Answered step by step

Verified Expert Solution

Question

1 Approved Answer

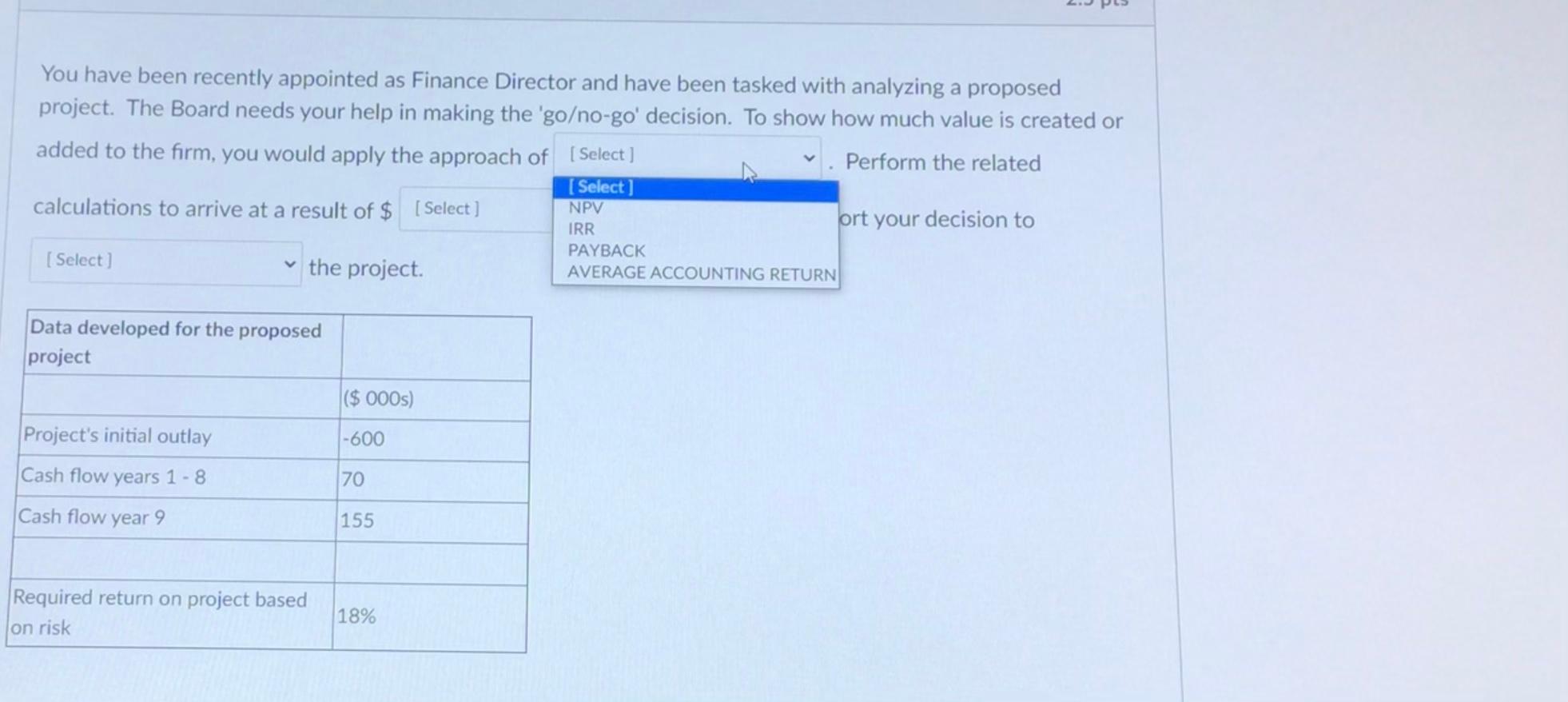

2nd slot drop down options) 280,000, -259,625, -279,625 3rd slot drop down options) be indifferent on the project, reject the project, approve the project You

2nd slot drop down options) 280,000, -259,625, -279,625

2nd slot drop down options) 280,000, -259,625, -279,625

3rd slot drop down options) be indifferent on the project, reject the project, approve the project

You have been recently appointed as Finance Director and have been tasked with analyzing a proposed project. The Board needs your help in making the 'goo-go' decision. To show how much value is created or added to the firm, you would apply the approach of (Select ] Perform the related [ Select ] calculations to arrive at a result of $ (Select] ort your decision to PAYBACK [ Select) the project AVERAGE ACCOUNTING RETURN NPV IRR Data developed for the proposed project ($ 000s) Project's initial outlay -600 Cash flow years 1-8 70 Cash flow year 9 155 Required return on project based 18% on riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started