Answered step by step

Verified Expert Solution

Question

1 Approved Answer

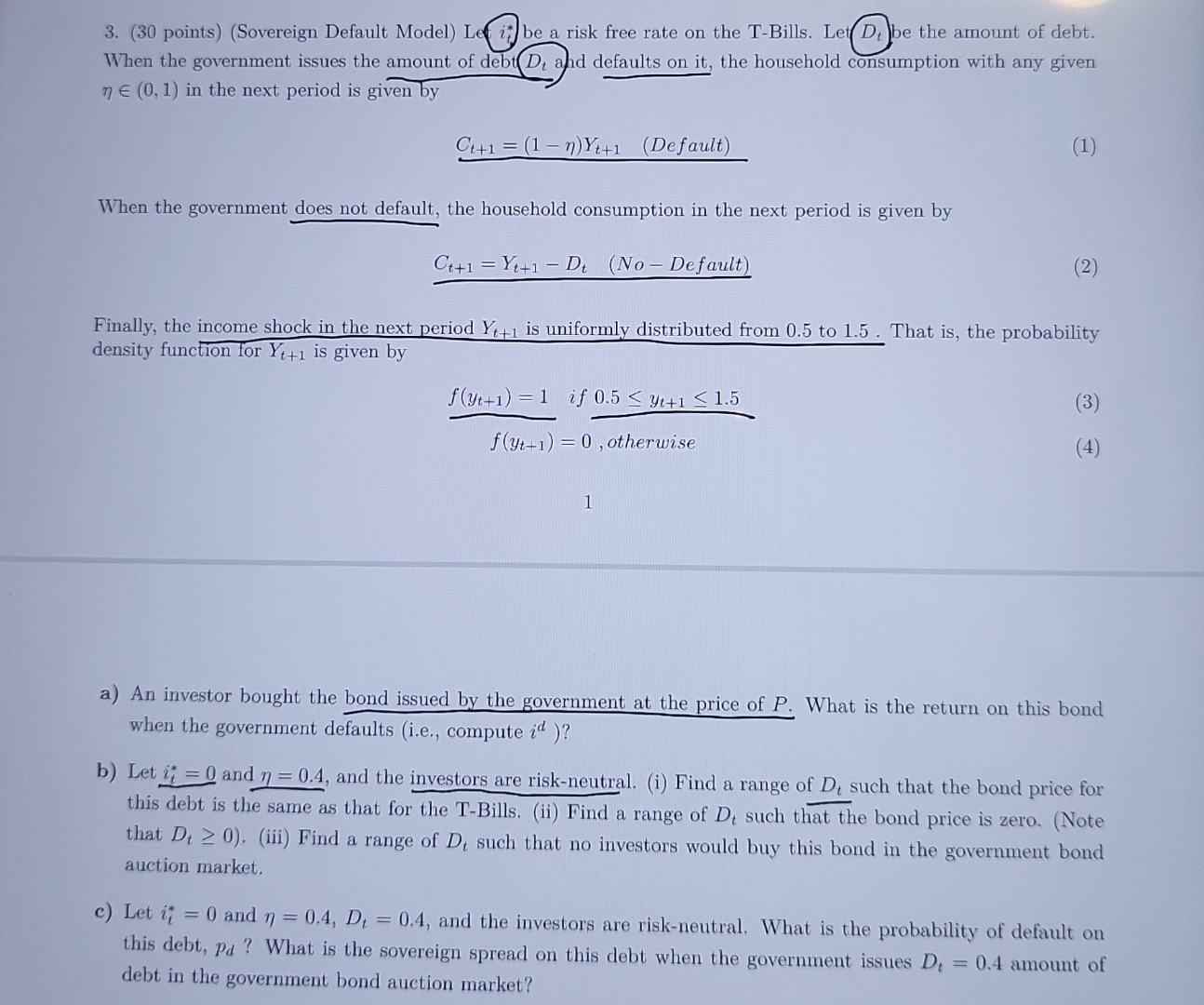

( 3 0 points ) ( Sovereign Default Model ) Le i t * * be a risk free rate on the T - Bills.

pointsSovereign Default Model Le be a risk free rate on the TBills. Let be the amount of debt. When the government issues the amount of debt ahd defaults on it the household consumption with any given in the next period is given by

Default

When the government does not default, the household consumption in the next period is given by

Default

Finally, the income shock in the next period is uniformly distributed from to That is the probability density function for is given by

otherwise

a An investor bought the bond issued by the government at the price of What is the return on this bond when the government defaults ie compute

b Let and and the investors are riskneutral. i Find a range of such that the bond price for this debt is the same as that for the TBills. ii Find a range of such that the bond price is zero. Note that iii Find a range of such that no investors would buy this bond in the government bond auction market.

c Let and and the investors are riskneutral. What is the probability of default on this debt, What is the sovereign spread on this debt when the government issues amount of debt in the government bond auction market?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started