Question

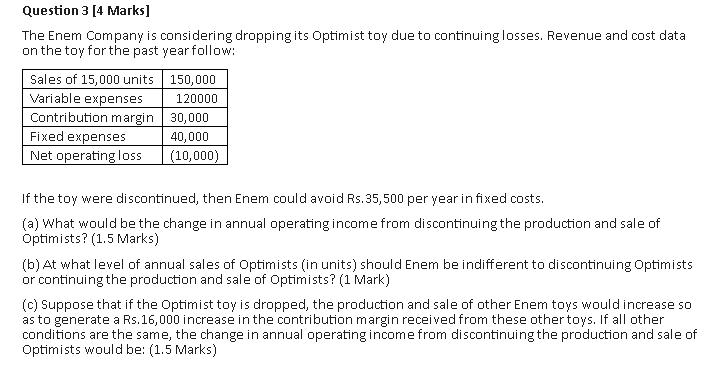

3 [4 Marks] The Enem Company is considering dropping its Optimist toy due to continuing losses. Revenue and cost data on the toy for the

3 [4 Marks] The Enem Company is considering dropping its Optimist toy due to continuing losses. Revenue and cost data on the toy for the past year follow: Sales of 15,000 units Variable expenses Contribution margin Fixed expenses Net operating loss 150,000 120000 30,000 40,000 (10,000) If the toy were discontinued, then Enem could avoid Rs. 35,500 per year in fixed costs. (a) What would be the change in annual operating income from discontinuing the production and sale of Optimists? (1.5 Marks) (b) At what level of annual sales of Optimists (in units) should Enem be indifferent to discontinuing Optimists or continuing the production and sale of Optimists? (1 Mark) (c) Suppose that if the Optimist toy is dropped, the production and sale of other Enem toys would increase so as to generate a Rs.16,000 increase in the contribution margin received from these other toys. If all other conditions are the same, the change in annual operating income from discontinuing the production and sale of Optimists would be: (1.5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started