Answered step by step

Verified Expert Solution

Question

1 Approved Answer

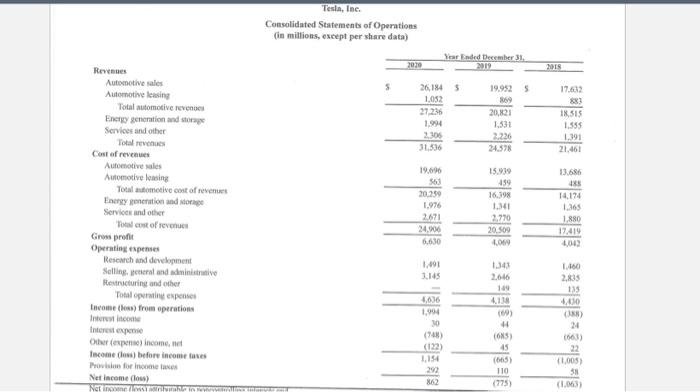

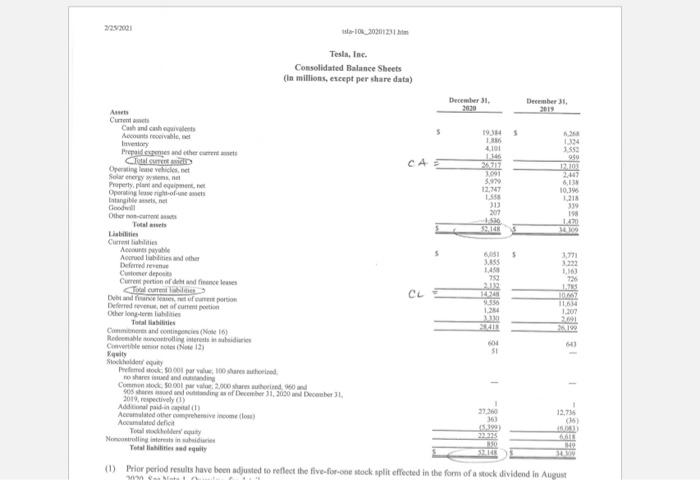

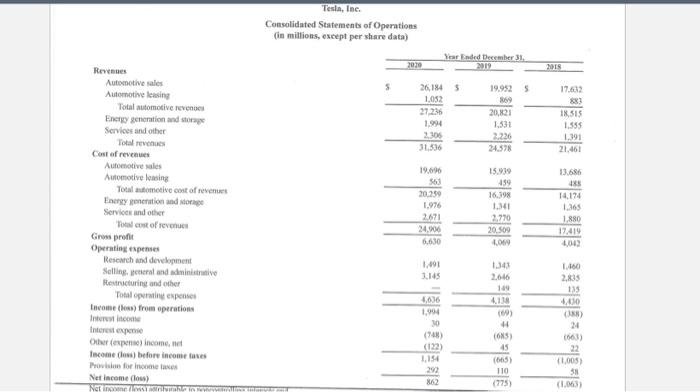

#3) 10 POINTS You are to do a full Horizontal Analysis (on both the Balance Sheet and on the Income Statement) for the years presented

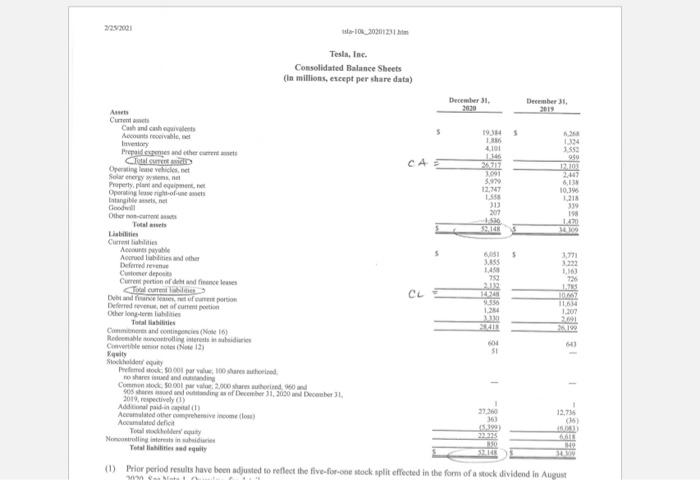

#3) 10 POINTS You are to do a full Horizontal Analysis (on both the Balance Sheet and on the Income Statement) for the years presented using the oldest year as your base year and rolling forward that base year to the next recent year. In other words, for the Balance Sheet which contains 2 years of data, you compare the oldest year to the most recent year. Easy. But for the Income Statement, there should be 3 years included in your Horizontal Analysis. I am looking for whole dollars here. NO PENNIES ! Use the exact same numerical format in your tables as that in the original financial statements. I am requiring the differences here be stated in dollar amounts (not percentages). For the income statement, the oldest year gets compared to the middle year. Then the middle year becomes the base year and that base year gets compared to the most recent year. (Thus, the "rolling base year concept.)

