Answered step by step

Verified Expert Solution

Question

1 Approved Answer

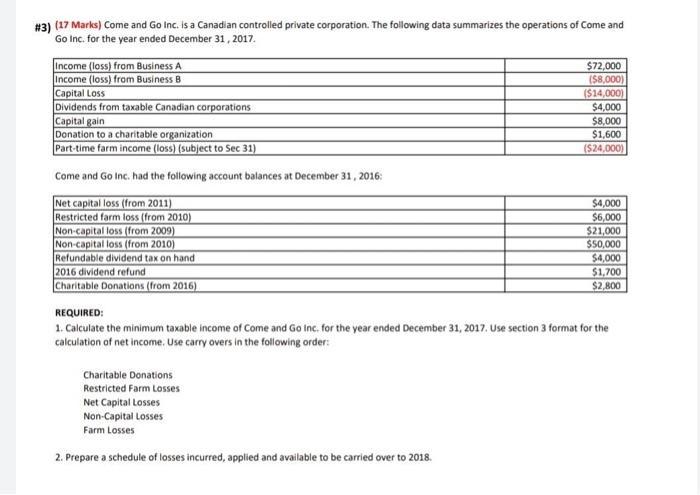

#3) (17 Marks) Come and Go Inc. is a Canadian controlled private corporation. The following data summarizes the operations of Come and Go Inc.

#3) (17 Marks) Come and Go Inc. is a Canadian controlled private corporation. The following data summarizes the operations of Come and Go Inc. for the year ended December 31, 2017. Income (loss) from Business A Income (loss) from Business B Capital Loss Dividends from taxable Canadian corporations Capital gain Donation to a charitable organization Part-time farm income (loss) (subject to Sec 31) Come and Go Inc. had the following account balances at December 31, 2016: Net capital loss (from 2011) Restricted farm loss (from 2010) Non-capital loss (from 2009) Non-capital loss (from 2010) Refundable dividend tax on hand 2016 dividend refund Charitable Donations (from 2016) Charitable Donations Restricted Farm Losses $72,000 ($8,000) Net Capital Losses Non-Capital Losses Farm Losses 2. Prepare a schedule of losses incurred, applied and available to be carried over to 2018. ($14,000) $4,000 $8,000 $1,600 ($24,000) $4,000 $6,000 $21,000 $50,000 REQUIRED: 1. Calculate the minimum taxable income of Come and Go Inc. for the year ended December 31, 2017. Use section 3 format for the calculation of net income. Use carry overs in the following order: $4,000 $1,700 $2,800

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of Minimum Taxable Income Section 3 Format Income Source Amount Business A Activ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started