Answered step by step

Verified Expert Solution

Question

1 Approved Answer

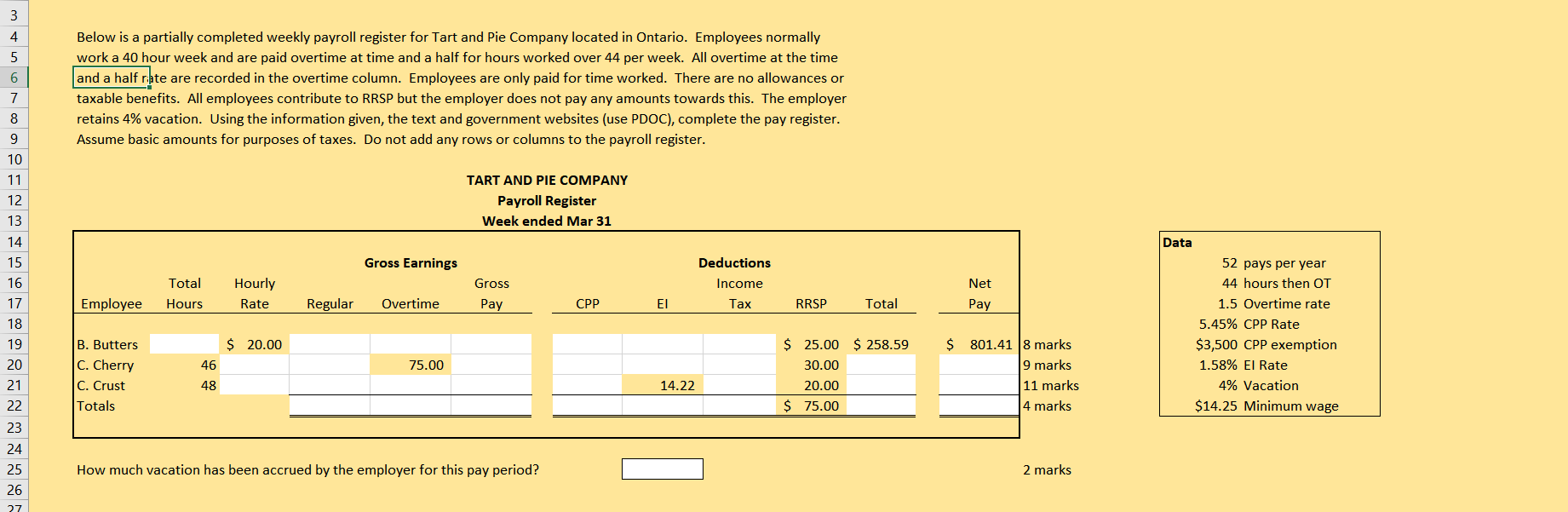

3 4 5 6 7 8 9 Below is a partially completed weekly payroll register for Tart and Pie Company located in Ontario. Employees

3 4 5 6 7 8 9 Below is a partially completed weekly payroll register for Tart and Pie Company located in Ontario. Employees normally work a 40 hour week and are paid overtime at time and a half for hours worked over 44 per week. All overtime at the time and a half rate are recorded in the overtime column. Employees are only paid for time worked. There are no allowances or taxable benefits. All employees contribute to RRSP but the employer does not pay any amounts towards this. The employer retains 4% vacation. Using the information given, the text and government websites (use PDOC), complete the pay register. Assume basic amounts for purposes of taxes. Do not add any rows or columns to the payroll register. 10 11 12 13 TART AND PIE COMPANY Payroll Register Week ended Mar 31 14 222222226712G 24 25 23 15 Gross Earnings Deductions Total Employee Hours Hourly Rate Regular Overtime Gross Pay Income CPP Tax RRSP Total Net Pay 18 19 B. Butters $ 20.00 20 C. Cherry 46 75.00 $ 25.00 $ 258.59 30.00 $ 801.41 8 marks 9 marks C. Crust 48 14.22 20.00 Totals $ 75.00 How much vacation has been accrued by the employer for this pay period? 2 marks Data 52 pays per year 11 marks 4 marks 44 hours then OT 1.5 Overtime rate 5.45% CPP Rate $3,500 CPP exemption 1.58% El Rate 4% Vacation $14.25 Minimum wage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started