500.00 7 Social security tips e file Third-party sick pay 1RS Retirement plan 18 Local wages, tips, etc. 19 Local income tax 2 Federal income tax withheld 2,996.00 Third-party sick pay 4 Social security tax withheld 1,900.92 6 Medicare tax withheld 444.57 8 Allocated tips 10 Dependent care benefits 8 12a See instructions for box 12 d 12b 12c Department of the Treasury-Internal Revenue Service 12d Visit the IRS website at www.lrs.gov/efilo N file 20 Locality name 2 Federal income tax withheld 2,654.00 4 Social security tax withheld 2,015.00 Visit the IRS website at www.irs.gov/efile 6 Medicare tax withheld 471.25 8 Allocated tips 12b 10 Dependent care benefits 12c 12a See instructions for box 12 12d 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Department of the Treasury-Internal Revenue Service

Step by Step Solution

★★★★★

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

FORM OF INCOME TAX RETURN IS NOT UPLOADED ANSWER DETAIL THAT NEED TO FILL INTH...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started