Answered step by step

Verified Expert Solution

Question

1 Approved Answer

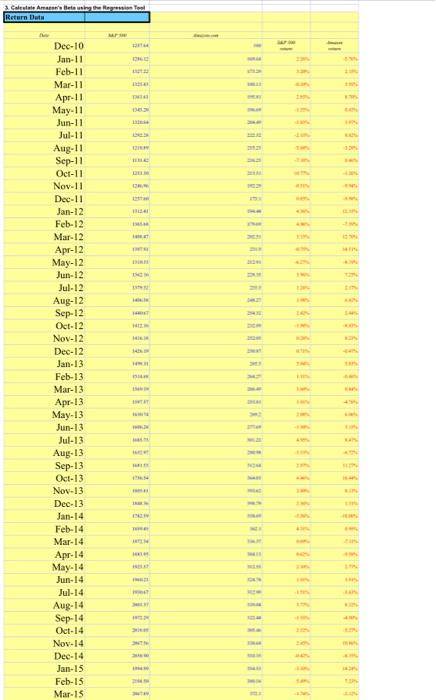

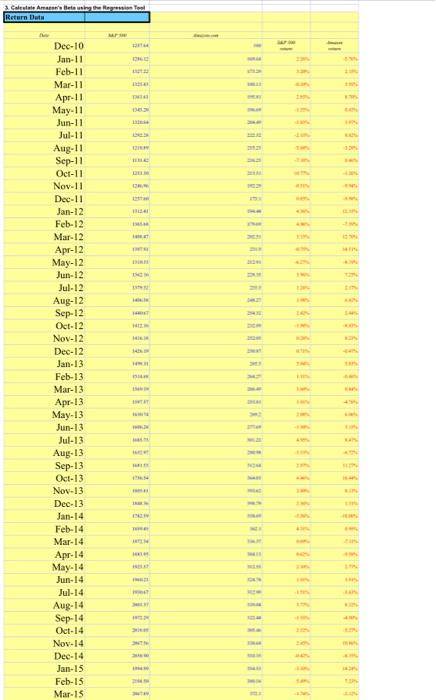

2.Beta1.23Market E(R)10.90%Risk-free return3.60%Output area:Stock E(R)3. Calculate Amazon's Beta using the Regression ToolReturn DataDateS&P 500Amazon.comDec-101257.64180S&P 500 returnAmazon returnJan-111286.12169.642.26%-5.76%Feb-111327.22173.293.20%2.15%Mar-111325.83180.13-0.10%3.95%Apr-111363.61195.812.85%8.70%May-111345.20196.69-1.35%0.45%Jun-111320.64204.49-1.83%3.97%Jul-111292.28222.52-2.15%8.82%Aug-111218.89215.23-5.68%-3.28%Sep-111131.42216.23-7.18%0.46%Oct-111253.30213.5110.77%-1.26%Nov-111246.96192.29-0.51%-9.94%Dec-111257.60173.10.85%-9.98%Jan-121312.41194.444.36%12.33%Feb-121365.68179.694.06%-7.59%Mar-121408.47202.513.13%12.70%Apr-121397.91231.9-0.75%14.51%May-121310.33212.91-6.27%-8.19%Jun-121362.16228.353.96%7.25%Jul-121379.32233.31.26%2.17%Aug-121406.58248.271.98%6.42%Sep-121440.67254.322.42%2.44%Oct-121412.16232.89-1.98%-8.43%Nov-121416.18252.050.28%8.23%Dec-121426.19250.870.71%-0.47%Jan-131498.11265.55.04%5.83%Feb-131514.68264.271.11%-0.46%Mar-131569.19266.493.60%0.84%Apr-131597.57253.811.81%-4.76%May-131630.74269.22.08%6.06%Jun-131606.28277.69-1.50%3.15%Jul-131685.73301.224.95%8.47%Aug-131632.97280.98-3.13%-6.72%Sep-131681.55312.642.97%11.27%Oct-131756.54364.034.46%16.44%Nov-131805.81393.622.80%8.13%Dec-131848.36398.792.36%1.31%Jan-141782.59358.69-3.56%-10.06%Feb-141859.45362.14.31%0.95%Mar-141872.34336.370.69%-7.11%Apr-141883.95304.130.62%-9.58%May-141923.57312.552.10%2.77%Jun-141960.23324.781.91%3.91%Jul-141930.67312.99-1.51%-3.63%Aug-142003.37339.043.77%8.32%Sep-141972.29322.44-1.55%-4.90%Oct-142018.05305.462.32%-5.27%Nov-142067.56338.642.45%10.86%Dec-142058.90310.35-0.42%-8.35%Jan-151994.99354.53-3.10%14.24%Feb-152104.50380.165.49%7.23%Mar-152067.89372.1-1.74%-2.12%Apr-152085.51421.780.85%13.35%May-152107.39429.231.05%1.77%Jun-152063.11434.09-2.10%1.13%Jul-152103.84536.151.97%23.51%Aug-151972.18512.89-6.26%-4.34%Sep-151920.03511.89-2.64%-0.19%Oct-152079.36625.98.30%22.27%Nov-152080.41664.80.05%6.22%Dec-152043.94675.89-1.75%1.67% II 1 is

