Answered step by step

Verified Expert Solution

Question

1 Approved Answer

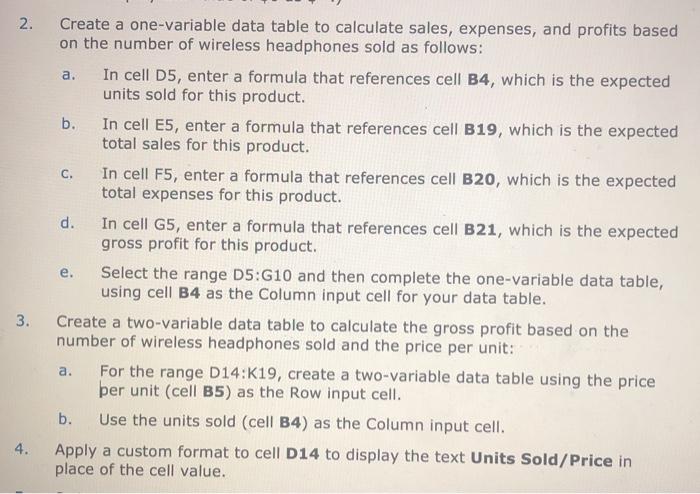

Create a one-variable data table to calculate sales, expenses, and profits based on the number of wireless headphones sold as follows: 2. In cell

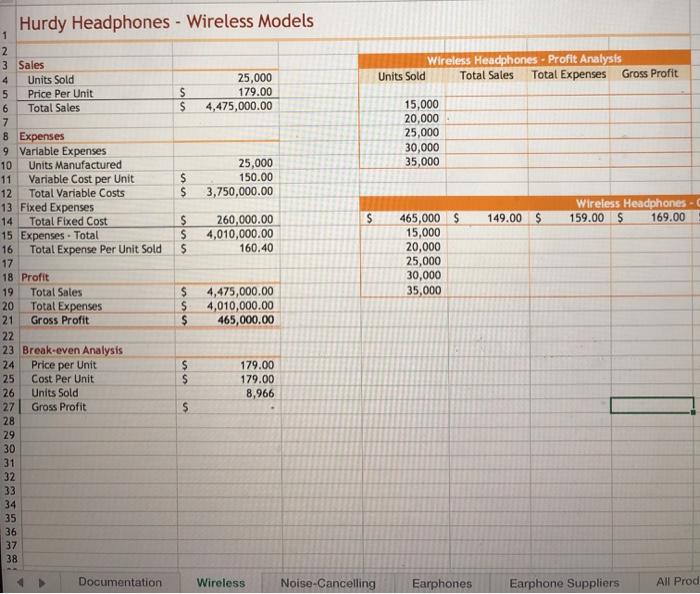

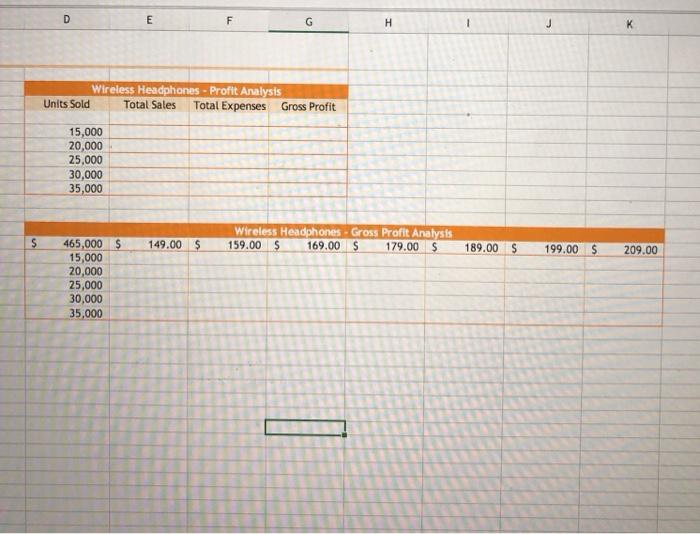

Create a one-variable data table to calculate sales, expenses, and profits based on the number of wireless headphones sold as follows: 2. In cell D5, enter a formula that references cell B4, which is the expected units sold for this product. a. In cell E5, enter a formula that references cell B19, which is the expected total sales for this product. b. In cell F5, enter a formula that references cell B20, which is the expected total expenses for this product. C. In cell G5, enter a formula that references cell B21, which is the expected gross profit for this product. d. Select the range D5:G10 and then complete the one-variable data table, using cell B4 as the Column input cell for your data table. . Create a two-variable data table to calculate the gross profit based on the number of wireless headphones sold and the price per unit: 3. For the range D14:K19, create a two-variable data table using the price er unit (cell B5) as the Row input cell. a. b. Use the units sold (cell B4) as the Column input cell. 4. Apply a custom format to cell D14 to display the text Units Sold/Price in place of the cell value. Hurdy Headphones Wireless Models 3 Sales Units Sold Wireless Headphones - Profit Analysis Total Expenses Units Sold Total Sales Gross Profit 25,000 179.00 4,475,000.00 4 Price Per Unit Total Sales 7. 8 Expenses 9 Variable Expenses Units Manufactured Variable Cost per Unit 15,000 20,000 25,000 30,000 35,000 6 25,000 150.00 3,750,000.00 10 11 Total Variable Costs 13 Fixed Expenses Total Fixed Cost 15 Expenses Total Total Expense Per Unit Sold 17 12 Wireless Headphones - 0 159.00 $ 149.00 $ 169.00 260,000.00 4,010,000.00 160.40 465,000 $ 15,000 20,000 25,000 30,000 35,000 14 16 18 Profit 4,475,000.00 4,010,000.00 465,000.00 19 Total Sales %24 20 Total Expenses 21 Gross Profit 22 23 Break-even Analysis Price per Unit Cost Per Unit 24 179.00 25 179.00 26 Units Sold Gross Profit 8,966 27 28 29 30 31 32 33 34 35 36 37 38 Documentation Wireless Noise-Cancelling Earphones Earphone Suppliers All Prod 24 E F G K. Wireless Headphones - Profit Analysis Units Sold Total Sales Total Expenses Gross Profit 15,000 20,000 25,000 30,000 35,000 Wireless Headphones - Gross Profit Analysis 169.00 $ 465,000 $ 15,000 20,000 25,000 30,000 35,000 149.00 $ 159.00 $ 179.00 $ 189.00 $ 199.00 $ 209.00

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Steps to solve Ques 2 Link Cell D5 to B4 cell E5 to B19 F5 t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started