Answered step by step

Verified Expert Solution

Question

1 Approved Answer

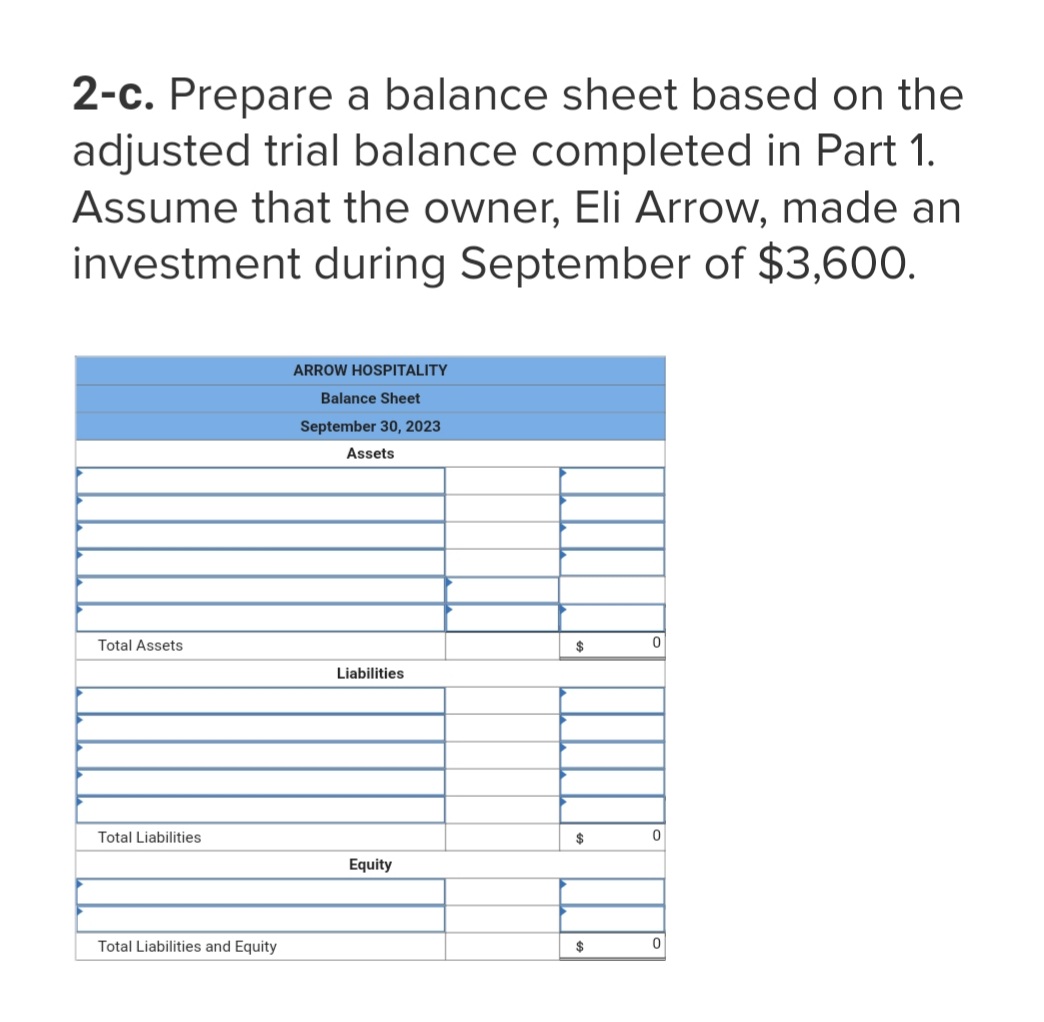

2-c. Prepare a balance sheet based on the adjusted trial balance completed in Part 1. Assume that the owner, Eli Arrow, made an investment

