Question

2What is the geometric average weekly return for the S&P 500? 3What is the annualized return for the S&P 500 (EAR)? 4Calculate the weekly returns.

2)What is the geometric average weekly return for the S&P 500?

3)What is the annualized return for the S&P 500 (EAR)?

4)Calculate the weekly returns. What is standard deviation of weekly returns for the S&P 500?5)What is the beta of the stock?

6)Assume the risk-free rate (Treasury bill yield) is 2%. What is the annualized Sharpe ratio of the stock?Hint: Use the annualized return and standard deviation. The variance of returns over N weeks is N times the weekly variance. The standard deviation of returns over N weeks is N^0.5 times the weekly standard deviation.

7)For all remaining parts, create a portfolio of 80% stock and 20% S&P 500. If you rebalanced such a portfolio every week to keep the weights at 0.8/0.2, what is the holding period return over the 10 weeks for the portfolio?

8)What is the standard deviation of weekly returns for such a portfolio if you rebalanced every week?

9) What is the beta of such a portfolio if you rebalanced every week?

10) Still assume that you create a portfolio of 80% stock and 20% S&P 500. However, after the initial allocation, you do not rebalance the portfolio at all. What is the holding period return over the 10 weeks for the portfolio?

11)What is the standard deviation of weekly returns for such a portfolio if you do not rebalance at all?

12)What is the beta of such a portfolio if you do not rebalance at all?

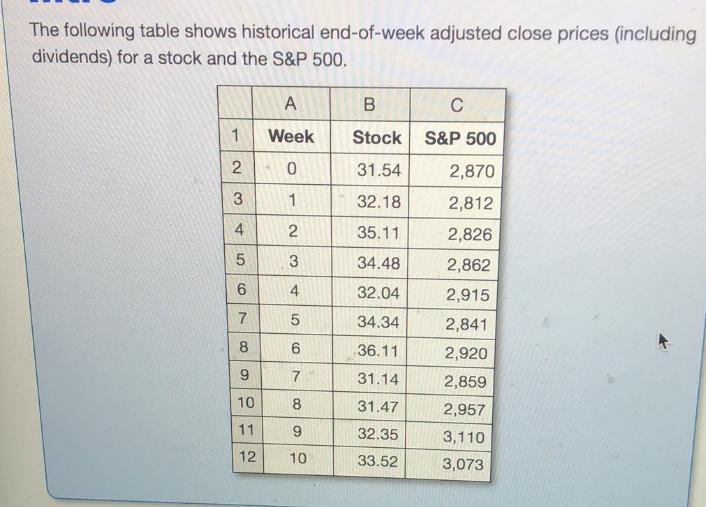

The following table shows historical end-of-week adjusted close prices (including dividends) for a stock and the S&P 500. 1 2 3 4 5 6 7 8 9 10 11 12 A Week 0 1 2 3 4 5 6 7 8 9 10 B Stock 31.54 132.18 35.11 34.48 32.04 34.34 36.11 31.14 31.47 32.35 33.52 C S&P 500 2,870 2,812 2,826 2,862 2,915 2,841 2,920 2,859 2,957 3,110 3,073

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION He re are the answers to the questions youve provided 1 The geometric average weekly return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started