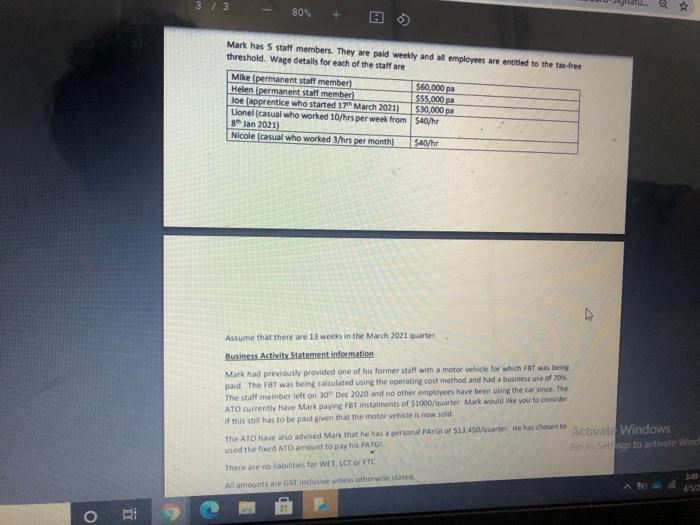

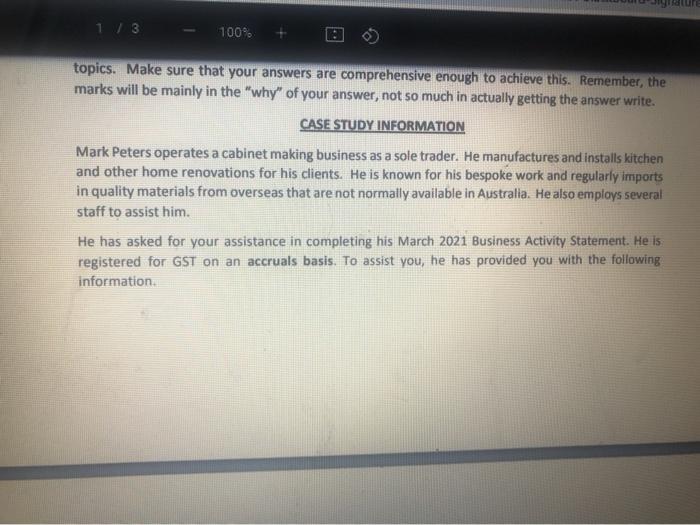

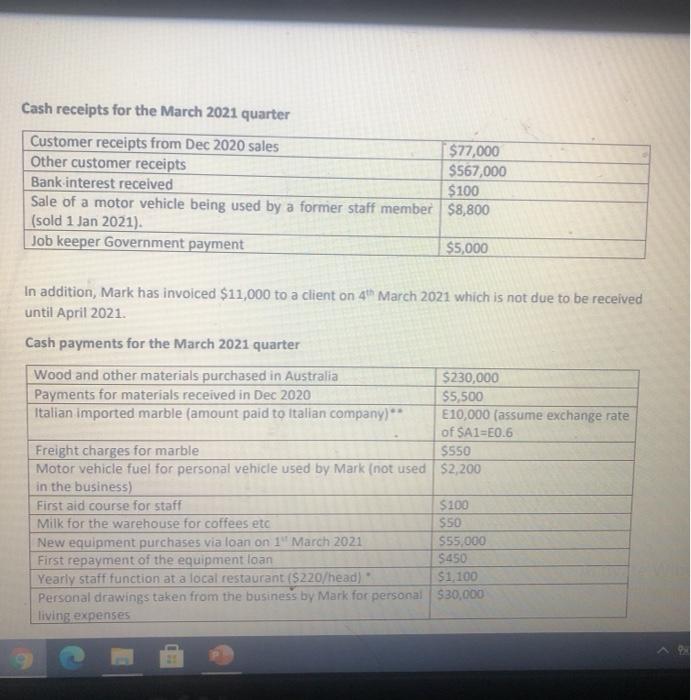

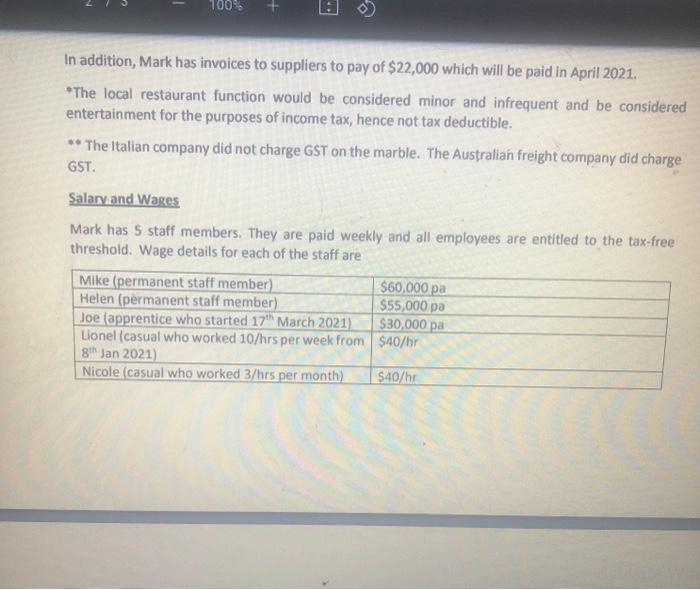

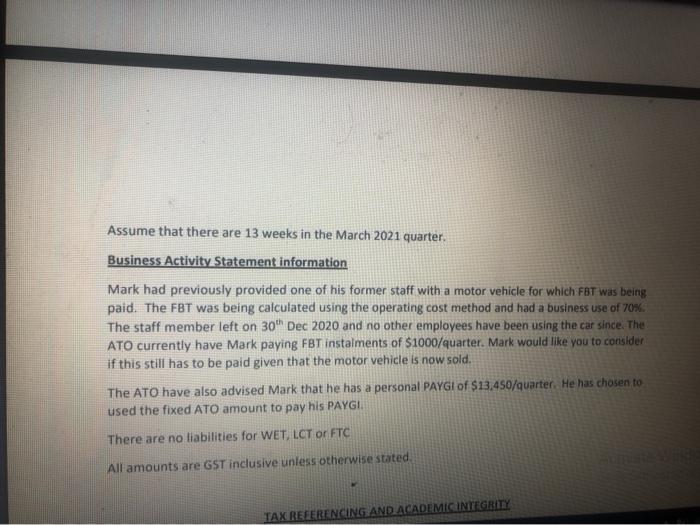

3 / 3 80% Mark has 5 staff members. They are paid weekly and all employees are entitled to the tax-free threshold. Wage details for each of the staff are Mike (permanent staff member $60,000 pa Helen permanent staff member) $55,000 pa Joe (apprentice who started 17 March 2021) $30,000 pa Lonel (casual who worked 10/hrs per week from 540/h 8 Jan 2021) Nicole (casual who worked 3 hrs per month $40/hr Assume that there are 13 weeks in the March 2021 quarter Business Activity Statement information Mark had previously provided one of his former staff with a motor vehicle for which Fat was being paid the fat was being calculated using the operating cost method and lud business use of yo The staff member left on 30 Dec 2020 and no other employees have been using the car since the ATO currently have Mark paying installments of S1000/quarter Mark would like you to con if this still has to be paid given that the motor vehicle is now sold The ATO has advised Mark that he has a personal PAYGI 08513.450/Quarter. He has chosen to Activate Windows used the red ATO amount to pay his PAYG! bebes to activate Wind There are no abilities for WET LC or FTC All amounts are inclusive unless otherwise O 1 / 3 100% topics. Make sure that your answers are comprehensive enough to achieve this. Remember, the marks will be mainly in the "why" of your answer, not so much in actually getting the answer write. CASE STUDY INFORMATION Mark Peters operates a cabinet making business as a sole trader. He manufactures and installs kitchen and other home renovations for his clients. He is known for his bespoke work and regularly imports in quality materials from overseas that are not normally available in Australia. He also employs several staff to assist him. He has asked for your assistance in completing his March 2021 Business Activity Statement. He is registered for GST on an accruals basis. To assist you, he has provided you with the following information Cash receipts for the March 2021 quarter Customer receipts from Dec 2020 sales $77,000 Other customer receipts $567,000 Bank interest received $100 Sale of a motor vehicle being used by a former staff member $8,800 (sold 1 Jan 2021). Job keeper Government payment $5,000 In addition, Mark has invoiced $11,000 to a client on 4th March 2021 which is not due to be received until April 2021 Cash payments for the March 2021 quarter Wood and other materials purchased in Australia $230,000 Payments for materials received in Dec 2020 $5,500 Italian imported marble (amount paid to Italian company) E10,000 (assume exchange rate of SA1=E0.6 Freight charges for marble $550 Motor vehicle fuel for personal vehicle used by Mark (not used $2,200 in the business) First aid course for staff $100 Milk for the warehouse for coffees eta $50 New equipment purchases via loan on 1 March 2021 $55,000 First repayment of the equipment loan $450 Yearly staff function at a local restaurant ($220/head) $1,100 Personal drawings taken from the business by Mark for personal $30,000 living expenses 100 In addition, Mark has invoices to suppliers to pay of $22,000 which will be paid in April 2021. *The local restaurant function would be considered minor and infrequent and be considered entertainment for the purposes of income tax, hence not tax deductible. * The Italian company did not charge GST on the marble. The Australian freight company did charge GST Salary and Wages Mark has 5 staff members. They are paid weekly and all employees are entitled to the tax-free threshold. Wage details for each of the staff are Mike (permanent staff member) $60,000 pa Helen (permanent staff member) $55,000 pa Joe (apprentice who started 17h March 2021) $30,000 pa Lionel (casual who worked 10/hrs per week from $40/hr 8th Jan 2021 Nicole (casual who worked 3/hrs per month) $40/hr Assume that there are 13 weeks in the March 2021 quarter. Business Activity Statement information Mark had previously provided one of his former staff with a motor vehicle for which FBT was being paid. The FBT was being calculated using the operating cost method and had a business use of 70% The staff member left on 30 Dec 2020 and no other employees have been using the car since. The ATO currently have Mark paying FBT instalments of $1000/quarter. Mark would like you to consider if this still has to be paid given that the motor vehicle is now sold. The ATO have also advised Mark that he has a personal PAYGI of $13.450/quarter. He has chosen to used the fixed ATO amount to pay his PAYGI There are no liabilities for WET, LCT or FTC All amounts are GST inclusive unless otherwise stated. TAX REFERENCING AND ACADEMIC INTEGRITY