Tesla, Ine. Consolidated Statements of Operations in millions, except per share data) 2030 Year Ended December 31 2019 2015 19.9525 26,1845 1,052 27.236 1.994 20.121 17.612 883 18,315 1.555 1.391 21.461 22226 24.378 13.686 Rennes Automotive sales Automotive leasing Total utomotive reven Energy generation and stone Services and other Total revenues Cost of revenues Automotive sales Automotive lensing Totaltomotive cost of revenue Energy mention and more Services and other The cost of revenues Grow profit Operating expenses Research and development Selling real and administrative Restructuring and other Totalt expenses Incomes from operations Interest income Interest expense Other expense income.net Income before income fare Proval for income Net Income (los) Neti 19.096 563 20.259 1.976 2671 24.000 15.99 459 16.398 L.MI 2.770 20.509 4.069 14.174 1.365 1.880 12.419 4,042 1,001 1.343 2.646 100 1.460 2,833 135 4,40 (8) 24 4,036 1,994 30 (748) (122) 1.154 292 862 44 (685) 45 (665) 110 (275) (1,005) SN YO Tesla, Inc. Consolidated Balance Sheets (in millions, except per share data) December 31 2020 December 31 5 193H 4101 114 1234 1353 950 CAE Current Cash and the Accounts receivable, Invey Prepaid comes and the current Operating ne volicies, net Property, plant and equipment, Optome Intangible Candell Other Lntaries Current liabilities Acne Accredibilities with 1991 3. 12.27 2,447 8,13 10.396 218 339 1 2017 120 100 3.55 1,71 3.22 1.13 752 LE CL 124 14 1 51 Deferreret, of current Other online Total abilities Cummer and contine (16) Redeme rolling red Cover ity Soldet equiry Pred. pr. 100 hard to shared and Contok 0.00 2.00 hod 2014 reading of December 31, 3.00 December 31 Asal Ateherememe Amated delict Teledy Noming internet Totally - 12,735 36 15199 23235 30 (1) Prior period results have been adjusted to reflect the five-for-stock split effected in the form of a stock dividend in August IM Tesla, Ine. Consolidated Statements of Operations in millions, except per share data) 2030 Year Ended December 31 2019 2015 19.9525 26,1845 1,052 27.236 1.994 20.121 17.612 883 18,315 1.555 1.391 21.461 22226 24.378 13.686 Rennes Automotive sales Automotive leasing Total utomotive reven Energy generation and stone Services and other Total revenues Cost of revenues Automotive sales Automotive lensing Totaltomotive cost of revenue Energy mention and more Services and other The cost of revenues Grow profit Operating expenses Research and development Selling real and administrative Restructuring and other Totalt expenses Incomes from operations Interest income Interest expense Other expense income.net Income before income fare Proval for income Net Income (los) Neti 19.096 563 20.259 1.976 2671 24.000 15.99 459 16.398 L.MI 2.770 20.509 4.069 14.174 1.365 1.880 12.419 4,042 1,001 1.343 2.646 100 1.460 2,833 135 4,40 (8) 24 4,036 1,994 30 (748) (122) 1.154 292 862 44 (685) 45 (665) 110 (275) (1,005) SN YO Tesla, Inc. Consolidated Balance Sheets (in millions, except per share data) December 31 2020 December 31 5 193H 4101 114 1234 1353 950 CAE Current Cash and the Accounts receivable, Invey Prepaid comes and the current Operating ne volicies, net Property, plant and equipment, Optome Intangible Candell Other Lntaries Current liabilities Acne Accredibilities with 1991 3. 12.27 2,447 8,13 10.396 218 339 1 2017 120 100 3.55 1,71 3.22 1.13 752 LE CL 124 14 1 51 Deferreret, of current Other online Total abilities Cummer and contine (16) Redeme rolling red Cover ity Soldet equiry Pred. pr. 100 hard to shared and Contok 0.00 2.00 hod 2014 reading of December 31, 3.00 December 31 Asal Ateherememe Amated delict Teledy Noming internet Totally - 12,735 36 15199 23235 30 (1) Prior period results have been adjusted to reflect the five-for-stock split effected in the form of a stock dividend in August IM I could really use some help please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started