Answered step by step

Verified Expert Solution

Question

1 Approved Answer

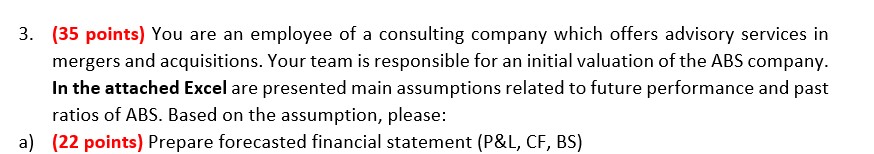

3. (35 points) You are an employee of a consulting company which offers advisory services in mergers and acquisitions. Your team is responsible for an

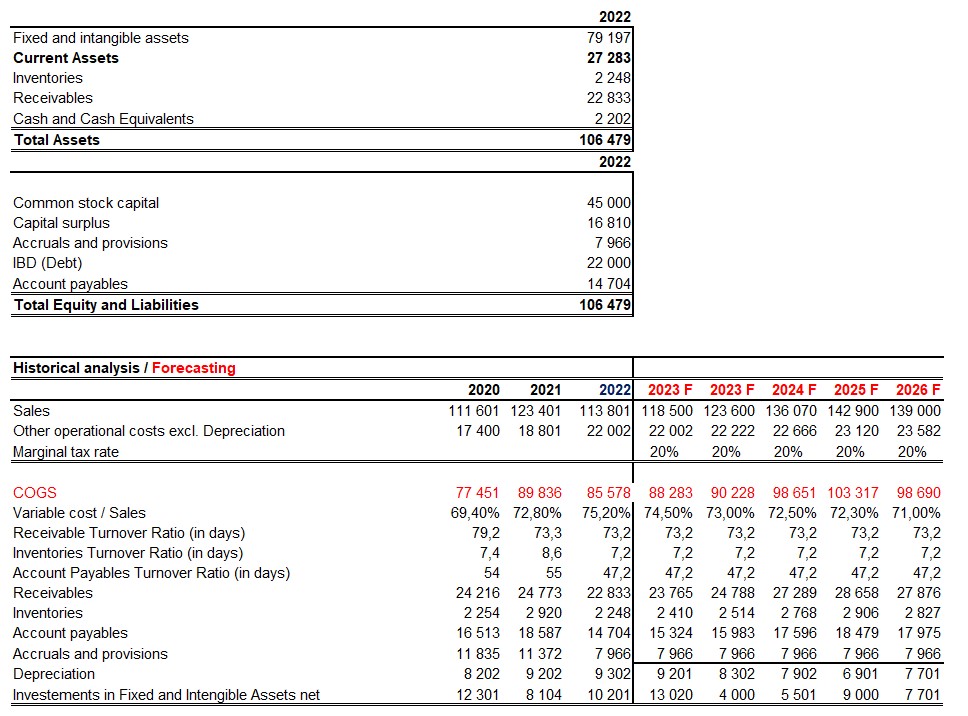

3. (35 points) You are an employee of a consulting company which offers advisory services in mergers and acquisitions. Your team is responsible for an initial valuation of the ABS company. In the attached Excel are presented main assumptions related to future performance and past ratios of ABS. Based on the assumption, please: a) (22 points) Prepare forecasted financial statement ( P&L,CF,BS ) 3. (35 points) You are an employee of a consulting company which offers advisory services in mergers and acquisitions. Your team is responsible for an initial valuation of the ABS company. In the attached Excel are presented main assumptions related to future performance and past ratios of ABS. Based on the assumption, please: a) (22 points) Prepare forecasted financial statement ( P&L,CF,BS )

3. (35 points) You are an employee of a consulting company which offers advisory services in mergers and acquisitions. Your team is responsible for an initial valuation of the ABS company. In the attached Excel are presented main assumptions related to future performance and past ratios of ABS. Based on the assumption, please: a) (22 points) Prepare forecasted financial statement ( P&L,CF,BS ) 3. (35 points) You are an employee of a consulting company which offers advisory services in mergers and acquisitions. Your team is responsible for an initial valuation of the ABS company. In the attached Excel are presented main assumptions related to future performance and past ratios of ABS. Based on the assumption, please: a) (22 points) Prepare forecasted financial statement ( P&L,CF,BS ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started