3 4 5 Suppose you observe the following securities. Assume that all of them are priced correctly based on the appropriate spot rates. 1-year

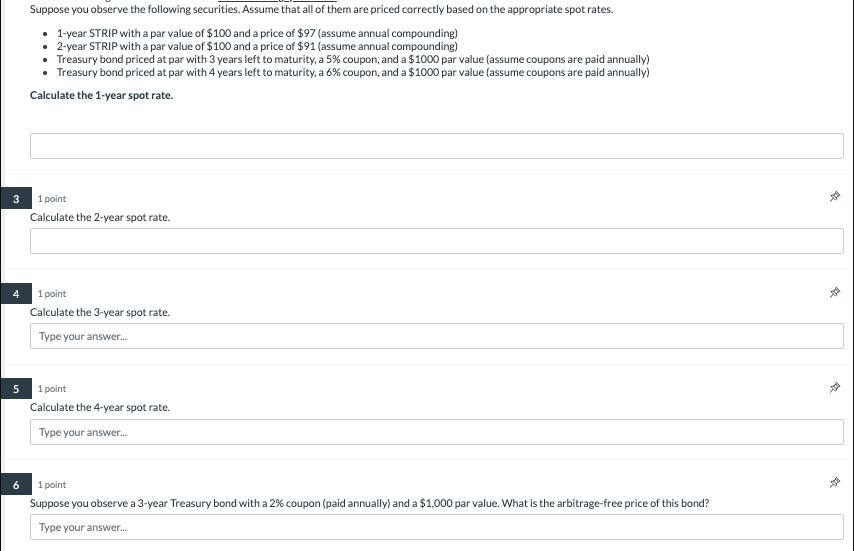

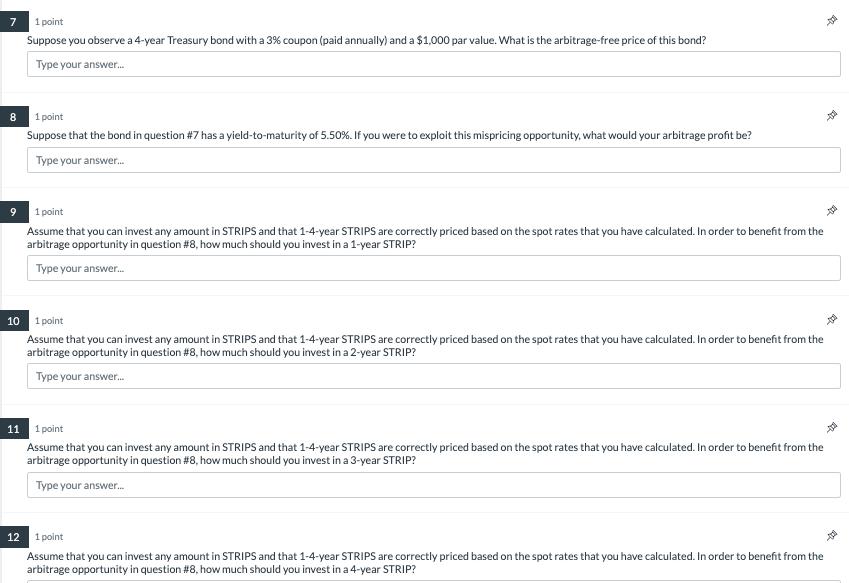

3 4 5 Suppose you observe the following securities. Assume that all of them are priced correctly based on the appropriate spot rates. 1-year STRIP with a par value of $100 and a price of $97 (assume annual compounding) 2-year STRIP with a par value of $100 and a price of $91 (assume annual compounding) Treasury bond priced at par with 3 years left to maturity, a 5% coupon, and a $1000 par value (assume coupons are paid annually) Treasury bond priced at par with 4 years left to maturity, a 6% coupon, and a $1000 par value (assume coupons are paid annually) Calculate the 1-year spot rate. 1 point Calculate the 2-year spot rate. 1 point Calculate the 3-year spot rate. Type your answer... 1 point Calculate the 4-year spot rate. Type your answer..... 1 point Suppose you observe a 3-year Treasury bond with a 2% coupon (paid annually) and a $1,000 par value. What is the arbitrage-free price of this bond? Type your answer... 12 $ 7 8 1 point Suppose you observe a 4-year Treasury bond with a 3% coupon (paid annually) and a $1,000 par value. What is the arbitrage-free price of this bond? Type your answer... 1 point Suppose that the bond in question #7 has a yield-to-maturity of 5.50%. If you were to exploit this mispricing opportunity, what would your arbitrage profit be? Type your answer.... 1 point Assume that you can invest any amount in STRIPS and that 1-4-year STRIPS are correctly priced based on the spot rates that you have calculated. In order to benefit from the arbitrage opportunity in question #8, how much should you invest in a 1-year STRIP? Type your answer... 10 1 point Assume that you can invest any amount in STRIPS and that 1-4-year STRIPS are correctly priced based on the spot rates that you have calculated. In order to benefit from the arbitrage opportunity in question #8, how much should you invest in a 2-year STRIP? Type your answer.... 11 1 point Assume that you can invest any amount in STRIPS and that 1-4-year STRIPS are correctly priced based on the spot rates that you have calculated. In order to benefit from the arbitrage opportunity in question #8 , how much should you invest in a 3-year STRIP? Type your answer... 12 1 point Assume that you can invest any amount in STRIPS and that 1-4-year STRIPS are correctly priced based on the spot rates that you have calculated. In order to benefit from the arbitrage opportunity in question #8 , how much should you invest in a 4-year STRIP? $2 42 $.

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Apologies for the confusion in the previous response Lets go through the calculations step by step 1 Calculate the 1year spot rate The spot rate can be calculated using the formula Spot rate Par value ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started