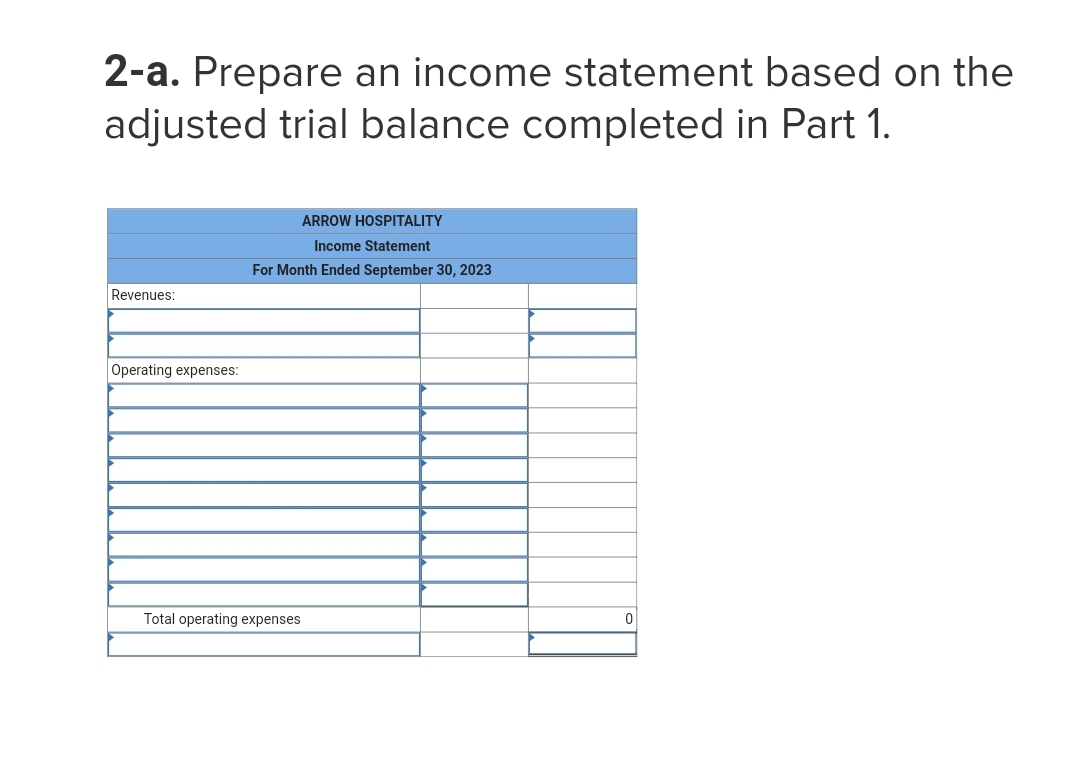

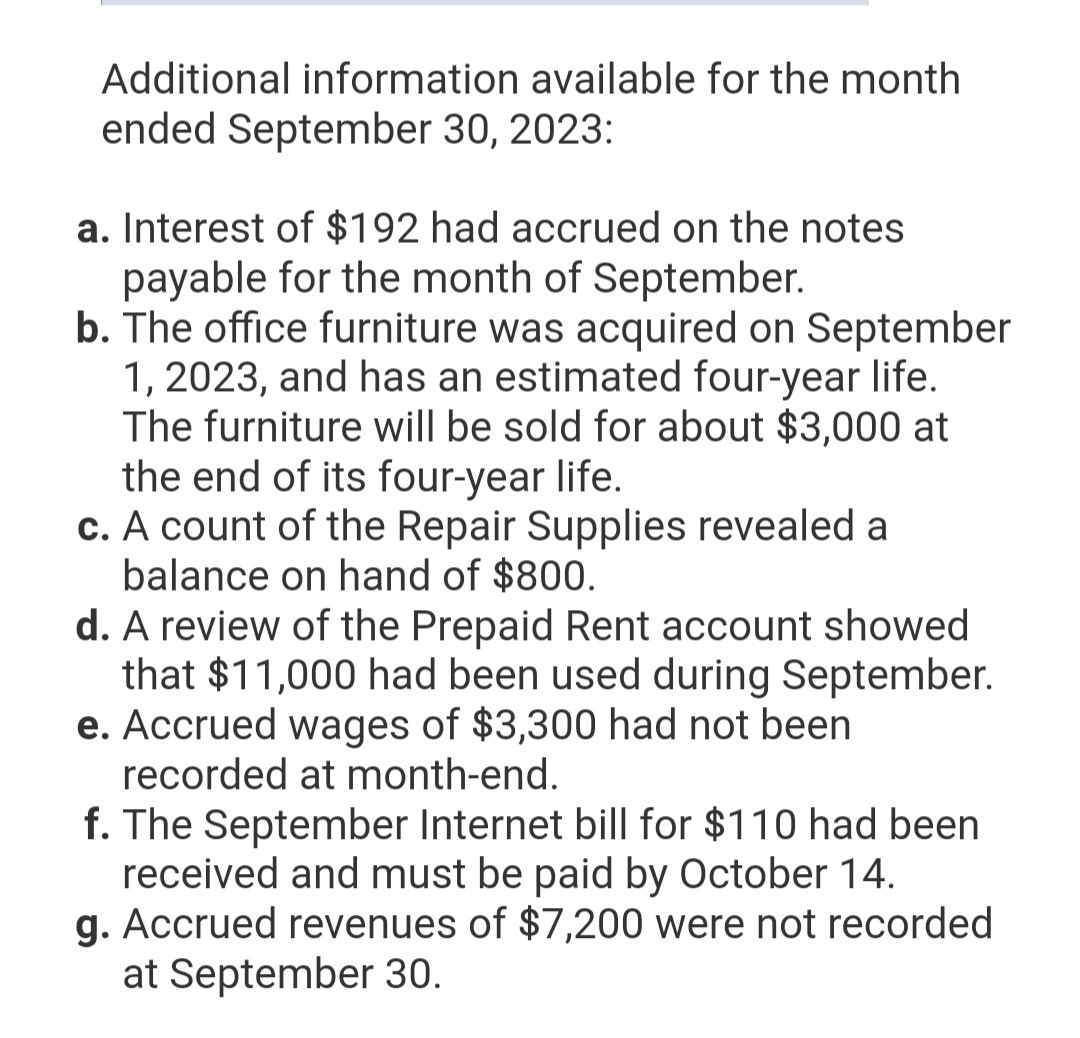

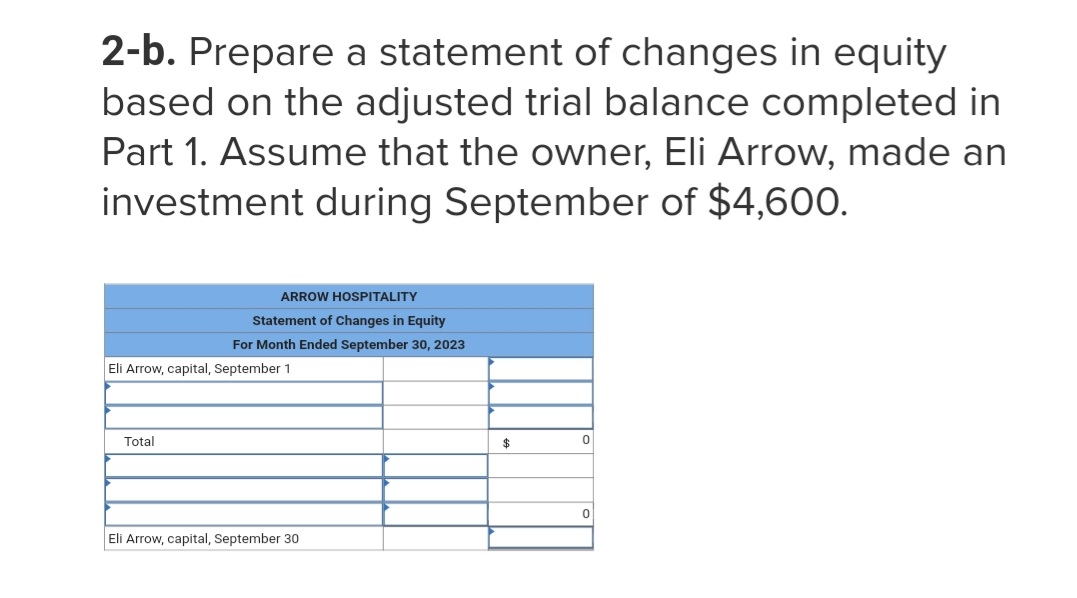

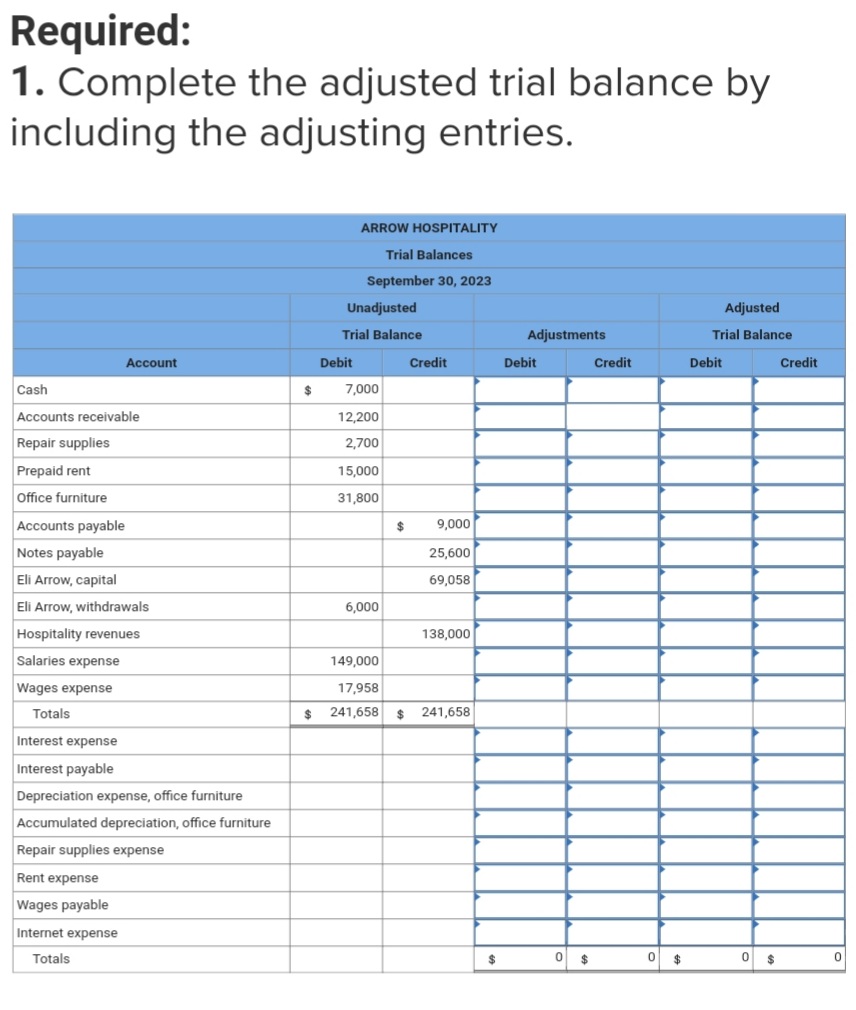

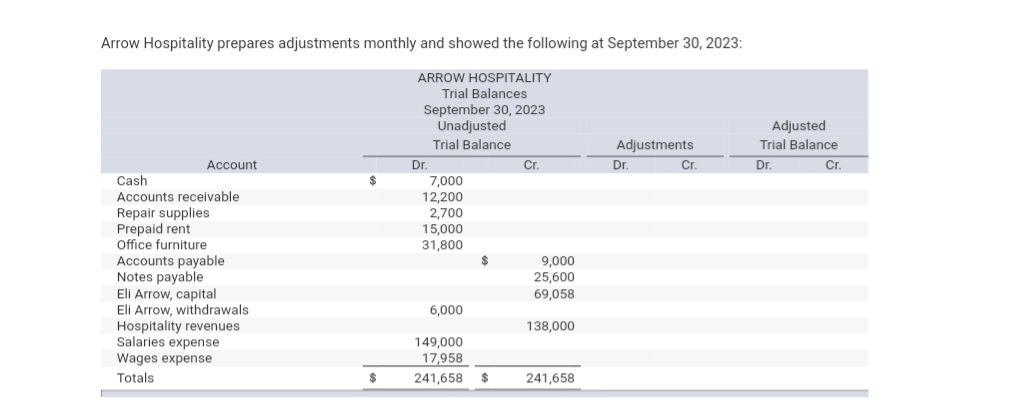

2-c. Prepare a balance sheet based on the adjusted trial balance completed in Part 1. Assume that the owner, Eli Arrow, made an investment during September of $3,600. ARROW HOSPITALITY Balance Sheet September 30, 2023 Assets Total Assets $ 0 Liabilities Total Liabilities Total Liabilities and Equity $ 0 Equity $ 0 2-a. Prepare an income statement based on the adjusted trial balance completed in Part 1. Revenues: ARROW HOSPITALITY Income Statement For Month Ended September 30, 2023 Operating expenses: Total operating expenses 0 Additional information available for the