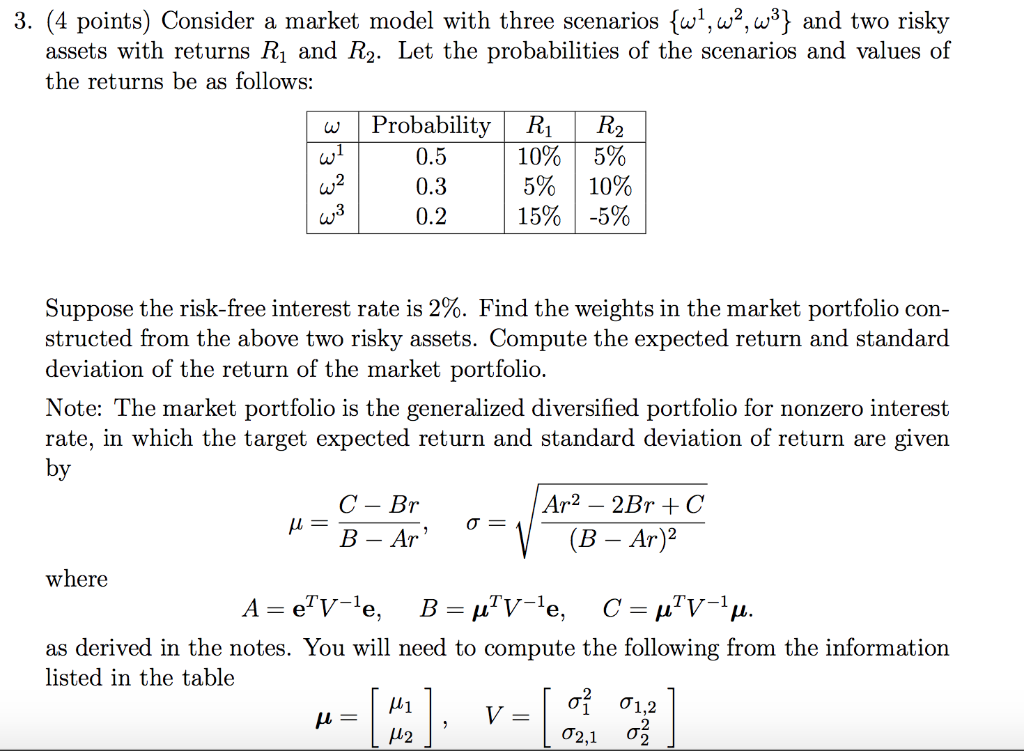

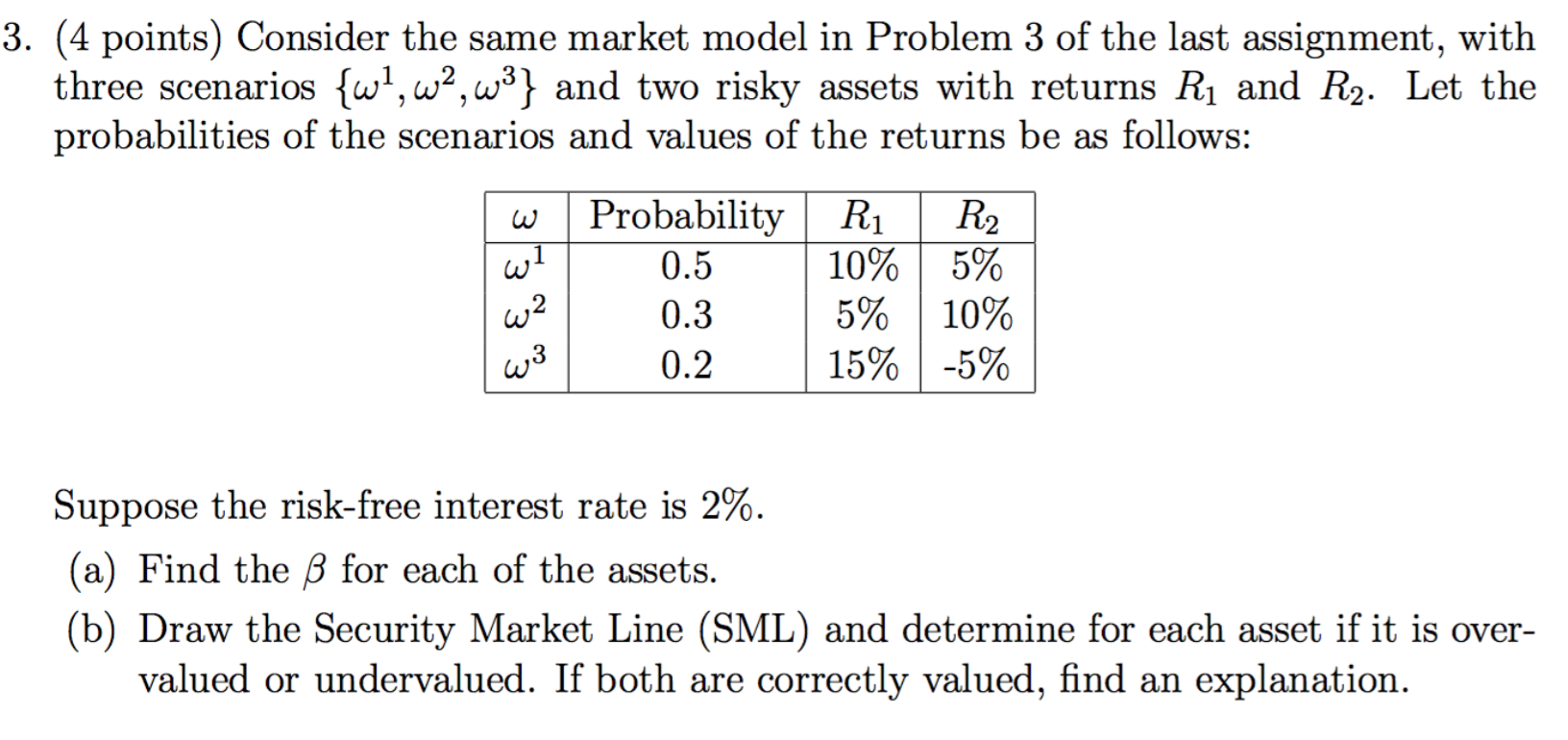

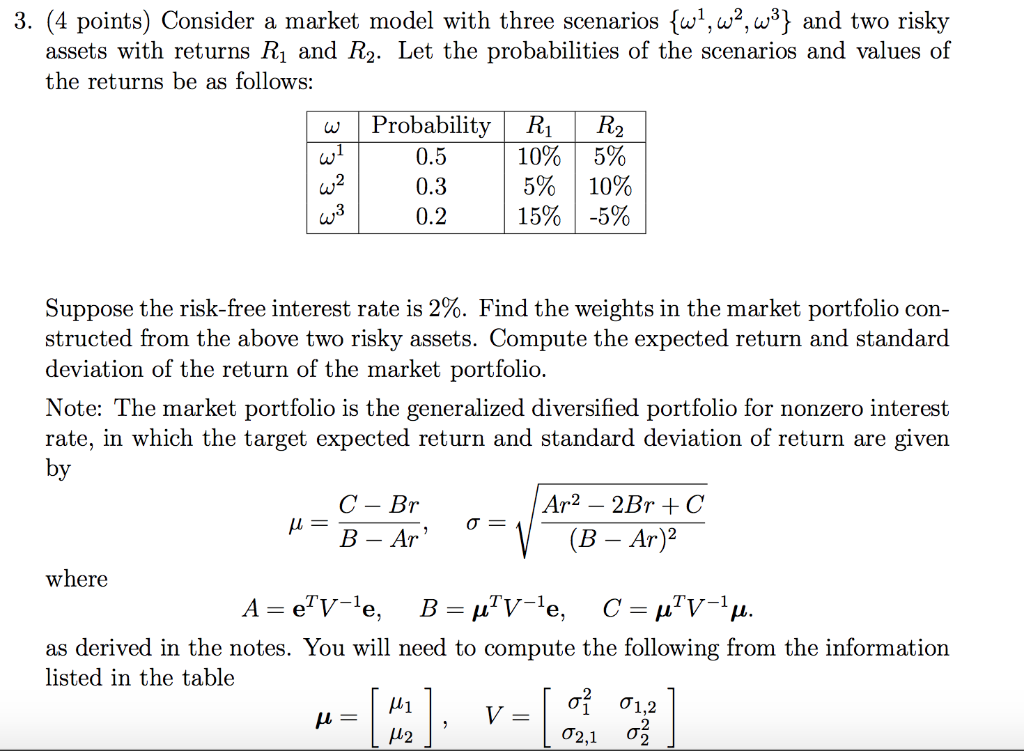

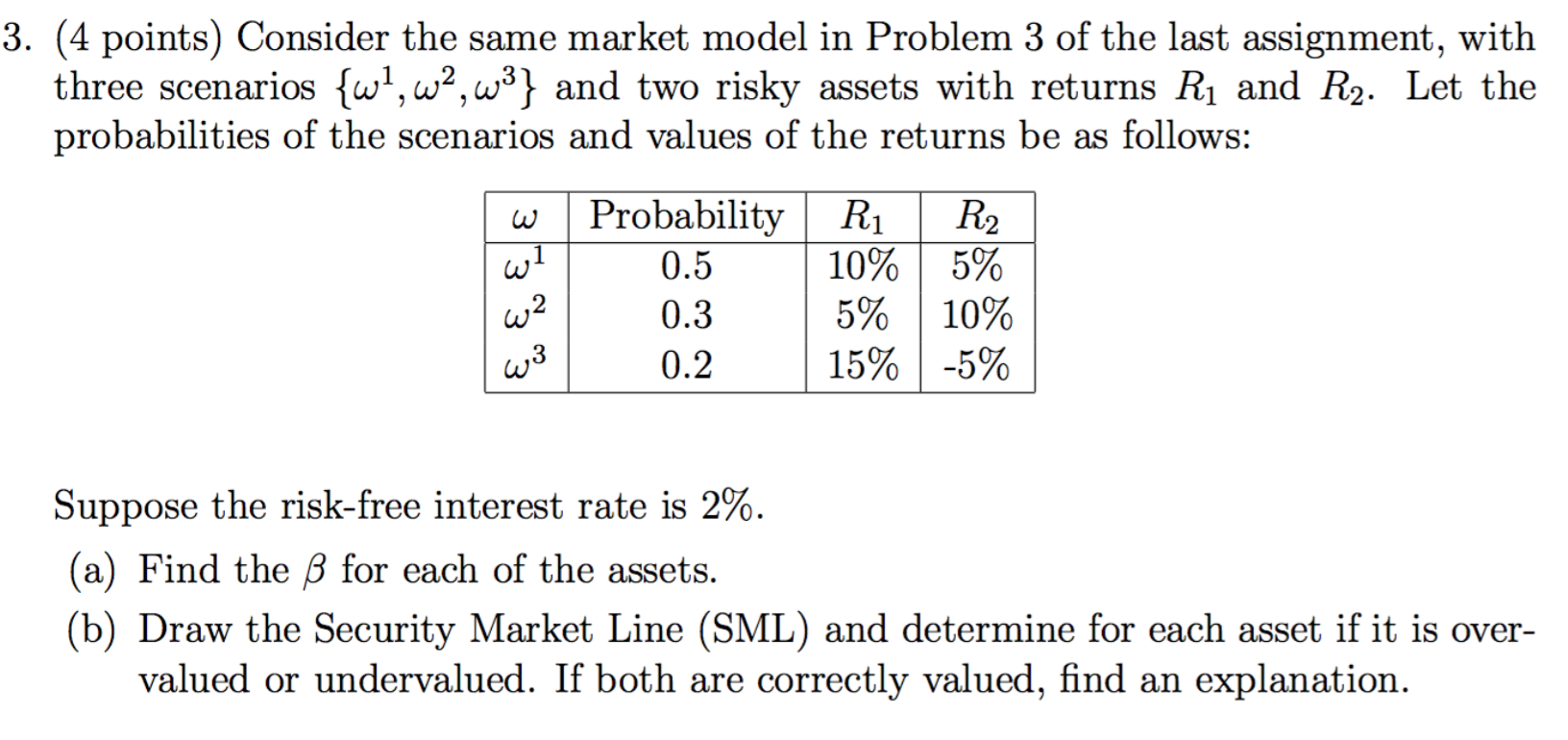

3. (4 points) Consider a market model with three scenarios {w1, wa,w3} and two risky assets with returns R and R2. Let the probabilities of the scenarios and values of the returns be as follows: w Probability R1 R2 wl 0.5 10% 5% 0.3 5% 10% 0.2 15% -5% W3 Suppose the risk-free interest rate is 2%. Find the weights in the market portfolio con- structed from the above two risky assets. Compute the expected return and standard deviation of the return of the market portfolio. Note: The market portfolio is the generalized diversified portfolio for nonzero interest rate, in which the target expected return and standard deviation of return are given by C - Br Ar2 2Br +C u= B - ArEV (B Ar)2 where A = efy-le, Bru?y-le, C = 4?v=4h. as derived in the notes. You will need to compute the following from