Answered step by step

Verified Expert Solution

Question

1 Approved Answer

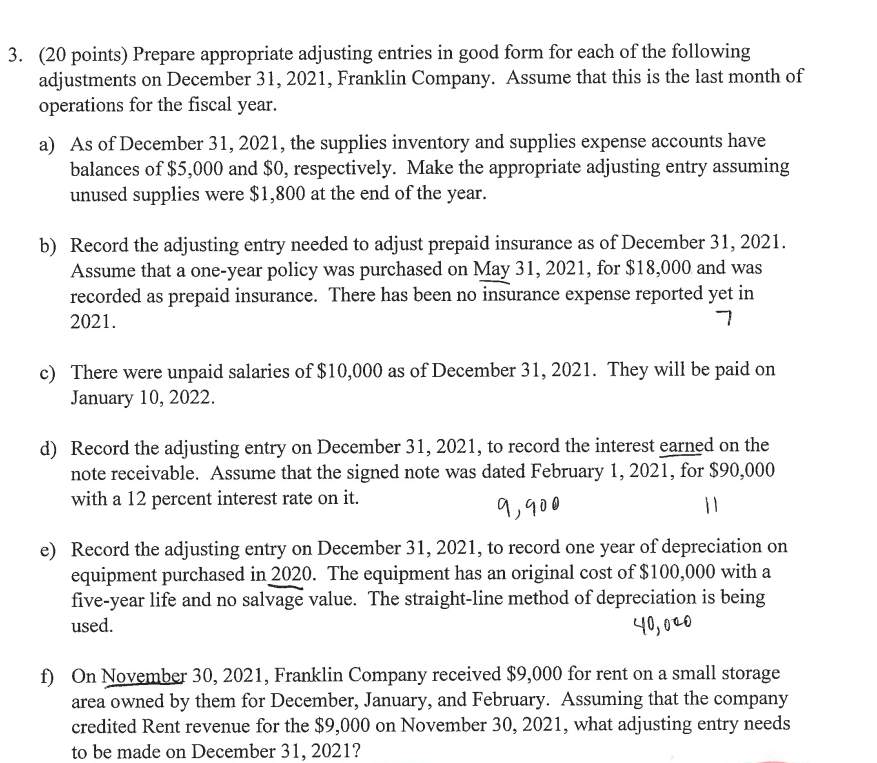

3. (20 points) Prepare appropriate adjusting entries in good form for each of the following adjustments on December 31, 2021, Franklin Company. Assume that

3. (20 points) Prepare appropriate adjusting entries in good form for each of the following adjustments on December 31, 2021, Franklin Company. Assume that this is the last month of operations for the fiscal year. a) As of December 31, 2021, the supplies inventory and supplies expense accounts have balances of $5,000 and $0, respectively. Make the appropriate adjusting entry assuming unused supplies were $1,800 at the end of the year. b) Record the adjusting entry needed to adjust prepaid insurance as of December 31, 2021. Assume that a one-year policy was purchased on May 31, 2021, for $18,000 and was recorded as prepaid insurance. There has been no insurance expense reported yet in 2021. 7 c) There were unpaid salaries of $10,000 as of December 31, 2021. They will be paid on January 10, 2022. d) Record the adjusting entry on December 31, 2021, to record the interest earned on the note receivable. Assume that the signed note was dated February 1, 2021, for $90,000 with a 12 percent interest rate on it. 9,900 11 e) Record the adjusting entry on December 31, 2021, to record one year of depreciation on equipment purchased in 2020. The equipment has an original cost of $100,000 with a five-year life and no salvage value. The straight-line method of depreciation is being used. 40,000 f) On November 30, 2021, Franklin Company received $9,000 for rent on a small storage area owned by them for December, January, and February. Assuming that the company credited Rent revenue for the $9,000 on November 30, 2021, what adjusting entry needs to be made on December 31, 2021?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started