2.Beta1.23Market E(R)10.90%Risk-free return3.60%Output area:Stock E(R)3. Calculate Amazon's Beta using the Regression ToolReturn DataDateS&P 500Amazon.comDec-101257.64180S&P 500

returnAmazon

returnJan-111286.12169.642.26%-5.76%Feb-111327.22173.293.20%2.15%Mar-111325.83180.13-0.10%3.95%Apr-111363.61195.812.85%8.70%May-111345.20196.69-1.35%0.45%Jun-111320.64204.49-1.83%3.97%Jul-111292.28222.52-2.15%8.82%Aug-111218.89215.23-5.68%-3.28%Sep-111131.42216.23-7.18%0.46%Oct-111253.30213.5110.77%-1.26%Nov-111246.96192.29-0.51%-9.94%Dec-111257.60173.10.85%-9.98%Jan-121312.41194.444.36%12.33%Feb-121365.68179.694.06%-7.59%Mar-121408.47202.513.13%12.70%Apr-121397.91231.9-0.75%14.51%May-121310.33212.91-6.27%-8.19%Jun-121362.16228.353.96%7.25%Jul-121379.32233.31.26%2.17%Aug-121406.58248.271.98%6.42%Sep-121440.67254.322.42%2.44%Oct-121412.16232.89-1.98%-8.43%Nov-121416.18252.050.28%8.23%Dec-121426.19250.870.71%-0.47%Jan-131498.11265.55.04%5.83%Feb-131514.68264.271.11%-0.46%Mar-131569.19266.493.60%0.84%Apr-131597.57253.811.81%-4.76%May-131630.74269.22.08%6.06%Jun-131606.28277.69-1.50%3.15%Jul-131685.73301.224.95%8.47%Aug-131632.97280.98-3.13%-6.72%Sep-131681.55312.642.97%11.27%Oct-131756.54364.034.46%16.44%Nov-131805.81393.622.80%8.13%Dec-131848.36398.792.36%1.31%Jan-141782.59358.69-3.56%-10.06%Feb-141859.45362.14.31%0.95%Mar-141872.34336.370.69%-7.11%Apr-141883.95304.130.62%-9.58%May-141923.57312.552.10%2.77%Jun-141960.23324.781.91%3.91%Jul-141930.67312.99-1.51%-3.63%Aug-142003.37339.043.77%8.32%Sep-141972.29322.44-1.55%-4.90%Oct-142018.05305.462.32%-5.27%Nov-142067.56338.642.45%10.86%Dec-142058.90310.35-0.42%-8.35%Jan-151994.99354.53-3.10%14.24%Feb-152104.50380.165.49%7.23%Mar-152067.89372.1-1.74%-2.12%Apr-152085.51421.780.85%13.35%May-152107.39429.231.05%1.77%Jun-152063.11434.09-2.10%1.13%Jul-152103.84536.151.97%23.51%Aug-151972.18512.89-6.26%-4.34%Sep-151920.03511.89-2.64%-0.19%Oct-152079.36625.98.30%22.27%Nov-152080.41664.80.05%6.22%Dec-152043.94675.89-1.75%1.67%

II 1 is returnAmazon

returnJan-111286.12169.642.26%-5.76%Feb-111327.22173.293.20%2.15%Mar-111325.83180.13-0.10%3.95%Apr-111363.61195.812.85%8.70%May-111345.20196.69-1.35%0.45%Jun-111320.64204.49-1.83%3.97%Jul-111292.28222.52-2.15%8.82%Aug-111218.89215.23-5.68%-3.28%Sep-111131.42216.23-7.18%0.46%Oct-111253.30213.5110.77%-1.26%Nov-111246.96192.29-0.51%-9.94%Dec-111257.60173.10.85%-9.98%Jan-121312.41194.444.36%12.33%Feb-121365.68179.694.06%-7.59%Mar-121408.47202.513.13%12.70%Apr-121397.91231.9-0.75%14.51%May-121310.33212.91-6.27%-8.19%Jun-121362.16228.353.96%7.25%Jul-121379.32233.31.26%2.17%Aug-121406.58248.271.98%6.42%Sep-121440.67254.322.42%2.44%Oct-121412.16232.89-1.98%-8.43%Nov-121416.18252.050.28%8.23%Dec-121426.19250.870.71%-0.47%Jan-131498.11265.55.04%5.83%Feb-131514.68264.271.11%-0.46%Mar-131569.19266.493.60%0.84%Apr-131597.57253.811.81%-4.76%May-131630.74269.22.08%6.06%Jun-131606.28277.69-1.50%3.15%Jul-131685.73301.224.95%8.47%Aug-131632.97280.98-3.13%-6.72%Sep-131681.55312.642.97%11.27%Oct-131756.54364.034.46%16.44%Nov-131805.81393.622.80%8.13%Dec-131848.36398.792.36%1.31%Jan-141782.59358.69-3.56%-10.06%Feb-141859.45362.14.31%0.95%Mar-141872.34336.370.69%-7.11%Apr-141883.95304.130.62%-9.58%May-141923.57312.552.10%2.77%Jun-141960.23324.781.91%3.91%Jul-141930.67312.99-1.51%-3.63%Aug-142003.37339.043.77%8.32%Sep-141972.29322.44-1.55%-4.90%Oct-142018.05305.462.32%-5.27%Nov-142067.56338.642.45%10.86%Dec-142058.90310.35-0.42%-8.35%Jan-151994.99354.53-3.10%14.24%Feb-152104.50380.165.49%7.23%Mar-152067.89372.1-1.74%-2.12%Apr-152085.51421.780.85%13.35%May-152107.39429.231.05%1.77%Jun-152063.11434.09-2.10%1.13%Jul-152103.84536.151.97%23.51%Aug-151972.18512.89-6.26%-4.34%Sep-151920.03511.89-2.64%-0.19%Oct-152079.36625.98.30%22.27%Nov-152080.41664.80.05%6.22%Dec-152043.94675.89-1.75%1.67%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started