the information listed in the table 3. (4 points) Consider the same market model in Problem 3 of the last assignment, with three scenarios {w?, w2,W3} and two risky assets with returns R and R2. Let the probabilities of the scenarios and values of the returns be as follows: w R2 | 5% Probability 0.5 0.3 0.2 Rj 10% 5% 15% 10% -5% Suppose the risk-free interest rate is 2%. (a) Find the for each of the assets. (b) Draw the Security Market Line (SML) and determine for each asset if it is over- valued or undervalued. If both are correctly valued, find an explanation. 3. (4 points) Consider a market model with three scenarios {w1, wa,w3} and two risky assets with returns R and R2. Let the probabilities of the scenarios and values of the returns be as follows: w Probability R1 R2 wl 0.5 10% 5% 0.3 5% 10% 0.2 15% -5% W3 Suppose the risk-free interest rate is 2%. Find the weights in the market portfolio con- structed from the above two risky assets. Compute the expected return and standard deviation of the return of the market portfolio. Note: The market portfolio is the generalized diversified portfolio for nonzero interest rate, in which the target expected return and standard deviation of return are given by C - Br Ar2 2Br +C u= B - ArEV (B Ar)2 where A = efy-le, Bru?y-le, C = 4?v=4h. as derived in the notes. You will need to compute the following from the information listed in the table 3. (4 points) Consider the same market model in Problem 3 of the last assignment, with three scenarios {w?, w2,W3} and two risky assets with returns R and R2. Let the probabilities of the scenarios and values of the returns be as follows: w R2 | 5% Probability 0.5 0.3 0.2 Rj 10% 5% 15% 10% -5% Suppose the risk-free interest rate is 2%. (a) Find the for each of the assets. (b) Draw the Security Market Line (SML) and determine for each asset if it is over- valued or undervalued. If both are correctly valued, find an explanation