Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2nd question what is the npv of the project drom the parent's company's perspective? 3rd ques. what is the correct course of action for the

2nd question what is the npv of the project drom the parent's company's perspective?

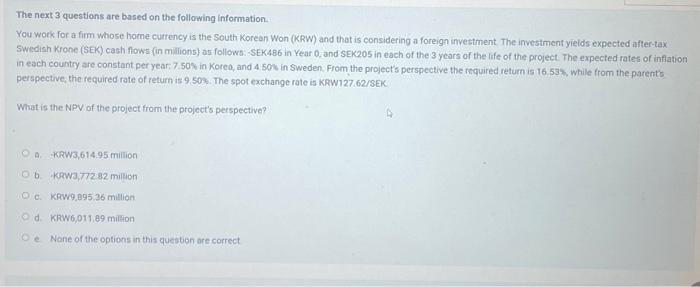

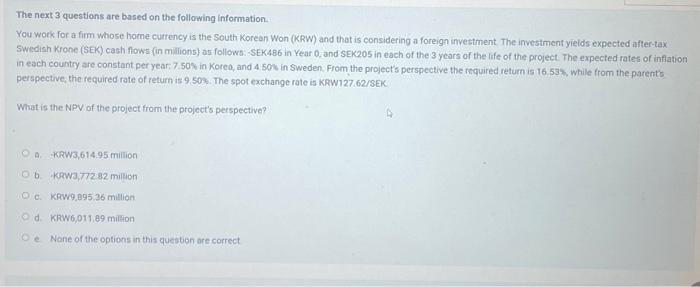

The next 3 questions are based on the following information. You wock for a firm whose home cuirency is the South Korean won (KRW) and that is considering a foreign investment. The investment yieids expected after-tax SWedish Krone (SEK) cach flows (in millions) as follows:-SEK486 in Year 0,and SEK205 in each of the 3 years of the life of the project: The expected rates of inflation in each country are constant per year. 7.50% in Korea, and 4.50% in Sweden. From the projects perspective the required return is 16.53% while from the parents perspective, the required rate of return is 9.50%. The spot exchange rate is KRW127. 62/SEK. What is the NPV of the groject from the project's perspective? a. KRW3,614.95 milion b. kRW3 77282 milion c. KRW9.895.36 milion d. KRW6,011, 89 mieson 1e. Nane of the options in this question are correct 3rd ques. what is the correct course of action for the manager of the firm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started