Question

2-year SOFR/Tsy spread update 1. Calculate the net profit or loss on the 2-year SOFR/Tsy spread trade over the past week, using prices as of

2-year SOFR/Tsy spread update

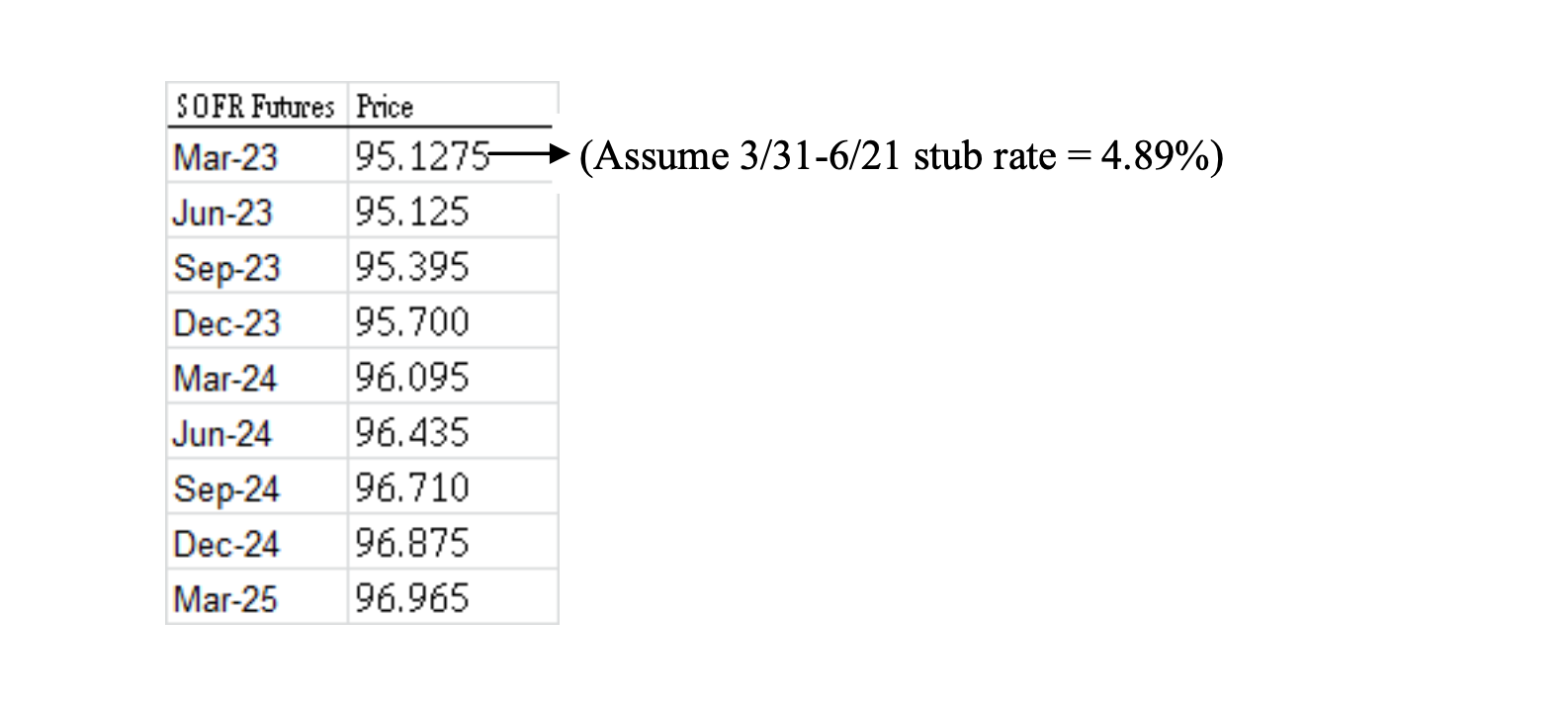

1. Calculate the net profit or loss on the 2-year SOFR/Tsy spread trade over the past week, using prices as of Friday, March 31. Include in your profit calculation the coupon income earned on the 2-year Treasury net of the cost of financing the position over a one week (7 day) period. SOFR futures prices as of March 31 are as follows:

4-5/8% of 2/25: Full price: 101.35504

1-week repo (7 days): 4.9% (you can use this to calculate financing cost on the Treasury)

2. Recalculate your SOFR futures hedge as of March 31 and update the SOFR/Tsy Futures spread table distributed last week.

SOFR Futures Price Mar-23 95.1275 (Assume 3/31-6/21 stub rate = 4.89%) Jun-23 95.125 Sep-23 95.395 Dec-23 95.700 Mar-24 96.095 Jun-24 96.435 Sep-24 96.710 Dec-24 96.875 Mar-25 96.965

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Anwers To calculate the net profit or loss on the 2year SOFRTsy spread trade over the past week we need to consider the following 1 The cost of financing the position This can be calculated by multipl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started