3) 10 POINTS You are to do a full Horizontal Analysis (on both the Balance Sheet and on the Income Statement) for the years presented using the oldest year as your base year and rolling forward that base year to the next recent year. In other words, for the Balance Sheet which contains 2 years of data, you compare the oldest year to the most recent year. Easy. But for the Income Statement, there should be 3 years included in your Horizontal Analysis. I am looking for whole dollars here. NO PENNIES ! Use the exact same numerical format in your tables as that in the original financial statements. I am requiring the differences here be stated in dollar amounts (not percentages). For the income statement, the oldest year gets compared to the middle year. Then the middle year becomes the base year and that base year gets compared to the most recent year. (Thus, the "rolling base year concept.)

#4) 10 POINTS You are to do a Vertical Analysis (on both the Balance Sheet and Income Statement) for EACH of the years presented. You must show your results as % amounts (not regular numbers) and round your % results to exactly 2 decimal places (ex: 2.07% ~ not 2% and not 2.0689538%).

For these two analyses (#3 and #4 above), you are to present the actual tables of your Vertical and Horizontal Analysis. If you only submit commentary on your results (and not the tables), you lose 20 points. The analysis tables MUST SHOW: titles, every single individual account as shown on the original financial statement, the original dollar balances alongside each of those named accounts under the respective yearly column, and the columns for your vertical/horizontal calculation results. Be sure to label all columns.

