Answered step by step

Verified Expert Solution

Question

1 Approved Answer

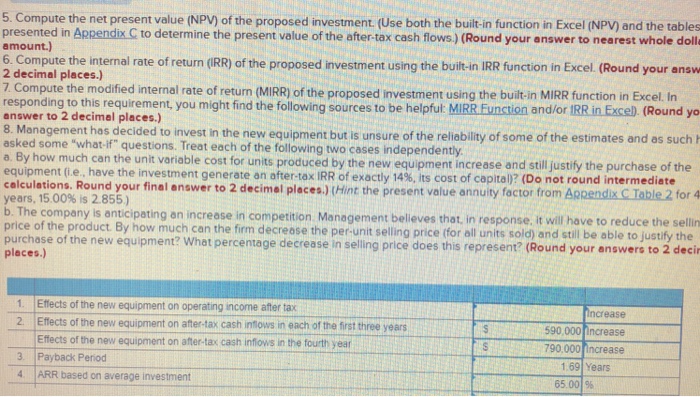

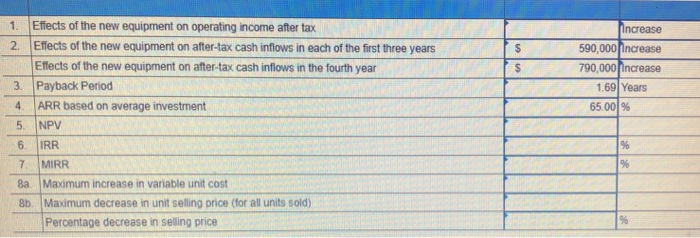

2Please answer question 5-8b. Rob Roy Corporation has been using its present facilities at its annual full capacity of 10,000 units for the last 3

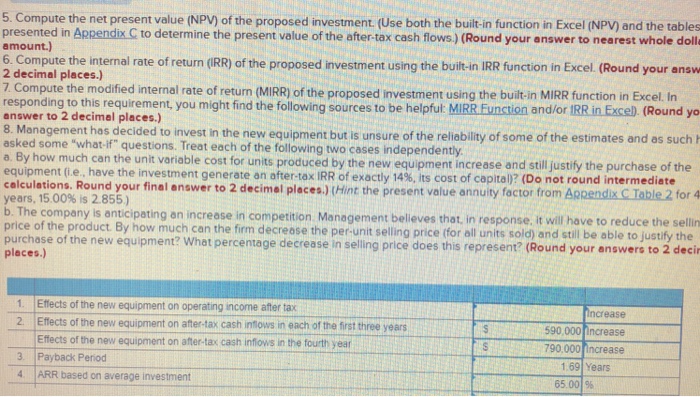

2Please answer question 5-8b.

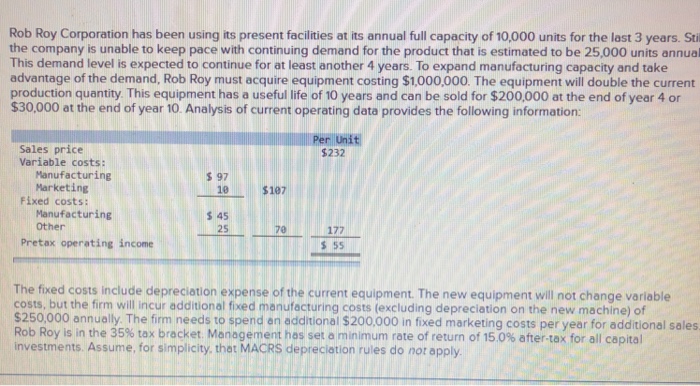

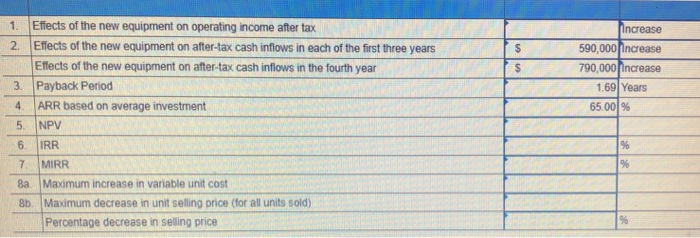

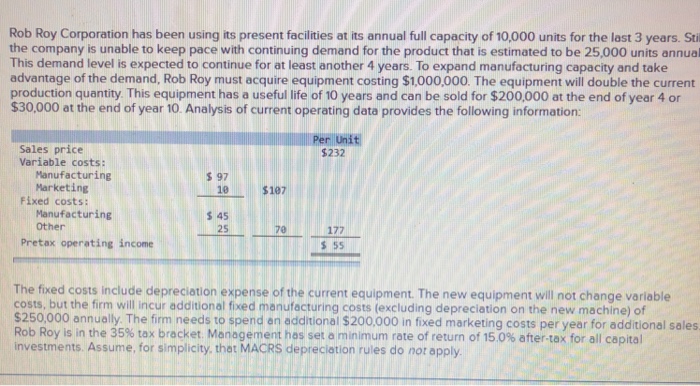

Rob Roy Corporation has been using its present facilities at its annual full capacity of 10,000 units for the last 3 years. Sti the company is unable to keep pace with continuing demand for the product that is estimated to be 25,000 units annual This demand level is expected to continue for at least another 4 years. To expand manufacturing capacity and take advantage of the demand, Rob Roy must acquire equipment costing $1,000,000. The equipment will double the current production quantity This equipment has a useful life of 10 years and can be sold for $200,000 at the end of year 4 or $30,000 at the end of year 10. Analysis of current operating data provides the following information: Sales price Variable costs: Per Unit $232 Manufacturing Marketing s 97 10 s 45 $107 Fixed costs: Manufacturing 25177 s 55 Pretax operating income The fixed costs include depreciation expense of the current equipment. The new equipment will not change variable costs, but the firm will incur additional fixed manufacturing costs (excluding depreciation on the new machine) of $250,000 annually. The firm needs to spend an additional $200,000 in fixed marketing costs per year for additional sales Rob Roy is in the 35% tax bracket Management has set a minimum rate of return of 150% after-tax for all capital investments. Assume, for simplicity, that MACRS depreciation rules do not apply

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started