month ended September 30, 2023: a. Interest of $192 had accrued on the notes payable for the month of September. b. The office furniture was acquired on September 1, 2023, and has an estimated four-year life. The furniture will be sold for about $3,000 at the end of its four-year life. c. A count of the Repair Supplies revealed a balance on hand of $800. d. A review of the Prepaid Rent account showed that $11,000 had been used during September. e. Accrued wages of $3,300 had not been recorded at month-end. f. The September Internet bill for $110 had been received and must be paid by October 14. g. Accrued revenues of $7,200 were not recorded at September 30. 2-b. Prepare a statement of changes in equity based on the adjusted trial balance completed in Part 1. Assume that the owner, Eli Arrow, made an investment during September of $4,600. ARROW HOSPITALITY Statement of Changes in Equity For Month Ended September 30, 2023 Eli Arrow, capital, September 1 Total Eli Arrow, capital, September 30 $ 0 0 Required: 1. Complete the adjusted trial balance by including the adjusting entries. ARROW HOSPITALITY Trial Balances September 30, 2023 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Debit Credit Debit Credit Debit Credit $ 7,000 12,200 2,700 15,000 31,800 Cash Accounts receivable Repair supplies Prepaid rent Office furniture Accounts payable $ 9,000 Notes payable 25,600 Eli Arrow, capital 69,058 Eli Arrow, withdrawals 6,000 Hospitality revenues 138,000 Salaries expense Wages expense 149,000 17,958 Totals Interest expense $ 241,658 $ 241,658 Interest payable Depreciation expense, office furniture Accumulated depreciation, office furniture Repair supplies expense Rent expense Wages payable Internet expense Totals $ 0 $ 0 $ 0 $ 0 Arrow Hospitality prepares adjustments monthly and showed the following at September 30, 2023: ARROW HOSPITALITY Trial Balances September 30, 2023 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Cr. Dr. Cr. Dr. Cr. Account Dr. Cash 7,000 Accounts receivable 12,200 Repair supplies 2,700 Prepaid rent 15,000 Office furniture 31,800 Accounts payable 9,000 Notes payable 25,600 Eli Arrow, capital 69,058 Eli Arrow, withdrawals 6,000 Hospitality revenues 138,000 Salaries expense 149,000 Wages expense 17,958 Totals 241,658 $ 241,658

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started