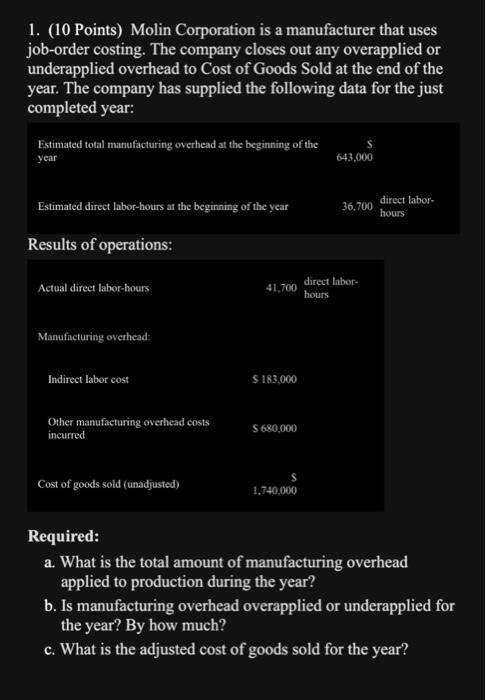

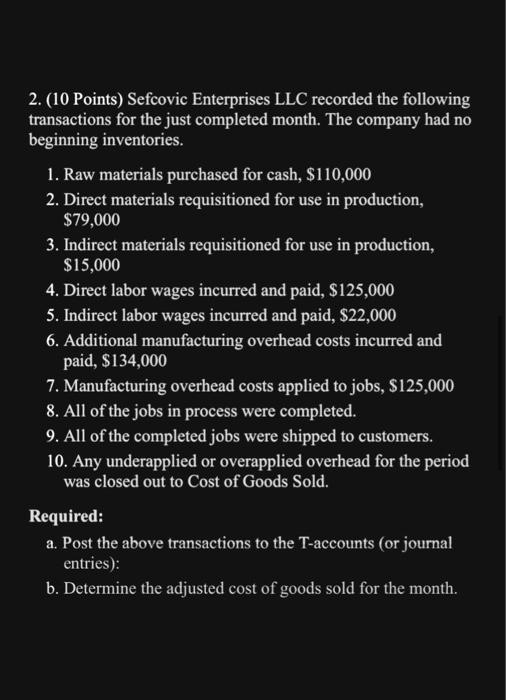

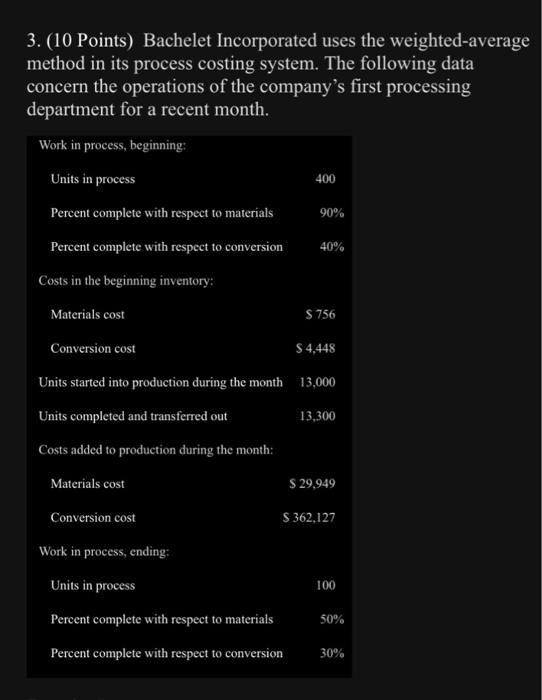

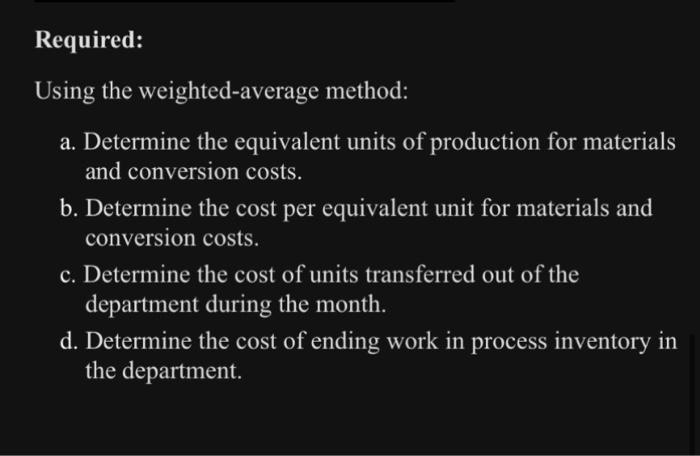

3. (10 Points) Bachelet Incorporated uses the weighted-average following data irst processing Required: Using the weighted-average method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of units transferred out of the department during the month. d. Determine the cost of ending work in process inventory in the department. 1. (10 Points) Molin Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year: Estimated total manufacturing overhead at the beginning of the year 5 643,000 Estimated direct labor-hours at the beginning of the year 36,700 direct labor: Results of operations: Actual direct labor-hours 41,700 direct labor- Manufncturing overhead: Indirect labor cost \$ 183.000 Other manufacturing overhead costs incurred S 680,000 Cost of goods sold (unadjusted) 1,740,000 Required: a. What is the total amount of manufacturing overhead applied to production during the year? b. Is manufacturing overhead overapplied or underapplied for the year? By how much? c. What is the adjusted cost of goods sold for the year? 2. (10 Points) Sefcovic Enterprises LLC recorded the following transactions for the just completed month. The company had no beginning inventories. 1. Raw materials purchased for cash, $110,000 2. Direct materials requisitioned for use in production, $79,000 3. Indirect materials requisitioned for use in production, $15,000 4. Direct labor wages incurred and paid, $125,000 5. Indirect labor wages incurred and paid, $22,000 6. Additional manufacturing overhead costs incurred and paid, $134,000 7. Manufacturing overhead costs applied to jobs, $125,000 8. All of the jobs in process were completed. 9. All of the completed jobs were shipped to customers. 10. Any underapplied or overapplied overhead for the period was closed out to Cost of Goods Sold. Required: a. Post the above transactions to the T-accounts (or journal entries): b. Determine the adjusted cost of goods sold for the month