Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 1. Bond Valuation & Refunding (a) Britterby Ltd has an outstanding perpetual bond with a 7 percent coupon rate. The bonds make semi-annual

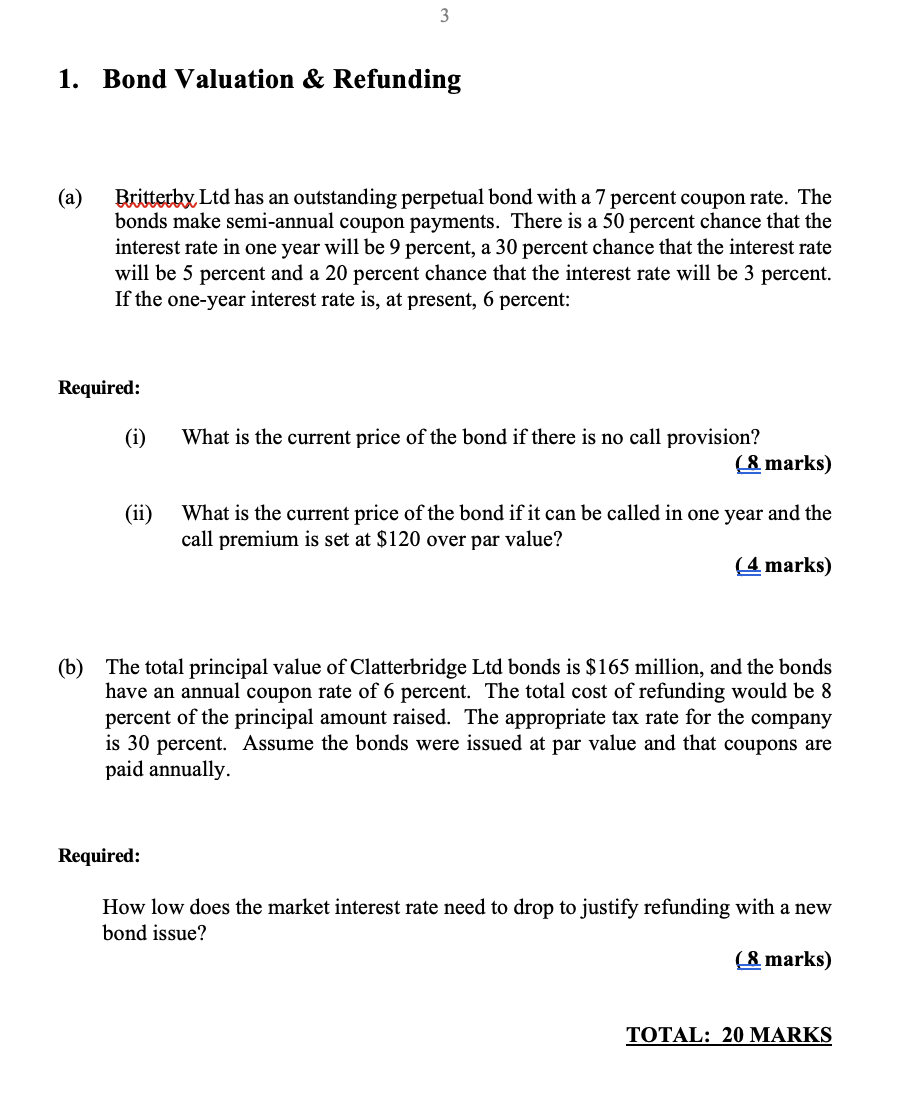

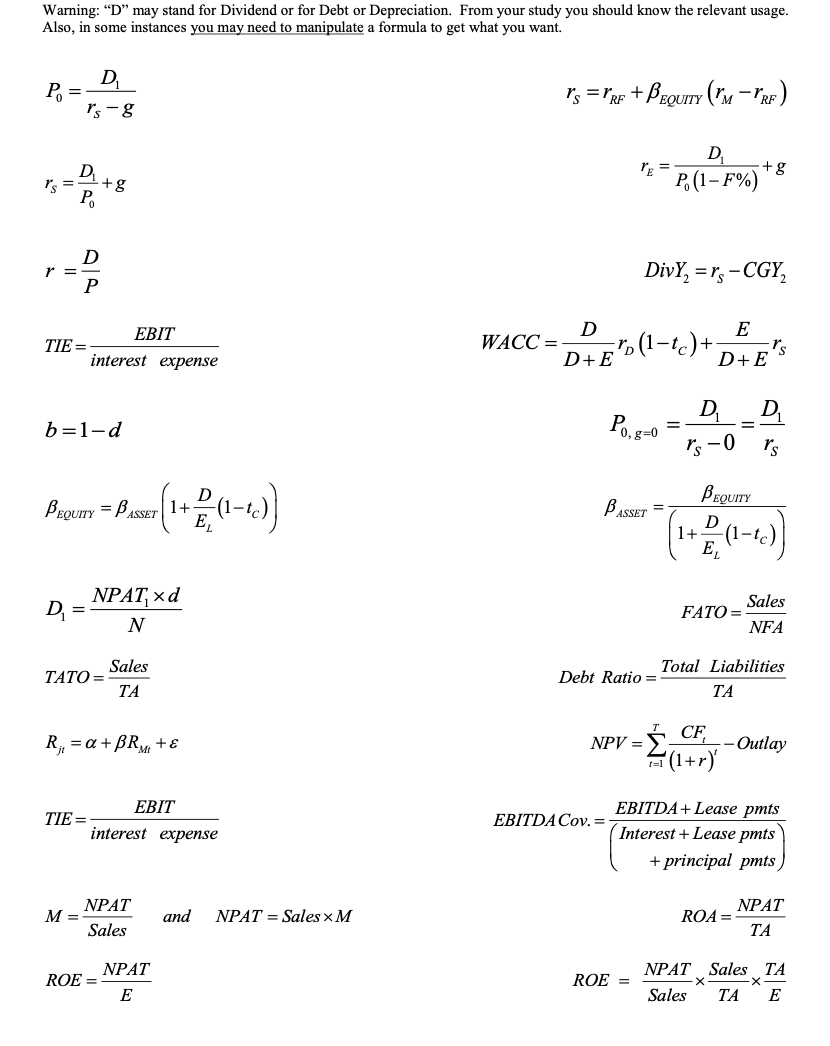

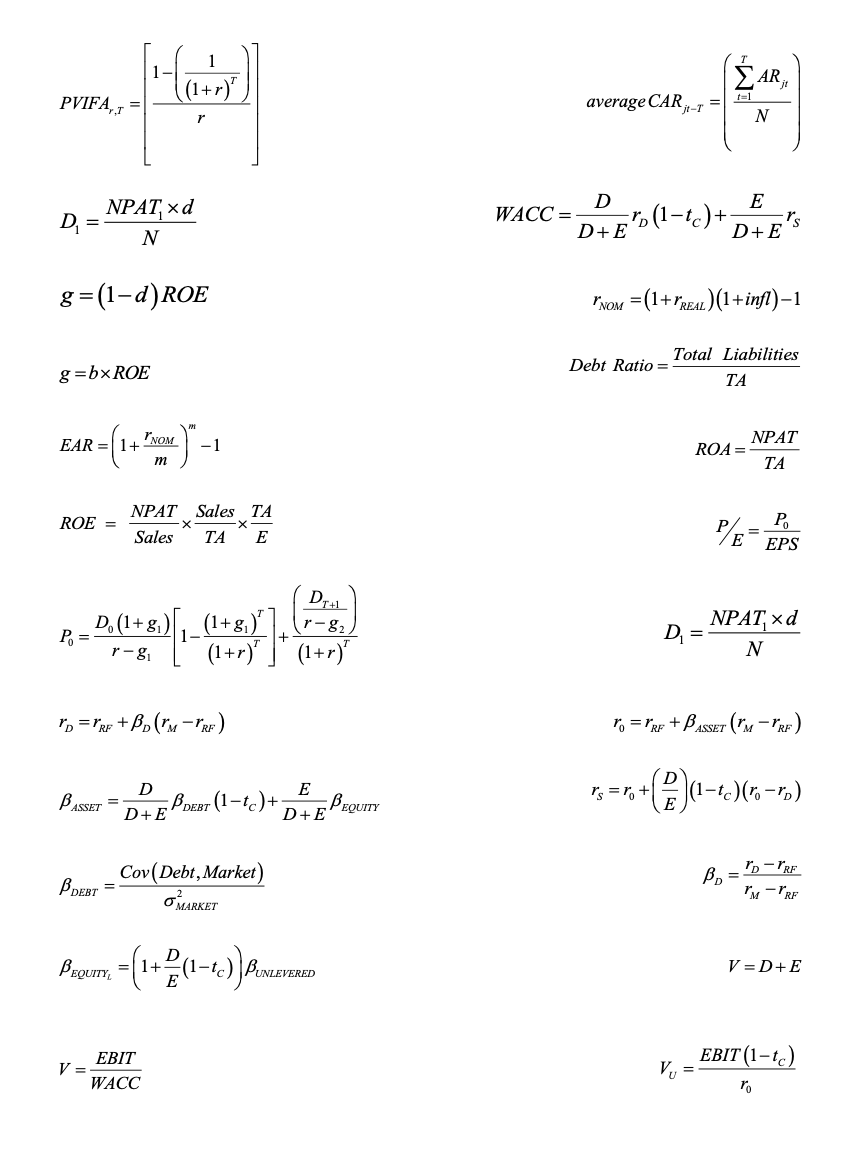

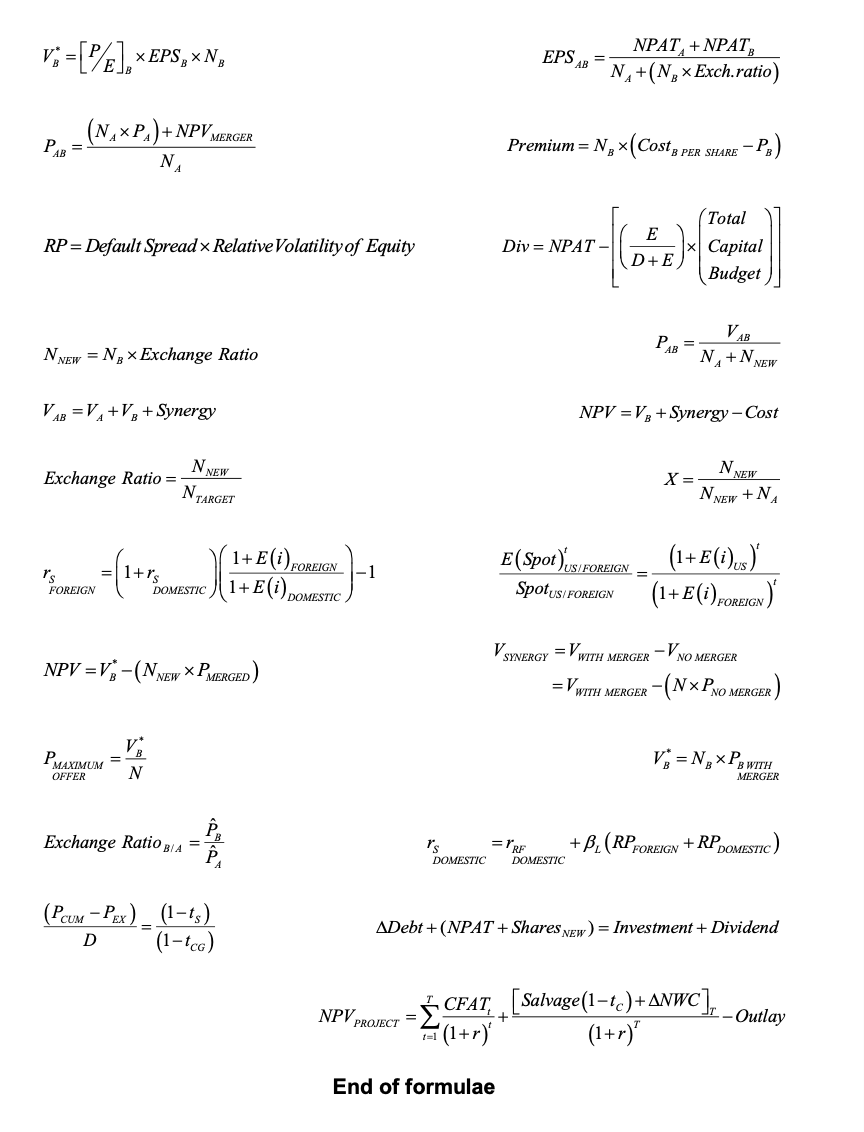

3 1. Bond Valuation & Refunding (a) Britterby Ltd has an outstanding perpetual bond with a 7 percent coupon rate. The bonds make semi-annual coupon payments. There is a 50 percent chance that the interest rate in one year will be 9 percent, a 30 percent chance that the interest rate will be 5 percent and a 20 percent chance that the interest rate will be 3 percent. If the one-year interest rate is, at present, 6 percent: Required: (i) What is the current price of the bond if there is no call provision? (& marks) (ii) What is the current price of the bond if it can be called in one year and the call premium is set at $120 over par value? (4 marks) (b) The total principal value of Clatterbridge Ltd bonds is $165 million, and the bonds have an annual coupon rate of 6 percent. The total