Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 -3 Chapter 3 Financial Statements, Cash Flow, and Taxes 91 (Hint: Write out the headings for an income statement, and fill in the known

3-3

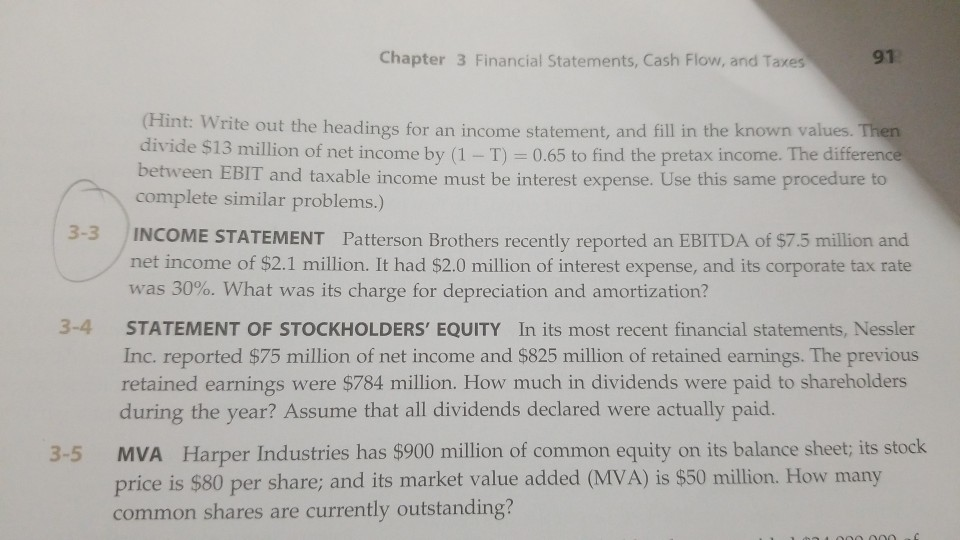

Chapter 3 Financial Statements, Cash Flow, and Taxes 91 (Hint: Write out the headings for an income statement, and fill in the known values. Then divide $13 million of net income by (1- T) 0.65 to find the pretax income. The difference between EBIT and taxable income must be interest expense. Use this same complete similar problems.) procedure to 3-3 INCOME STATEMENT Patterson Brothers recently reported an EBITDA of $7.5 million and net income of $2.1 million. It had $2.0 million of interest expense, and its corporate tax rate was 30%. What was its charge for depreciation and amortization? 3-4 STATEMENT OF STOCKHOLDERS' EQUITY In its most recent financial statements, Nessler Inc. reported $75 million of net income and $825 million of retained earnings. The previous retained earnings were $784 million. How much in dividends were paid to shareholders during the year? Assume that all dividends declared were actually paid. Harper Industries has $900 million of common equity on its balance sheet; its stock 3-5 MVA price is $80 per share; and its market value added (MVA) is $50 million. How many common shares are currently outstandingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started