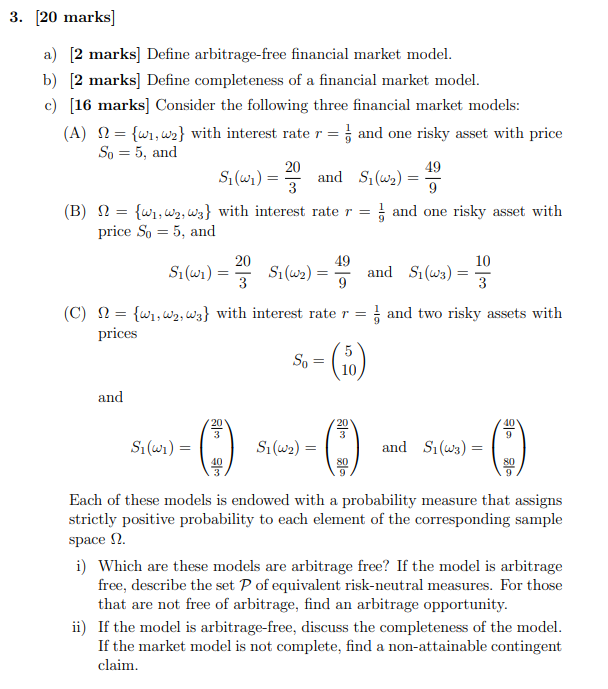

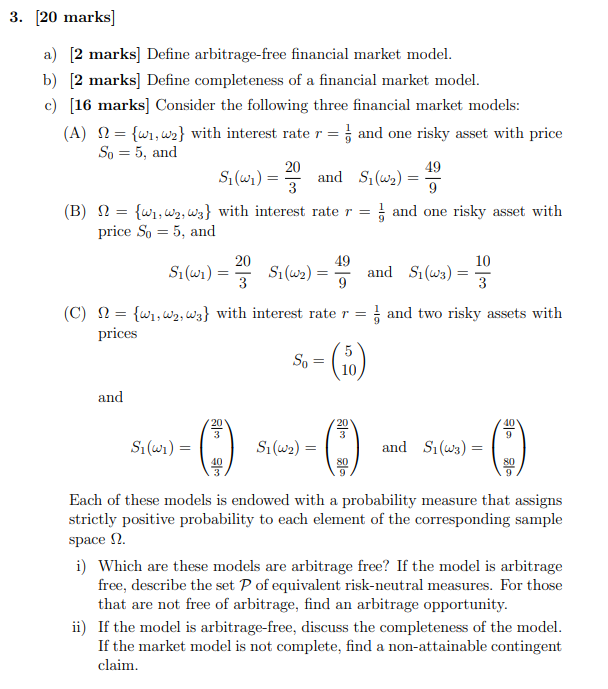

3. [20 marks] a) [2 marks] Define arbitrage-free financial market model. b) [2 marks] Define completeness of a financial market model. c) [16 marks] Consider the following three financial market models: (A) N = {wi, w2} with interest rate r = = 1 and one risky asset with price So = 5, and 20 49 Swi) = and S. (W) 3 9 (B) 1 = {w1,W2, wy} with interest rate r = and one risky asset with price So = 5, and 20 49 10 Siwi) = S.(wa) and Si(w3) 3 9 3 (C) 2 = {W1, W2,w3} with interest rate r = and two risky assets with prices 5 S. 10 and 20 20 40 9 Si(wi) = ( ) Si(wa) = () and S(W3) = 40 80 80 Each of these models is endowed with a probability measure that assigns strictly positive probability to each element of the corresponding sample space 2. i) Which are these models are arbitrage free? If the model is arbitrage free, describe the set of equivalent risk-neutral measures. For those that are not free of arbitrage, find an arbitrage opportunity. ii) If the model is arbitrage-free, discuss the completeness of the model. If the market model is not complete, find a non-attainable contingent claim. 3. [20 marks] a) [2 marks] Define arbitrage-free financial market model. b) [2 marks] Define completeness of a financial market model. c) [16 marks] Consider the following three financial market models: (A) N = {wi, w2} with interest rate r = = 1 and one risky asset with price So = 5, and 20 49 Swi) = and S. (W) 3 9 (B) 1 = {w1,W2, wy} with interest rate r = and one risky asset with price So = 5, and 20 49 10 Siwi) = S.(wa) and Si(w3) 3 9 3 (C) 2 = {W1, W2,w3} with interest rate r = and two risky assets with prices 5 S. 10 and 20 20 40 9 Si(wi) = ( ) Si(wa) = () and S(W3) = 40 80 80 Each of these models is endowed with a probability measure that assigns strictly positive probability to each element of the corresponding sample space 2. i) Which are these models are arbitrage free? If the model is arbitrage free, describe the set of equivalent risk-neutral measures. For those that are not free of arbitrage, find an arbitrage opportunity. ii) If the model is arbitrage-free, discuss the completeness of the model. If the market model is not complete, find a non-attainable contingent claim