cost of refunding would be 8 percent of the principal amount raised. The appropriate tax rate for the company is 30 percent. Assume the bonds were issued at par value and that coupons are paid annually. Required: How low does the market interest rate need to drop to justify refunding with a new bond issue? (& marks) TOTAL: 20 MARKS Warning: "D" may stand for Dividend or for Debt or Depreciation. From your study you should know the relevant usage. Also, in some instances you may need to manipulate a formula to get what you want. Po = D rs-g D+8 rs= Po r = D TIE= P EBIT interest expense b=1-d Pasar (1+ D (1-6)) BEQUITY = BASSET NPATxd EL D = N Sales TATO= TA R = a+BRM + TIE= EBIT interest expense M = NPAT Sales and NPAT=Sales M NPAT ROE = E r's =RF + PEQUITY (M-VRF) D YE= +g P(1-F%) DivY2=rs-CGY2 D E WACC= rD (1-tc rs D+E D+E D Po,g=0 = rs-0 rs BEQUITY BASSET = D 1+ E Sales FATO= NFA Total Liabilities Debt Ratio = CF NPV = -Outlay (1+r) EBITDA+Lease pmts EBITDA Cov. = Interest + Lease pmts + principal pmts) ROE = NPAT ROA= NPAT Sales TA X X Sales TA E Debt to Equity Ratio = P/E = EPS D E D Ws and WD = E D+E D+E NPAT EPS = N PV COST = TVx%(1-tc) AFN = 4* (AS) (AS)-MS,(1d) (AS)-(AS)-MS, S _ R-RR = a;+; (RM RRFt) + & ;t NOM EAR=(1+)-1 m a PDIRTY = P CLEAN + C; a=time elapsed; b = period length b DT+L r-82 1- BD, (1+8) 1 (147) (1+7) = PV GAIN r-g TV (COUPON-YTM MIN) YTM MIN Index RM = In Index-1 D=RF + BD (M-RF) CFAT EBIT (1-tc)+Depn PV BOND=Cl 1 1- (1+r)" FV r (1+r) PV CONSOL r D=RF+BD (M-RF) r = r + IP + DRP+LP+MRP IGR= Po, g=0 = bx ROA 1-(bx ROA) D D rs-0 = rs P R. = In P 1-1 NxD d = NPAT NPATxd D = N CFAT (EBITD)(1-tc)+Depn(tc) 1 1 FV PV BOND r(1+r) (1+r) 1 Call Price PV CALLABLE BOND=C r(1+r) (1+r) 1=RF + BASSET (MRF) P = P+E(R) + g=bxROE R =+ BRM + AR,, = R, -E(R) SGR= bx ROE M (1-4)(1+0) SIGR= 1-(b ROE) -M(1-d) 1+ So V =Vv EPS P = + NPVGO r EQUITY ASSET + 73-+-(6-8) -+((1-1)(6-1) (1-tc)(ro r's = E (1-tc) ("ASSET-DEBT) E NPV EAC= DEBT = -; A = PVIFAT Cov(Debt Security, Market MARKET BASSETS BUNLEVERED FIRM PEQUITY BASSET = DEBT Pecom + [2-(1-tc)] Pocer (+) (1-t P-P CGY = AEBIT Sales DOL = DOL= BEQUITY BASSET + ( D DivY = AEBIT SALES x EBIT ASALES B = D-RF "M-RF (1-tc) (BASSET -PDEBT) AEPS NPVGOg=0 = -Co + AEPS (1+g) NPVGO g>0 r-g EBIT ASales WC = CA; r's (UNLEVERED)=RF+BASSET ("M-RF) NWC CA-CL; OWC = CA*; NOWC CA- PVIFA,.I 1- 1 ((1+r) r D = NPATxd N g= (1-d)ROE g=bxROE := (1. EAR 1+ NOM m -1 ROE = NPAT Sales TA Sales X E average CAR jt-T AR t=1 N D E WACC = rn (1-tc)+ rs D+E D+E NOM =(1+REAL) (1+infl)1 Debt Ratio = Total Liabilities TA ROA= NPAT P/E= EPS DI+L D = NPATxd N D(1+g) (1+8) r-82. Po = r-g 1- + (1+r) D=RF+BD (M-VRF) 1=RF + BASSET (M-RF) rs=ro + E D BASSET PDEBT (1-tc)+ BEQUITY D+E D+E DEBT = Cov(Debt, Market) MARKET D (1- -r B = D-RF TM-TRF D PEQUITY = (1+/-(1-1)) PLM V = 1 EBIT WACC E BUNLEVERED V=D+E EBIT (1-tc) ter D -D "D E= CF available to Equity Holders rs 5 (1-tc)rD NPVF = Proceeds "D V =V+D (1-1)(1-1)] (1-1) Volatility of Equity Relative Volatility of Equity= Volatility of Debt V =V+tD V=V+ NPVF PVF = FIRM EBITPVIFA YEARS +tcpD PVIFA,YEARS APV = NPV + NPVF ALL EQUITY Additional UCF APV = + effects of t=1 *(1+r)' Initial investment debt 00 UCF Initial '(1+WACC)' investment LCF, Initial Amount NPV = FTE= WACC t=1 t=1 '(1+rs)' investment borrowed Do 1+ NO MERGER +8 NO MERGER AB VAR >V+V NAL = Outlay(CFxPVIFA DUE)(CF PVIFA ORDINARY); X = one or more types of CF NAL=0=PV (CFPVIFA)(CF, PVIFA) PV, UNLEVERED