Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2a. What is budgeting? What is the importance of preparing a cash budget? 2b. In what financial statement(s) will depreciation appear? Will it be appeared

2a. What is budgeting? What is the importance of preparing a cash budget?

2b. In what financial statement(s) will depreciation appear? Will it be appeared in the cash budget? Please explain.

2c. Prepare Brilliant Resorts cash budget for the months of April, May and June. The ending cash balance on 31 March 2021 is estimated to be $8,600.

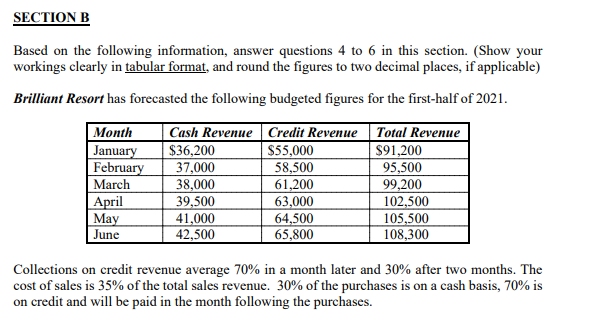

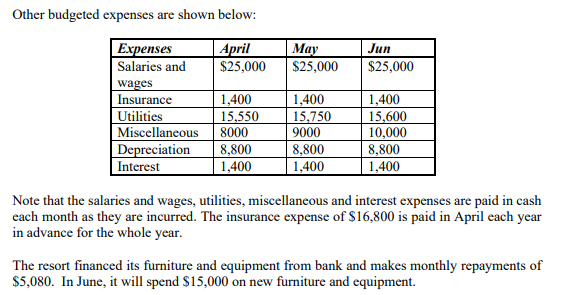

SECTION B Based on the following information, answer questions 4 to 6 in this section. (Show your workings clearly in tabular format, and round the figures to two decimal places, if applicable) Brilliant Resort has forecasted the following budgeted figures for the first-half of 2021. Month Cash Revenue Credit Revenue Total Revenue January $36,200 $55,000 $91,200 February 37,000 58,500 95,500 March 38,000 61,200 99,200 April 39,500 63,000 102,500 May 41,000 64,500 105,500 June 42,500 65,800 108,300 Collections on credit revenue average 70% in a month later and 30% after two months. The cost of sales is 35% of the total sales revenue. 30% of the purchases is on a cash basis, 70% is on credit and will be paid in the month following the purchases. May $25,000 Jun $25,000 Other budgeted expenses are shown below: Expenses April Salaries and $25,000 wages Insurance 1,400 Utilities 15,550 Miscellaneous 8000 Depreciation 8,800 Interest 1,400 1,400 15.750 9000 8,800 1,400 1,400 15,600 10,000 8,800 1,400 Note that the salaries and wages, utilities, miscellaneous and interest expenses are paid in cash each month as they are incurred. The insurance expense of $16,800 is paid in April each year in advance for the whole year. The resort financed its furniture and equipment from bank and makes monthly repayments of $5,080. In June, it will spend $15,000 on new furniture and equipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started