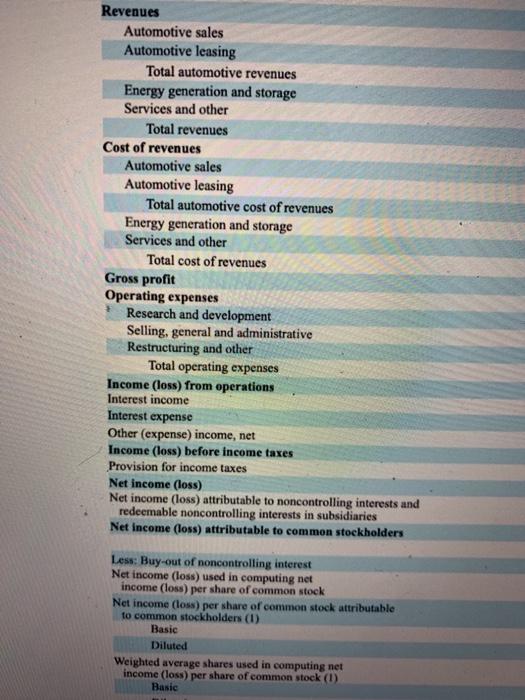

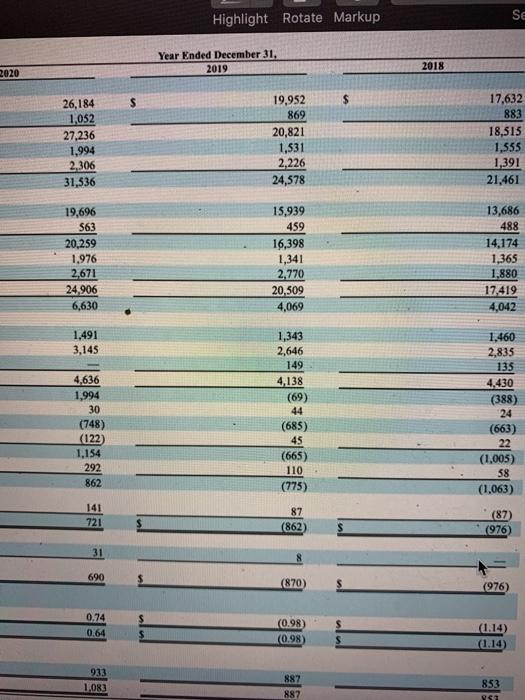

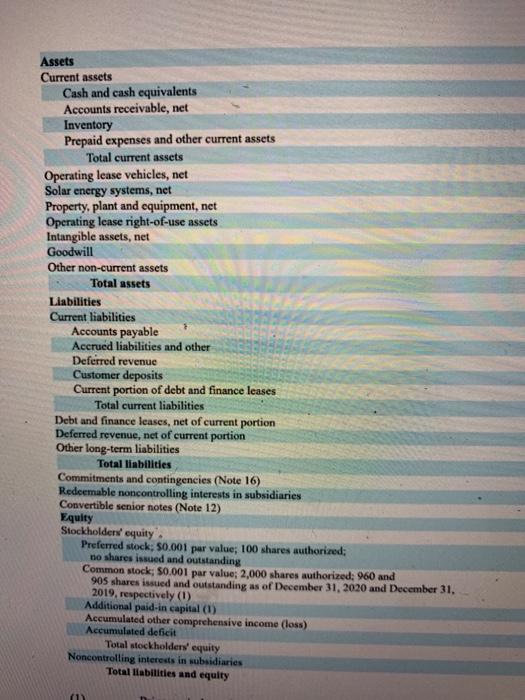

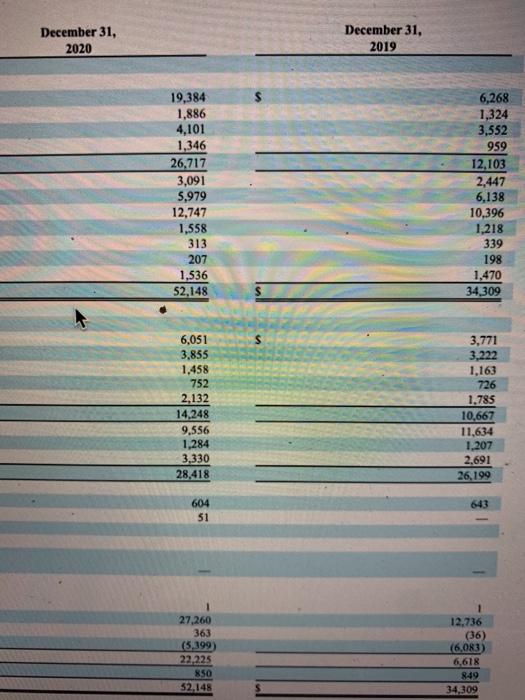

Revenues Automotive sales Automotive leasing Total automotive revenues Energy generation and storage Services and other Total revenues Cost of revenues Automotive sales Automotive leasing Total automotive cost of revenues Energy generation and storage Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling, general and administrative Restructuring and other Total operating expenses Income (loss) from operations Interest income Interest expense Other (expense) income, net Income (loss) before income taxes Provision for income taxes Net income (loss) Net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries Net Income (loss) attributable to common stockholders Less: Buy-out of noncontrolling interest Net income (loss) used in computing net income (loss) per share of common stock Net income (loss) per share of common stock attributable to common stockholders (1) Basic Diluted Weighted average shares used in computing net income (loss) per share of common stock (1) Basic Highlight Rotate Markup SE Year Ended December 31, 2019 2018 2020 $ 26,184 1,052 27,236 1,994 2,306 31,536 19,952 869 20,821 1.531 2,226 24,578 17.632 883 18,515 1,555 1,391 21,461 19,696 563 20.259 1.976 2,671 24,906 6,630 15,939 459 16,398 1,341 2,770 20.509 4,069 13,686 488 14.174 1,365 1.880 17.419 4,042 1,491 3,145 1,460 2,835 135 4,636 1,994 30 (748) (122) 1.154 292 862 1,343 2,646 149 4,138 (69) 44 (685) 45 (665) 110 (775) 4,430 (388) 24 (663) 22 (1,005) 58 (1,063) 141 721 87 (862 (87) (976) 31 690 (870) (976) 0.74 0.64 $ $ (0.98) (0.98) 1.14) 933 1,083 887 887 853 952 Assets Current assets Cash and cash equivalents Accounts receivable, net Inventory Prepaid expenses and other current assets Total current assets Operating lease vehicles, net Solar energy systems, net Property, plant and equipment, net Operating lease right-of-use assets Intangible assets, net Goodwill Other non-current assets Total assets Liabilities Current liabilities Accounts payable Accrued liabilities and other Deferred revenue Customer deposits Current portion of debt and finance leases Total current liabilities Debt and finance leases, net of current portion Deferred revenue, net of current portion Other long-term liabilities Total liabilities Commitments and contingencies (Note 16) Redeemable noncontrolling interests in subsidiaries Convertible senior notes (Note 12) Equity Stockholders' equity Preferred stock, 50.001 par value; 100 shares authorized; no shares issued and outstanding Common stock: 50.001 par value; 2,000 shares authorized; 960 and 905 shares issued and outstanding as of December 31, 2020 and December 31, 2019, respectively (1) Additional paid-in capital (1) Accumulated other comprehensive income (loss) Accumulated deficit Total stockholders' equity Noncontrolling interests in subsidiaries Total liabilities and equity (1) December 31, 2020 December 31, 2019 19,384 1,886 4,101 1,346 26,717 3,091 5,979 12,747 1,558 313 207 1,536 52,148 6,268 1,324 3,552 959 12.103 2,447 6,138 10,396 1,218 339 198 1,470 34309 6,051 3.855 1.458 752 2.132 14.248 9,556 1,284 3,330 28,418 3,771 3,222 1.163 726 1.785 10,667 11,634 1,207 2.691 26,199 643 