VERED PROJECT t=1 UCF =(1+%)' NPV=V-cash cost "D 1+%D DOMESTIC FOREIGN (1+E(i), ) DOMESTIC 1+E (i) FOREIGN Y = one or more types of CF T ACF Synergy = t=1 *(1+r)' V = VB + AV V-V+(-cash cost) AB PR B VB -VR B's DEBT NB V = [] EPS, NB PAB = (NXP)+NPV N MERGER RP=Default Spread Relative Volatility of Equity N NEW = NB Exchange Ratio VAB =V+V+Synergy N NEW Exchange Ratio = NTARGET ORION=(1+1 FOREIGN 1+rs 1+E (i) FOREIGN -1 DOMESTIC 1+E(i) DOMESTIC NPV=V-(N NEWP MERGED) PMAXIMUM OFFER V* == N Exchange Ratio B/A = (PCUM-PEX) (1-ts) D (1-tcG) = EPS AB = NPAT +NPAT N + (NBxExch.ratio) Premium = N(Cost B PER SHARE - PB) E Div NPAT- 161 D+E Total Capital Budget VAR P = N+N NEW NPV=VB + Synergy-Cost E(Spot) US/ FOREIGN Spot US/FOREIGN = V SYNERGY = V WITH MERGER =V WITH WITH MERGER X = N NEW N NEW + NA (1+E(i) us) (1+E (i) FOREIGN) -V NO MERGER -(NXP NO MERGER) V = NBxPB B WITH MERGER rs ='RF DOMESTIC DOMESTIC + B (RP FOREIGN + RP DOMESTIC) ADebt +(NPAT + Shares NEW) = Investment + Dividend CFAT [Salvage (1-1) + ANWC] - Outlay (1+r) NPV PROJECT + 1=1 (1+r)' End of formulae

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started