604 51 1 27,260 363 (5,399) 22,225 850 52,148 12.736 (36) (6,083) 6,618 849 34,309 Revenues Automotive sales Automotive leasing Total automotive revenues Energy generation and storage Services and other Total revenues Cost of revenues Automotive sales Automotive leasing Total automotive cost of revenues Energy generation and storage Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling, general and administrative Restructuring and other Total operating expenses Income (loss) from operations Interest income Interest expense Other (expense) income, net Income (loss) before income taxes Provision for income taxes Net income (loss) Net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries Net Income (loss) attributable to common stockholders Less: Buy-out of noncontrolling interest Net income (loss) used in computing net income (loss) per share of common stock Net income (loss) per share of common stock attributable to common stockholders (1) Basic Diluted Weighted average shares used in computing net income (loss) per share of common stock (1) Basic Highlight Rotate Markup SE Year Ended December 31, 2019 2018 2020 $ 26,184 1,052 27,236 1,994 2,306 31,536 19,952 869 20,821 1.531 2,226 24,578 17.632 883 18,515 1,555 1,391 21,461 19,696 563 20.259 1.976 2,671 24,906 6,630 15,939 459 16,398 1,341 2,770 20.509 4,069 13,686 488 14.174 1,365 1.880 17.419 4,042 1,491 3,145 1,460 2,835 135 4,636 1,994 30 (748) (122) 1.154 292 862 1,343 2,646 149 4,138 (69) 44 (685) 45 (665) 110 (775) 4,430 (388) 24 (663) 22 (1,005) 58 (1,063) 141 721 87 (862 (87) (976) 31 690 (870) (976) 0.74 0.64 $ $ (0.98) (0.98) 1.14) 933 1,083 887 887 853 952 Assets Current assets Cash and cash equivalents Accounts receivable, net Inventory Prepaid expenses and other current assets Total current assets Operating lease vehicles, net Solar energy systems, net Property, plant and equipment, net Operating lease right-of-use assets Intangible assets, net Goodwill Other non-current assets Total assets Liabilities Current liabilities Accounts payable Accrued liabilities and other Deferred revenue Customer deposits Current portion of debt and finance leases Total current liabilities Debt and finance leases, net of current portion Deferred revenue, net of current portion Other long-term liabilities Total liabilities Commitments and contingencies (Note 16) Redeemable noncontrolling interests in subsidiaries Convertible senior notes (Note 12) Equity Stockholders' equity Preferred stock, 50.001 par value; 100 shares authorized; no shares issued and outstanding Common stock: 50.001 par value; 2,000 shares authorized; 960 and 905 shares issued and outstanding as of December 31, 2020 and December 31, 2019, respectively (1) Additional paid-in capital (1) Accumulated other comprehensive income (loss) Accumulated deficit Total stockholders' equity Noncontrolling interests in subsidiaries Total liabilities and equity (1) December 31, 2020 December 31, 2019 19,384 1,886 4,101 1,346 26,717 3,091 5,979 12,747 1,558 313 207 1,536 52,148 6,268 1,324 3,552 959 12.103 2,447 6,138 10,396 1,218 339 198 1,470 34309 6,051 3.855 1.458 752 2.132 14.248 9,556 1,284 3,330 28,418 3,771 3,222 1.163 726 1.785 10,667 11,634 1,207 2.691 26,199 643 604 51 1 27,260 363 (5,399) 22,225 850 52,148 12.736 (36) (6,083) 6,618 849 34,309